Morning Note: Market News and a Muted Update from Tesco.

Market News

Markets have bounced sharply after President Trump announced a 90-day pause on higher tariffs for trade partners (non-retaliating countries), while raising duties to China to 125%.

China will impose 84% tariffs on US goods from today, up from the 34% previously announced, the finance ministry said. Chinese leaders are set to meet to discuss additional economic stimulus in response to Trump’s increased tariffs. The meeting will focus on support measures for housing, consumer spending, and tech innovation. The onshore yuan fell to its weakest level since 2007, while a state newspaper suggested the PBOC should cut rates.

US equities were sharply higher last night – S&P 500 (+9.5%, its best session since 2008); Nasdaq (+12.2%, it second best session on record). The rally continued in Asia this morning with stocks posting their biggest jump in more than two years: Nikkei 225 (+9.1%). However, the Hang Seng (+2.4%); Shanghai Composite (+1.0%) lagged. The FTSE 100 is currently 5% higher at 8,014.

Yields on 10-year Treasuries fell after a surge in the past three days spurred worries about the stability of the world’s biggest debt market. Demand was strong at yesterday’s key auction of $39bn of 10-year US government bonds. The 10-year currently yields 4.3%. Federal Reserve officials are leaning away from rate cuts that would protect against any tariff-induced slowdown, instead focusing on keeping inflation in check. Rate cut expectations plunged from five cuts on Monday to less than three cuts for 2025. The 2-year Treasury yield rose 30bps to over 4% intraday, biggest daily move since 2009.

