Morning Note: Market news and an update from Melrose Industries.

Market News

US stocks fell on Friday – S&P 500 (-1.3%); Nasdaq (-2.2%) – closing out the worst week in more than two months, as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing. The decline was led by tech stocks. The Fed’s Susan Collins said a reduction next month isn’t “a done deal.” Austan Goolsbee sees rates falling “a lot” over 12-18 months. The 10-year Treasury yields 4.45%. The recent rally in the dollar paused, while gold ticked up to $2,585 an ounce.

In Asia this morning, equities were mixed, with early gains given up: Nikkei 225 (-1.1%); Hang Seng (+0.8%); Shanghai Composite (-0.2%). The securities regulator in China urged listed companies to boost returns on their stocks. Morgan Stanley and Goldman turned more cautious on Chinese stocks. Samsung Electronics rallied after it announced a surprise $7bn stock buyback plan.

The FTSE 100 is currently trading 0.3% higher at 8,080. UK inflation for October is due out on Wednesday and is expected to have risen back above the Bank of England’s 2% target – the estimate is 2.2% – reinforcing the case for policymakers to take their time cutting interest rates. Sterling trades at $1.2624 and €1.1969.

Xi Jinping had a message for Trump at his final meeting with Joe Biden: Beijing wants to be friends but is ready for a fight if necessary. Xi reiterated the “four red lines” that the president-elect must avoid, including containing China’s economic rise. China and the EU reached “technical consensus” in their talks aimed at scaling back or reversing tariffs on China-made EVs.

Support for Olaf Scholz to lead Germany’s Social Democrats into an early election is crumbling within his own ranks, people familiar said. Defense Minister Boris Pistorius has been touted as a potential replacement.

