Morning Note: Market news and an update from Imperial Brands.

Market News

US equities ticked higher last night – S&P 500 (+0.4%); Nasdaq (+0.6%). The DOJ will push for Google to sell its Chrome browser to break up its monopoly, people familiar said. Antitrust officials are also seeking action on data licensing and AI measures. Alphabet traded 1% lower postmarket. In Asia this morning, equities rose: Nikkei 225 (+.5%); Hang Seng (+0.4%); Shanghai Composite (+0.6%).

The dollar gave back some of its recent gains, while the 10-year Treasury yield fell back to 4.38%. Japan and China dumped Treasuries last quarter ahead of the US election. Japanese investors sold a record $61.9bn, while funds in China offloaded $51.3bn, the second biggest sum on record. Gold trades at $2,620 an ounce.

The FTSE 100 is currently trading 0.3% higher at 8,133. The Bank of England’s Megan Greene made the case for a cautious approach to rate cuts in the UK. Britain’s biggest retailers wrote to Rachel Reeves, warning that job losses are inevitable as the industry faces up to £7bn a year in extra costs from her budget. Sterling trades at $1.2656 and €1.1969.

NATO’s 15 largest European members may have to double defence spending to $720bn annually to meet the challenge of Russia’s war in Ukraine and the possibility of less American support, Bloomberg Intelligence said.

Brent Crude trades at $73 a barrel as Lebanon and Hezbollah agreed to a US proposal for a ceasefire with Israel with some comments on the content, Reuters reported.

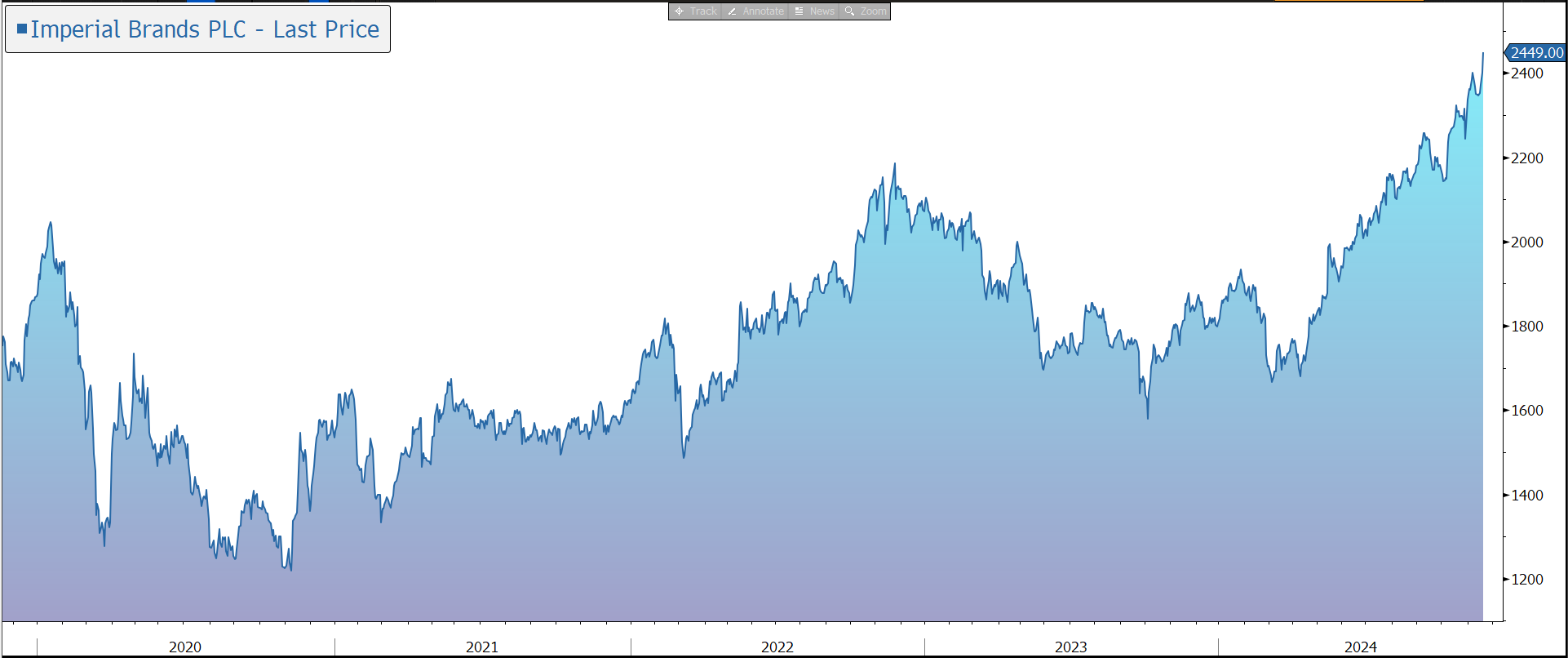

Source: Bloomberg

Company News

Imperial Brands has this morning released results for the financial year to 30 September 2024. The figures were in line with the guidance provided in the recent trading update. Guidance for FY2025 (the final year of its five-year strategy) has been set out and plans for the next five-year strategy will be disclosed at an investor day in March. The company recently announced an increase in shareholder returns – for FY2025, Imperial expects the return from dividends and buyback combined to amount to 14% of its current market capitalisation. In response, the shares are up 2% in early trading.