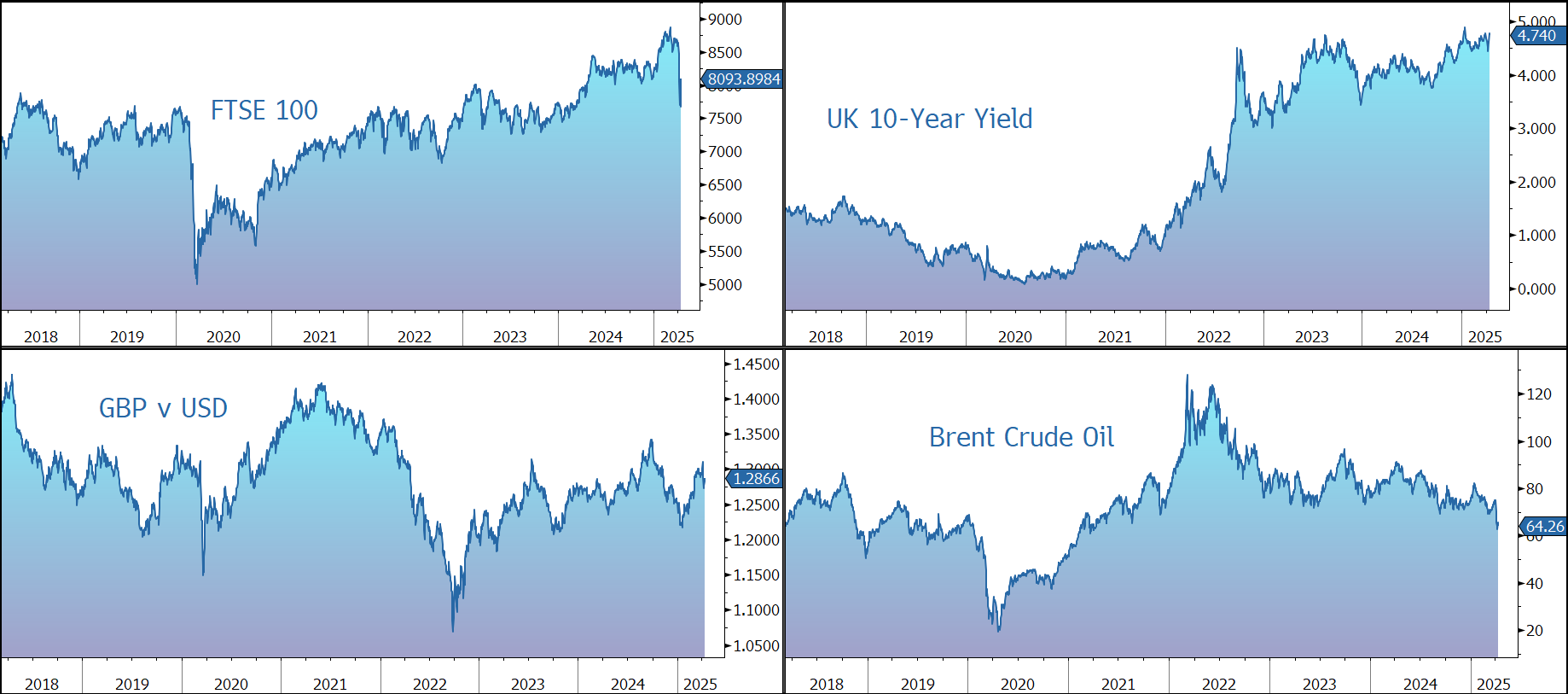

Gold finished up 3% and has pushed higher this morning to $3,115 an ounce. Other commodities also rose sharply as fears of a global recession eased. Brent Crude trades at $64 a barrel. Sterling trades at $1.2870 and €1.1680.

JPMorgan CEO Jamie Dimon said the bank had already lose a couple of bond deal overseas after the tariffs, while IPOs are being cancelled amid the volatility.

Source: Bloomberg

Company News

Tesco has today released results for the financial year to end February 2025 which highlight good progress on its operational improvement programme. However, over recent months the company has seen a rise in competitive intensity in the UK and in response has released guidance for the current financial year below market expectations. In response, the shares are down 7% in early trading, a marked contrast to the sharp rally across the overall market.

Against a highly competitive market backdrop, the company is undertaking a Save to Invest programme with significant opportunities to simplify its business, become more productive, and reduce costs. In the last financial year, the programme delivered £510m of savings, while this year the company is seeking a further £500m of savings to help offset new operating cost inflation, including the impact of an increase in National Insurance contributions of £235m.

During the year, group sales grew by 3.5% at actual exchange rates to £63.6bn, with Retail Like-for-like (LFL) sales up 3.1%.

In the UK, growth was 4.0%. Market share rose by 67 basis points year-on-year to 28.3%, with share gains for 21 consecutive four-week periods and reaching highest level since 2016 during the year. UK online sales were up 10.2%.

The Republic of Ireland rose by 4.6%, while Central Europe generated LFL sales growth of 2.2%. Booker fell by 1.8%, reflecting growth in core retail and catering, offset by ongoing decline in tobacco market and lower Best Food Logistics volumes.

The group’s Save to Invest programme generated significant cost reductions of £510m, helping the business manage inflationary pressures in its cost base. Group adjusted operating profit rose by 10.9% to £3,128m, of which Retail adjusted operating profit grew by 8.1% to £2,973m.

The UK & Ireland was up 10.3% to £3,016m, supported by strong volume performance and Save to Invest delivery. Central Europe profit rose by 29% to £112m, due to improved category mix, volume growth, and further Save to Invest progress.

Free cash flow fell by 15% to £1,750m, due to a tough comparable with last year which benefited from higher trade payables due to elevated input cost inflation. The result was, however, towards the top end of the company’s guidance range, reflecting strong trading performance.

The group’s financial position remains robust, with year-end net debt down 2.4% to £9.5bn (2.0x net debt to EBITDA). The dividend has been pushed up by 13.2% to 13.7p (yield 4.4%).

The company is undertaking an ongoing share buyback programme which reflects the strength of its balance sheet and management’s confidence in the group’s strategy and ability to continue to deliver strong future cash flows. The April 2024 commitment to buy back £1bn worth of shares have been completed and the company has today announced the commencement of a programme to buy back shares with an aggregate market value of up to £1.45bn by April 2026. This will be made up of £750m funded by free cash flow and £700m funded by the sale of the group’s Banking operations.

Looking forward, the company paints an uncertain picture. In the last few months, Tesco has seen a further increase in the competitive intensity of the UK market. The company is committed to ensuring that customers get the best value in the market by shopping at Tesco and management sees further opportunities to protect and strengthen its competitiveness. The company is therefore providing guidance that gives it flexibility and firepower to be able to respond to current market conditions. As a result, for the financial year to February 2026, Group adjusted operating profit is expected to be between £2.7bn and £3.0bn (down from £3.1bn and below the market forecast of £3.2bn). Free cash flow is still expected to be within the medium-term guidance range of £1.4bn to £1.8bn.

Source: Bloomberg