Morning Note: Market News and an Update on the Winton Trend Fund.

Market News

Markets remain extremely volatile as the US reciprocal tariffs on about 60 nations kicked in after countries failed to secure a last-minute reprieve. Tariffs on China climbed to as high as 104%, while imports from the EU will be taxed at a 20% rate. China held off on immediate retaliation to the new tariffs after hitting back within minutes in February and March. It is orchestrating a gradual weakening of the yuan to counter the economic impact of US tariffs. Premier Li Qiang said Beijing has ample tools to offset negative shocks.

Ray Dalio warned investors are too fixated on tariffs and not paying enough attention to a “once in a lifetime” breakdown occurring in major monetary, political, and geopolitical orders. Gold moved back above $3,000 an ounce and is currently trading 2% higher at $3,045.

Long-dated US treasuries are facing an accelerated sell-off as the escalation in trade war is sowing doubts over the safe haven status of US government debt. The yield on 30-year Treasuries surged as much as 25 basis points to a level unseen since November 2023. The 10-year yield leapt again, by 20 basis points to 4.5%, up 60 basis points in three days, although it has now drifted back below 4.4%. The minutes of the last FOMC meeting are due today.

US equities gave up large early gains to finish last night’s session heavily in the red: S&P 500 (-1.6% to its lowest close since February 2024); Nasdaq (-2.2% and now down 24% from its December peak). The Mag 7 has lost over $5tn in market cap from its highs.

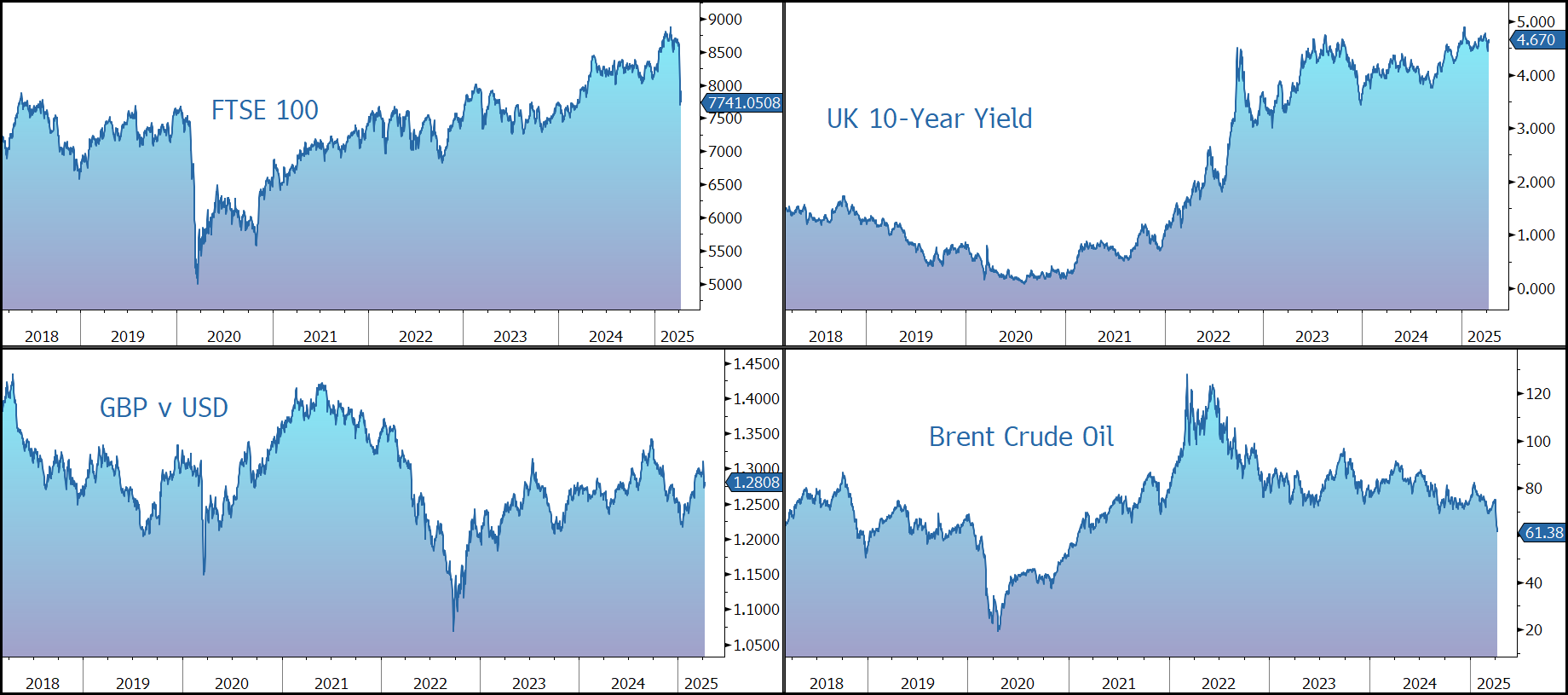

Asian stocks sank to their lowest level since January 2024 – Nikkei 225 (-3.9%); Hang Seng (-0.4%) – although China’s Shanghai Composite rose 0.9%. Markets in Europe opened heavily in the red; the FTSE 100 is currently down 2% at 7,741. Sterling trades at $1.2830 & €1.1595. UK rate futures show 95 basis points of rate cuts by the end of 2025, versus 78bps yesterday. Brent Crude slipped to $61 a barrel, the lowest level since the spring of 2021.

