Morning Note: Market news and updates from Capital Gearing Trust and Syncona.

Market News

Chairman Powell indicated the Federal Reserve was in no rush to cut interest rates. He noted the labour market has cooled to the point where it is no longer a source of significant inflationary pressure, and the economy remains strong. While he didn’t comment about the prospect of easing in December, markets dialled back expectations for a 25 basis points cut to less than 60% from 80% a day earlier. The Dollar lost some of its recent gains, while gold trades at $2,564 an ounce.

US equities rolled over last night – S&P 500 (-0.6%); Nasdaq (-0.6%). Vaccine names got hit following news that Trump has offered the Health Secretary position to Robert F Kenndy JR, while EV stocks, such as Rivian and Tesla, slumped as the Trump transition team reportedly plans to cancel Biden’s $7500 tax credit as part of broader reforms. The FT reported the FTC is preparing to launch an investigation into anti-competitive practices at Microsoft’s cloud business.

In Asia this morning, equities were mixed: Nikkei 225 (+0.3%, supported by yen weakness); Hang Seng (+0.1%); Shanghai Composite (-1.5%). There were some encouraging signs in China’s economy – retail sales expanded at the strongest pace in eight months and property prices fell at a slower pace. However, industrial output growth slowed more than expected in October.

The FTSE 100 is currently trading 0.6% lower at 8,033. The Bank of England Governor said the UK must look out for opportunities to rebuild relations with the EU. UK manufacturing production fell 1% month-on-month is September, worse than the flat results expected. Sterling trades at $1.2660 and €1.1990, while the 10-year gilt yield remains elevated at 4.50%.