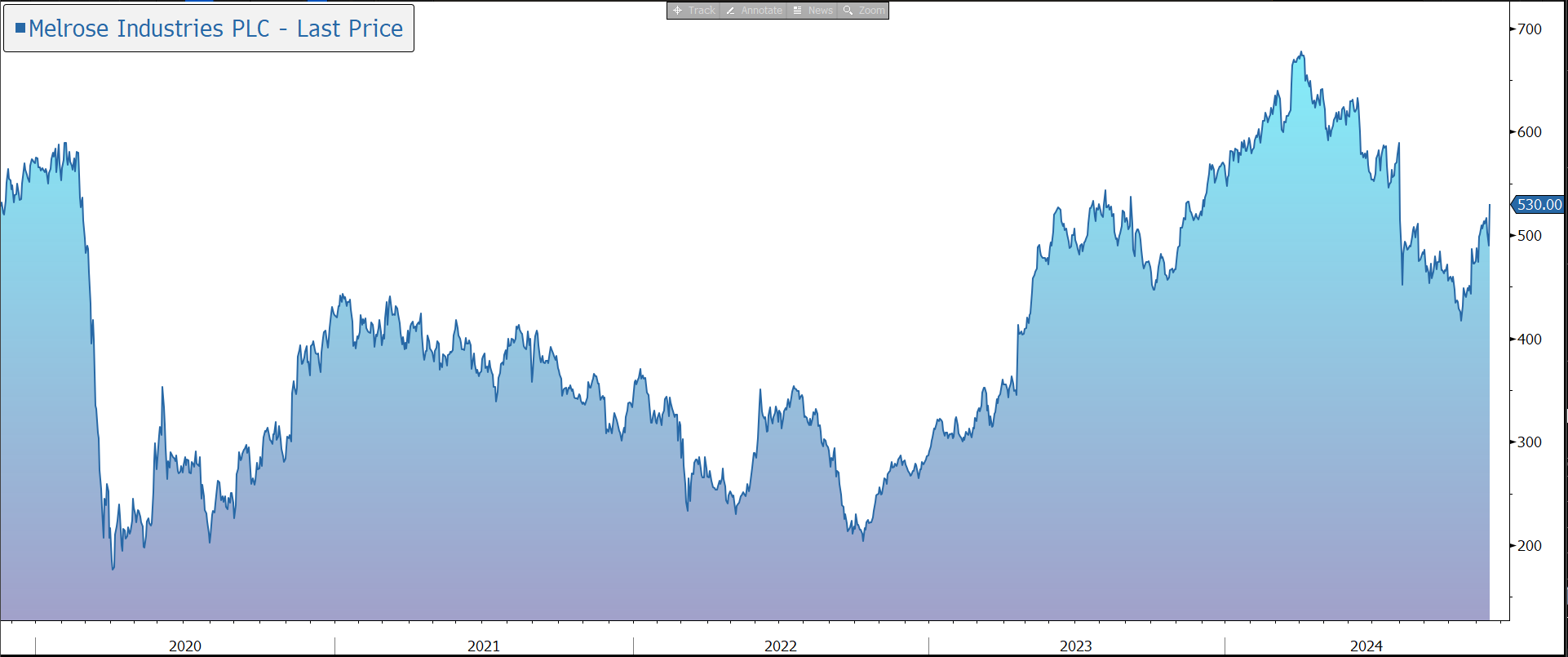

Source: Bloomberg

Company News

Melrose Industries has released a trading update for the four months from 1 July 2024 to 31 October 2024. The statement highlights that end market demand continues to be positive and expectations for the full year remain unchanged. The company also set out an upbeat outlook for cash flow in 2025 and, in response, the shares have been marked up by 8% in early trading.

Melrose is a tier one aerospace technology supplier with established positions on all the world’s high-volume aircraft. Its products are on-board c.90% of civil aircraft on the market today (wide and narrow body) and the company generates 95% of its revenue from industry-leading positions (and more than 70% as sole supplier). Revenue is split 70% civil, 30% defence, and is generated from two divisions: Engines and Structures.

R&D excellence and long-standing relationships create high barriers to entry and mean the company is well positioned for the next generation of technology, particularly that enabling zero emission flight – additive manufacturing, composite structures, and electric and hydrogen propulsion.

The civil industry is expected to enjoy long-term structural growth as airlines upgrade their ageing fleets after years of underinvestment. Defence is also growing given the escalation of geopolitical tension as NATO countries work to meet commitments to spend 2% of GDP.

A strong management team has an excellent long-term track record of delivery. For 2025, the company is targetting revenue of £3.8bn and an operating margin above 18%. These targets are increasingly underpinned by the Engines outlook and mix, Civil ramp up, Defence portfolio improvements, and ongoing business improvements throughout the group.

By 2025, Engines is forecast to contribute over 70% of Melrose profit with over 85% of this being from the accretive and structurally growing aftermarket. The business has OEM-level capability and responsibility for selected engines which gives more technical and commercial advantages than normal for a Tier 1 supplier. Engines is a leading independent Tier 1 partner to all major engine OEMs with its lucrative and diverse Revenue and Risk Sharing Partnerships (RRSP) portfolio providing strong cash flow growth. Last month, the group published a booklet which provided more information on its RRSPs, how Melrose is positioned today, how the cash generation flows, and the accounting involved. The market was very reassured and the stock rose markedly on the day.

In today’s update, the group highlights that in the four months to 31 October, revenue was up 7%, adjusted for disposals made in the first half of 2024. The group continues to partner closely with major customers to execute efficiently on production schedules, whilst internal business improvement actions progress as planned. As a result, adjusted operating profit continues to grow in line with management expectations of £550m-£570m.

In Engines, revenue was up 17% on a like-for-like basis adjusting for a transfer of business between divisions. Performance continues to be driven by the aftermarket business, which was up 32% with a particularly strong contribution from defence. OE volume growth remains constrained by industry-wide supply chain issues. Looking ahead, the division is well placed to meet the ongoing industry ramp-up from its established positions as well as through new technologies.

In Structures (i.e. the body and wings of planes), revenue grew by 1%, continuing to reflect the planned exit of non-core work, customer destocking, and industry-wide supply chain challenges affecting OE production rates. Defence repricing and business improvement actions, which are focused on this division, are coming through as planned. Restructuring programmes are on track and are nearing completion, which will result in a significant reduction in associated cash spend in 2025.

Melrose has a strong balance sheet with free cash flow ramping up sharply. Net debt is anticipated to end the year in line with current expectations, with the target leverage of 1.5x-2.0x net debt to EBITDA. Financial strength is expected to drive attractive shareholder returns through a progressive dividend and 5%-10% buybacks p.a. as the spending on restructuring comes to an end. The first £500m programme completed in September, with the group currently undertaking a new £250m 18-month programme. There is potential for a sizeable cash return every year until the end of the decade. The company has previously indicated that no material acquisitions will be made in the near term.

In addition to reiterating its 2024 guidance, the group has provided an upbeat outlook for 2025. Despite continued supply chain challenges, Melrose expects to make strong trading progress and is on track to deliver its adjusted operating profit target of £700m. This performance is expected to be led by the strong aftermarket performance in Engines offsetting OE volume constraints. The company expects its cash flow position to improve significantly next year and to deliver substantial free cash flow in 2025, post interest and tax. Cash flow is poised to grow materially beyond this as a result of the completion of the restructuring programmes, the resolution of the GTF powder metal issue, all RRSPs generating cash, and continuing profit.

Source: Bloomberg