Source: Bloomberg

Fund Update – Winton Trend

Diversification across asset classes is a critical element of managing your investments. At Patronus, when we construct a portfolio, we look to allocate a portion of capital to so-called ‘anti-fragile’ investments that provide shelter in difficult times when other (‘fragile’) asset classes (such as equities and bonds) are struggling to a generate positive return. We believe the Winton Trend Fund is one such investment.

Winton Trend is an actively managed fund which seeks to achieve long-term capital appreciation through a trend following strategy. The manager invests in a diversified portfolio of financial contracts (derivatives) that provide a return linked to the performance (up or down) of certain share indices, bonds, commodities, and currencies. Although the fund has a relatively short track record (since July 2018), it has performed very well in times of market stress.

Total assets in the UCITS vehicle currently stand at around $1.1bn, while the overall trend strategy has assets of just over $2.3bn.

• The correlation to equities (MSCI World, -0.2) and bonds (Bloomberg Global Aggregate, -0.4) is low.

• The fund employs a low level of leverage.

• The annualised volatility is the rate at which the price of a fund increases or decreases for a given set of returns. It is measured by calculating the standard deviation of the fund’s monthly returns. It is currently just under 10%. The manager seeks to mitigate against sharp reversals – positions decrease when volatility increases; the system naturally takes profits.

• Despite periodic bursts of outperformance for faster systems, Winton believes the evidence still suggests stronger performance for slower systems over most investment horizons. The fund continues to trade a blend of speeds with the twin aims of maximising risk-adjusted returns and portfolio diversification.

• The fund is relatively low cost: 1% OCR (of which Management fee is 0.80%) and no performance fee.

The manager highlights that although trend-following strategies are often associated with strong performance in difficult times for the stock market, the strategy can also perform well at the same time as equities. What is more important for trend followers is the diversity of the trends on offer – the strategy tends to perform strongly when there are large moves relative to volatility in markets across multiple sectors. Managers can therefore increase the consistency of a trend-following strategy’s returns by maximising the range of idiosyncratic trends in which the strategy can participate.

Although it is difficult to predict where trends will come from, an investor can identify the types of environment where trend following works well. This is where there is a high level of uncertainty that leads to large market moves that are difficult to price in.

Trend-following funds tend to struggle when a market move sideways or oscillates and when there is a sharp reversal in a trend.

Overall, we believe the decision to hold the fund depends on whether it will perform well and provide capital protection during periods of market stress. Clearly, 2022 was such a year, with a marked pick-up in risk and volatility as a result of Russia’s invasion of Ukraine. The fund achieved an 18% positive return – outstanding in the context of the heavy fall in both equities (-8% for the MSCI World stock Index in Sterling terms) and UK bonds (-15% for the Bloomberg/Barclays Bond Indices UK Govt 5-10 Year Index). On this measure, a typical 60/40 equity/bond portfolio was down by 10.8%.

However, in the first quarter of 2025, the strategy struggled, generating a 3.8% negative return, albeit slightly better than the -4.5% return for the SG Trend Index. This leaves the annualised return since inception in 2018 is 5.5%.

Profits concentrated in precious metals were insufficient to offset losses elsewhere in the portfolio:

- Trend following on gold was the most notable positive contributor in the quarter, with the strategy benefiting from the rally in the precious metal. While there were other profitable trends in coffee, cattle, and soybean meal, performance in commodities was challenging in the other sectors overall due to range-bound trading.

- The financial sectors were difficult for performance overall as long-standing trends in fixed income, currencies, and equity indices reversed. In fixed income, for example, short positions in Japanese, German, and UK government bonds were insufficient to offset losses from short positions in US Treasuries as bond yields declined in the US.

- In currencies, the strategy benefited from long positioning in the Swedish krona and Polish złoty versus the euro, yet overall, the sector was down, with the gains outpaced by losses from short exposure to the euro and Japanese yen versus the US dollar. The strategy is now net long in the euro.

Clearly, following President Trump’s tariff announcement, the first few days of April have been very challenging for markets. In response, Winton has provided an update on the performance of its trend-following CTAs. Early figures suggest losses of -0.9% on Thursday 3 April and -1.2% on Friday 4 April. The drawdown was driven by short fixed-income exposure and long positions in precious metals. Positions are reducing across the two sectors in response to the price action. Elsewhere, losses from directional trend following in stock indices have been largely mitigated by a tilt to faster models in the sector. This leaves performance down 7.3% in the year to 7 April.

Overall, diversification has improved within the portfolio, with reduced net leverage and portfolio sensitivities concealing a healthy balance of longs and shorts within each sector. In equity indices, for example, the trend-following strategy is flat overall, but long Europe and Asia ex Japan and short US and Japan. Similarly in fixed income, shorts in Europe and Japan are being reduced by longs in North America, while trading in currencies is no longer a concentrated bet on dollar strength.

We remain positive on the fund given its portfolio diversification attributes. At a time when the geopolitical and macro-economic outlook remain uncertain and the prospects for other asset classes remains unclear, we believe an allocation to Winton Trend Fund could continue to help mitigate any losses suffered elsewhere in portfolios.

Source: Bloomberg