Source: Bloomberg

Investment Fund News

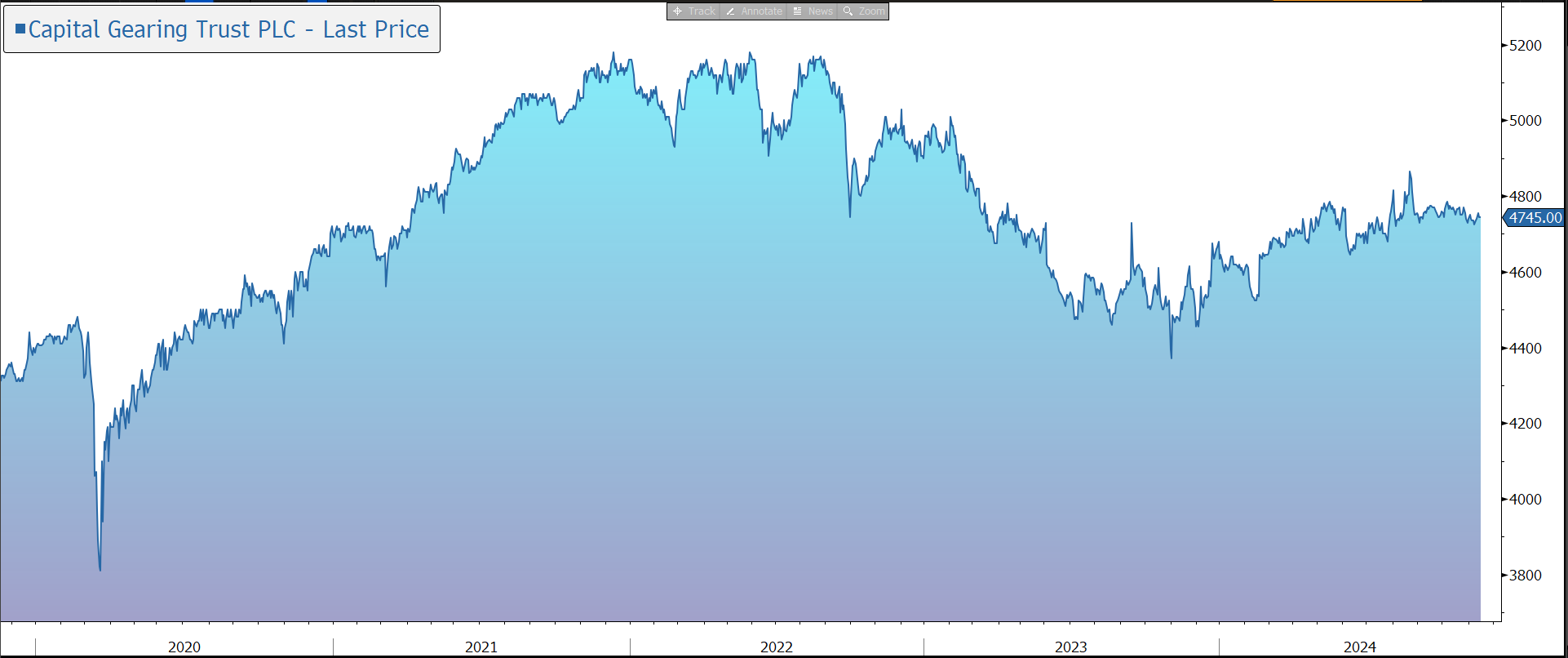

Earlier in the week, Capital Gearing Trust released results for the half-year to 30 September 2024. Performance was robust, albeit held back by the appreciation of Sterling. The manager is cautious on the medium-term outlook and has increased the level of ‘dry powder’ in the portfolio. The shares, which are listed in the FTSE 250 Index, remain on a small discount to NAV and the company continues to buy back its shares.

Capital Gearing Trust (CGT) is a closed-ended listed vehicle with a goal to preserve and grow shareholders’ real wealth over time. The strategy is managed by the investment team at CG Asset Management, led by Peter Spiller, Alastair Laing, and Chris Clothier.

The £1bn fund is actively managed, without reference to a benchmark, with a total return mindset made up of capital growth and income. A cautious asset allocation aims to avoid losses and, as a result, the fund tends to lag during large equity market upswings.

The fund is made up of a global portfolio of equities, bonds, commodities, and alternative assets, which are split into three risk categories: dry powder, index-linked, and risk assets.

Annualised performance since 2000 has been good: share price (+7.4%) versus MSCI UK (+4.6%) and CPI (+2.5%). In 2022, the fund was only down 4.2% compared to an 11.4% decline for a 30/70 equity/bond benchmark.

During the latest six-month period, the fund generated a total return of 2.4%, slightly above the 0.9% CPI. All parts of the portfolio contributed positively but most of the return came from the risk asset and the corporate credit holdings. Performance would have been stronger had it not been for the appreciation of sterling, which gained 7% against the dollar.

The allocation to risk assets increased from 28% to 33% during the period. Within that, the manager has been taking advantage of the large discounts on offer to increase the weighting in investment trusts (now 25%). This comes ahead of a potential reconsideration of cost disclosure requirements by the regulator – a temporary suspension of the rules has already been announced. The manager continued to build a holding in BH Macro on a double-digit discount, such that it is now one of the largest single positions in the fund, offering appeal as a genuine diversifier.

The credit portfolios performed well, so that credit spreads are no longer sufficiently wide enough to justify the additional risk over holding Treasury Bills. As a result, the credit portfolio was reduced from 12% to 9% through a combination of disposals and maturing bonds.

The most significant change in the period was the reduction in index-linked bonds, which fell from 44% of the portfolio to 34%. The main change was in UK index-linked bonds (22% to 12%) with a switch into US TIPS which look more attractively valued, particularly in Sterling terms. The weighting of conventional bonds rose from 14% to 20% during the period.