Imperial Brands manufactures and sells cigarettes, fine cut tobacco, smokeless tobacco, cigars, and next generation products (NGP). The main brands include Winston, Davidoff, L&B, West, and JPS. The group’s five-year business plan is split into three pillars, with investment focused on markets and brands with the greatest opportunity for value creation.

The primary driver of medium-term value creation is a revitalised tobacco business focused on the group’s top five (priority) markets – US, Germany, UK, Australia, and Spain – which represent 70% of combustible operating profit. Although this means there is some concentration risk, the company believes these are attractive markets, especially Germany and the US which are more ‘affordable’ providing scope to increase price.

The second strand focuses on the broader tobacco portfolio where there are additional opportunities to drive growth whilst realising operational efficiencies. An ERP roll-out will replace 60 legacy systems with a single platform over time. Finally, the group is building a targeted NGP business focused on heated tobacco in Europe and vaping in selective markets, particularly the US. Investment is disciplined and based on detailed market testing. Overall, rather than trying in vain to out-compete its larger rivals, we believe Imperial is now operating within the confines of what is achievable for a number four player in a concentrated global market.

The group’s five-year plan is divided into two distinct periods. The two-year strengthening phase (2020-2022) built the foundation for the current three-year phase (2022-2025) which focuses on the acceleration of returns and sustainable growth in shareholder value. In this phase, the company expects to generate low single-digit net revenue growth and mid-single digit adjusted operating profit growth, defined as 3.5%-6.5%.

In the financial year to September 2024, the group enjoyed an acceleration in tobacco and NGP net revenue growth versus the previous year – up 4.6% at constant current to £8,157m. Tobacco net revenue grew by %, driven by strong pricing (+7.8%). Volumes fell by 4.0% (to 190bn sticks equivalent) reflecting wider industry market size declines across the group’s footprint, although volume pressure has eased.

Investment activities in the group’s five priority markets delivered a small (5bps) aggregate market share increase, with gains in four markets – the US (+15 bps), Spain (+5 bps), Germany (+2 bps), and Australia (+5 bps) offset by a decline in the UK (-50 bps). The stabilisation in German market share for the first time under the strategy is encouraging, although the slide in the UK is disappointing.

NGP net revenue grew by 26% at constant currency to £335m, in the range of 20%-30%, with increases across all three regions as the company builds scale in the existing footprint and increased gross margin. A partnership approach to product innovation has enabled the group to launch new products across all three categories during the year, including the fast-growing modern oral category in the US with its brand 'Zone'.

Adjusted operating profit grew by 4.6% at constant currency to £3.9bn, close to the middle of its mid-single digit range. The performance reflects reduced NGP operating losses (down 43% to £79m) and 8.6% growth at Logista, the Spanish-based distribution business in which Imperial has a 50.01% stake, which reflected strong tobacco pricing and benefit of prior-year acquisitions.

Adjusted EPS grew by 10.9% at constant currency to 297p as reduced share count due to the ongoing share buyback more than offset higher finance costs.

The business typically generates strong cash flow which drives four pillars of capital allocation: investment in organic growth; strengthening the balance sheet; a progressive dividend; and share buybacks. During the financial year, adjusted operating cash conversion was strong (100%) and free cash flow generation was £2.4bn.

The group ended the period with net debt of £7.7bn, 4% below last year, and financial gearing of 1.8x net debt to EBITDA, below the 2.0x target. The all-in cost of debt modestly decreased from 4.3% to 4.2%, while interest cover stands at a comfortable 10.5x. The group remains committed to its investment grade credit rating.

In line with its capital allocation policy and reflecting management’s confidence in the group’s strategy and cash generation, the company has committed to an ongoing, multi-year buyback programme that will deliver a material reduction in the capital base over time. The company believes this is preferable to buying back some of its expensive debt even though the cost of servicing that debt is rising.

In the financial year to 30 September 2024, the group bought back £1.1bn of shares and, last month, announced a further £1.25bn buyback, expected to complete no later than 29 October 2025.

The total dividend for FY2024 was 153.43p, an increase of 4.5% and in line with its progressive dividend policy. Going forward, the dividend will be paid in four equal quarterly dividend payments, which will temporarily accelerate dividend cash payments of £270m in FY2025. The underlying dividend increase for FY2025 will be 4.5% to 160.32p.

Taking dividends and the buyback together, Imperial expects underlying capital returns to shareholders in FY2025 will amount to c. £2.8bn, 14% of its current market capitalisation. Overall, the group is on track to deliver five-year capital returns of c. £10bn, representing 67% of its market capitalisation in January 2021 when the strategy was launched.

In the coming year, the group expects to deliver tobacco and NGP net revenue growth at low single-digit constant currency and to grow group adjusted operating profit close to the middle of the mid-single-digit range at constant currency. In line with previous years, performance will be weighted to the second half of the year, with first-half adjusted operating profit expected to grow at low single digits at constant currency. The company expects to deliver at least high-single-digit EPS growth for the full year and sustainable growth in cash flow.

The group is now working on its strategy for the next five-year period through to 2030, which will build on the strong foundations established under the current strategy. Further details will be provided at a Capital Markets Day on 26 March 2025.

Source: Bloomberg