The manager views the medium-term outlook with caution. This comes not only from the many geopolitical concerns but the threat from persistent inflation impacting interest rates and economic growth both in the UK and abroad. Whilst a US recession in the next 12 months is not the manager’s central expectation, it is notable how many US economic indicators are slowing, in some cases markedly. The manager believes the combination of an economic slowdown (recession or not) and very high US equity valuations could make for a testing time for investors in US equities. The manager believes risk asset weightings at the end of the period (33%) could well be at the high point in this cycle. Profits are being taken in several positions that have performed well, and as such, the dry powder allocation now sits at 31% of the portfolio.

The share price of the listed vehicle (+3.1% during the period) is more volatile than the NAV, with larger drawdowns during periods of equity market weakness. CGT operates a zero-discount control policy (DCP) between a 2% discount to 2% premium. When the shares are trading at a premium, new shares are issued at a premium. When the fund is trading at a discount, as it is at present (1.8% at 30 September), the accretion from the share buyback programme helps to cover the fund fees.

Consistent with the experience of many investment companies, CGT has been required to significantly increase the rate of its share buybacks – £89.8m during the half-year – to meet the objective of the DCP, with the issue exacerbated by the number of investors crystallising capital gains ahead of Labour’s first budget.

The shares pay a dividend yield, although in order to mitigate the tax liability from the recent increase in bond income, the board is considering paying at least part of future dividends as interest distributions. The OCR is around 0.5%.

Source: Bloomberg

Yesterday Syncona released results for the financial half-year to 30 September 2024 and announced an extension to its share buyback programme. The company provided an update on its portfolio of life science companies and announced the creation of a new development pipeline company. The shares currently trade on a 38% discount to the current estimated NAV.

Syncona is a healthcare company focused on founding, building, and funding global leaders in life science. The current portfolio is made up of 14 innovative companies and several life science investments, each addressing areas of significant unmet need for patients. The focus is mainly on the so-called ‘Third Wave’ technologies, such as gene and cell therapy, which are used in place of surgery or drugs, and which the company believes is currently in a ‘transformational’ period. Syncona also has a strong manufacturing platform capability which allows new products to be rolled out more quickly and efficiently, while creating barriers to entry.

The company’s 10-year strategy is to organically grow net assets to £5bn by 2032 versus a 2022 base of £1.3bn, equal to an IRR of 15%. The target is three new Syncona-founded companies a year, delivering an expanded portfolio of 20-25 companies, to deliver top quartile life science portfolio returns. Syncona employs one of three core financing paths: (1) strategic hold – funding companies on a sole basis to clinical proof-of-concept; (2) strategic syndicated – following the launch financing, companies will be syndicated with like-minded long-term investors and are likely to be held privately to clinical proof-of-concept; and (3) fully syndicated – companies syndicated early in their lifecycle by bringing in significant external capital, with comparatively lower Syncona investment, to fully exploit the opportunity.

However, in the six months to 30 September 2024, the NAV fell by 7.6% to £1,145m, or by 5.2% to 178.9p per share. The decline was driven by a drop in the valuation of the life science business, alongside a positive return from the capital pool and accretive share buybacks.

The value of the life science portfolio fell by 8.8% to £792m, or 69% of NAV, driven by a decrease in the Autolus share price and a weakening of the US dollar, partially offset by valuation uplifts from private portfolio company financings.

The remaining £353m of asset value is a strategic capital pool. The group holds 12-24 months of liquidity in cash and treasuries, with capital also allocated to several low volatility, multi-asset funds with daily liquidity, to manage inflation risk. In the period, the overall return within the capital pool was 1.0%. In addition, there is more cash on the balance sheets of the group’s portfolio companies and access to third party financing. As at 30 September 2024, both of the group’s listed companies (Autolus and Achilles) were funded to deliver clinical data which represent key milestones for their businesses.

This all provides the capital to invest in the life science business as the company builds and scales rapidly. Furthermore, at a time when the financing environment for public and private companies remains challenging, with sector specialist investors continuing to prioritise funding their existing portfolio over making new investments, and an absence of generalist investors in the sector, Syncona’s strong cash position leaves it well placed to take advantage of potential investment opportunities and fund its companies through the current market conditions.

In the latest quarter, the company deployed £90m into the life science portfolio and continues to anticipate spend of £150m-£200m in the financial year to 31 March 2025. This excludes the capital allocated to the share buyback programme (see below).

To support its strategy, Syncona aims to maintain three years of financing runway to fund its portfolio. If, in the event of realisations, the capital pool increases significantly more than the three-year forward capital deployment guidance, and subject to an assessment of investment opportunities at the time, the Board will look to return capital to shareholders. As part of that process and considering the material discount to NAV at which the shares currently trade and the near-term NAV per share accretion available, the company is currently buying back its shares. In the latest half-year, £19.4m of shares were repurchased at an aggregate discount to NAV of 36.2%, resulting in accretion of 1.59p to NAV per share. Given the persistent discount to NAV, the company has announced an additional £15m programme, taking the total amount allocated to £75m, more than 10% of the current market cap, of which £46.3m has been deployed to date.

Over the last 24 months, Syncona has undertaken a thorough review to rebalance, diversify, and de-risk its portfolio and is prioritising capital allocation towards its most promising companies and assets. 68.1% of its value is now in clinical and late-stage clinical companies. The group has taken Freeline Therapeutics back into private ownership; portfolio company Freeline acquired SwanBio to create a new company, Spur Therapeutics; the stake in Clade Therapeutics was sold; Autolus announced a strategic collaboration with Germany’s BioNTech; and Quell entered a cell therapy collaboration with AstraZeneca.

Syncona’s exposure to portfolio company Autolus has been rebalanced as it transitions from development stage to a commercial biotech, in line with the strategy of building companies to late-stage development. 8.3% of the holding in was sold in the period (for £9.7m) and a further 5.7% post-period end (for £6.6m). Syncona has retained a 9.9% stake currently valued at £67m.

A total of £305.6m was raised across six financings which were closed in the period, including £170.5m from leading external life science investors, broadening the financial scale of the portfolio.

The company has delivered strong clinical execution across six clinical-stage companies, with one company entering the clinic and multiple data readouts delivered during the period, followed by two key value inflection points from Beacon and Spur post-period end. Earlier in the week, portfolio company Autolus received marketing approval from the US regulator for AUCATZYL (obe-cel), its novel CAR T-cell therapy, for the treatment of adult patients with relapsed or refractory B-cell precursor acute lymphoblastic leukaemia.

The company has committed £12.5m to new portfolio company Slingshot Therapeutics, the Syncona Accelerator, focused on accumulating and developing a pipeline of early-stage development programmes. Slingshot will efficiently advance and de-risk programmes from academic founders by providing access to high quality management, centralised development expertise, resource, funding, and operational support.

There are eight key value inflection points with the potential to drive significant NAV growth by the end of 2027 (delayed from 2026), including three by the end of 2025. There are also nine capital access milestones across the portfolio expected by the end of 2026, with seven expected by the end of 2025. Syncona is funded to deliver on all the portfolio’s potential key value inflection points, albeit they are not without risk.

Overall, although high risk, we believe Syncona provides exposure to a unique investment vehicle, exposed to cutting edge healthcare technology, that provides good portfolio diversification. The group’s investment track record to date is good – the disposal of portfolio companies has often generated an attractive return on invested capital. As always, data generated from the clinical pipeline will be a critical driver of value, and while not without risk, the group has several portfolio companies approaching key milestones that could provide a catalyst for the share price.

However, the shares, which are listed on the FTSE250 index, have fallen heavily over the last few years, due in part to the impact of rising bond yields on the valuation of, and appetite for, unprofitable ‘blue-sky’ companies. The company believes it is now emerging from a challenging market environment well positioned to take advantage of conditions as they improve.

The shares currently trade on a 38% discount to our estimated live NAV of 178p, with the life sciences portfolio trading on a 55% discount, assuming the capital pool is valued at par.

Source: Bloomberg