Morning Note: Market News and an Update from BP.

Market News

The dollar extended losses after its biggest plunge in three years while stocks and bonds sold off as a worsening global trade war eroded an already fragile appetite for risk as market relief turned to angst after the White House clarified US tariffs on China rose to 145%. Donald Trump acknowledged tariffs may cause “transition problems”.

EU leaders plan to visit Beijing in July for a summit with Xi Jinping, the SCMP reported. Separately, Handelsblatt said the bloc and China started talks to abolish tariffs on Chinese EVs.

In a sign investors are seeking havens and non-US alternatives, the euro soared as much as 1.6% against the dollar and Swiss franc touched the highest level in a decade. Gold traded at a new high above $3,200 an ounce.

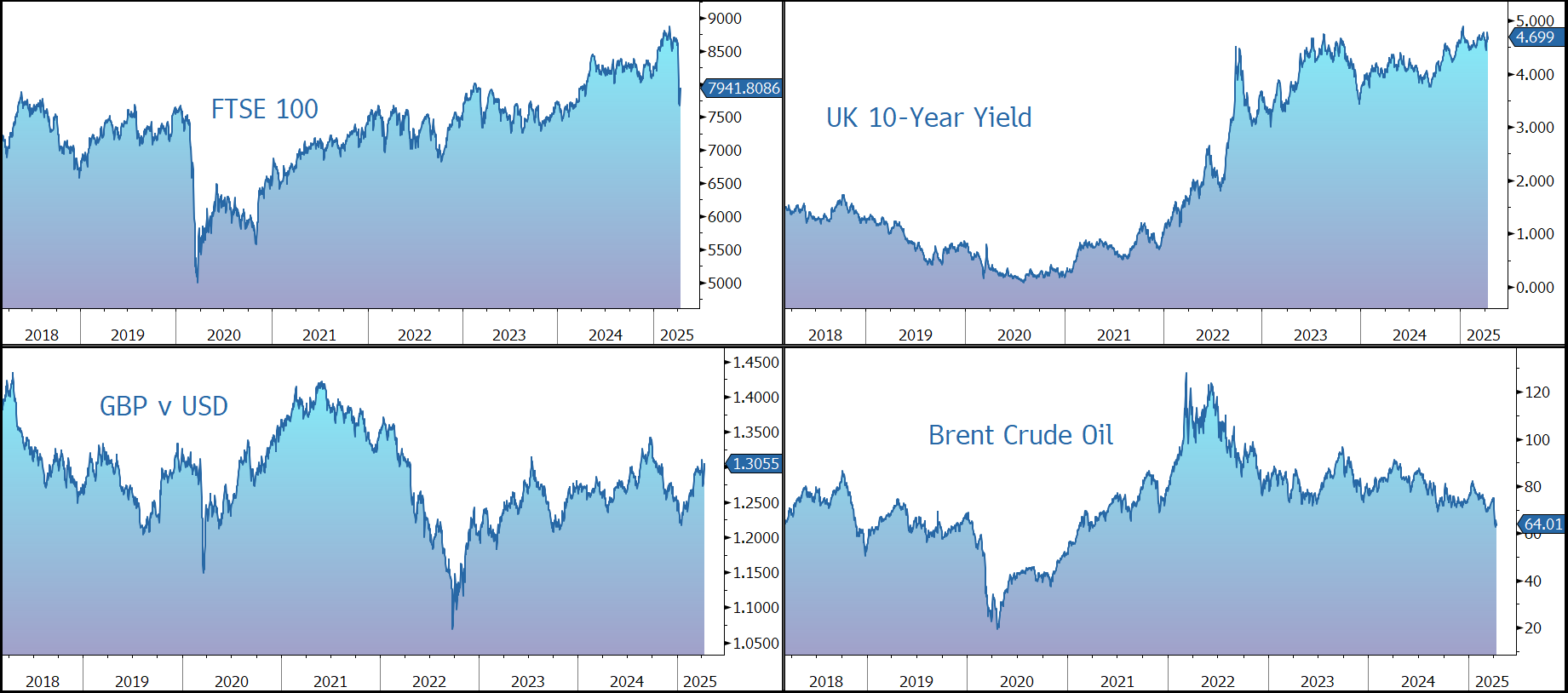

US equities fell last night – S&P 500 (-3.5%); Nasdaq (-4.3%) – giving back some of the gains from the previous session. The market is currently forecast to open slightly higher this afternoon. In Asia this morning, equities were mixed: Nikkei 225 (-3.0%); Hang Seng (+1.7%); Shanghai Composite (+0.5%). The FTSE 100 is currently 0.4% higher at 7,942.

The UK economy grew 0.5% in February, reversing a 0.1% contraction in the previous month. Sterling trades at $1.3040 and €1.1510.

The Q1 earnings season kicks off today. The biggest US banks are projected to post a combined $34.8bn haul from their trading businesses – the most for the first quarter in at least seven years. The companies are expected to strike a cautious tone given the current geopolitical uncertainty.

Source: Bloomberg

Company News

BP has today released a muted trading statement ahead of its Q1 results on 29 April. The statement provides a brief summary of current expectations for the first quarter of 2025, including data on the commodity price environment as well as performance during the period. The release points to lower upstream production and a temporary increase in debt. The shares have been weak over recent weeks on the back of the falling oil price and have been marked down by a further 2% this morning.

Over the last five years, BP has been gradually transforming from an International Oil Company (IOC) to an Integrated Energy Company (IEC). However, performance has been disappointing, and the market has questioned the company’s ability to generate a return on investment at a time when the world is more focused on security of supply and affordability. As a result, the group’s share price performance relative to industry peers has been poor.

Earlier in the year BP announced a reset of its strategy which will involve reducing and reallocating capital expenditure, significantly reducing costs, and driving improved performance in cash flow and returns to support a stronger balance sheet and resilient shareholder distributions. Some shareholders would have liked the company to go further, and we note the decision by the Chairman to stand down, albeit most likely during 2026.

In the Upstream business (i.e. exploration & production), the company is increasing investment in oil & gas to $10bn p.a. (split 70/30 oil/gas) and targetting returns of more than 15%. The portfolio will be strengthened, with 10 new major projects expected to start up by the end of 2027, and a further 8-10 by 2030. Production is set to grow to 2.3m-2.5m barrels a day in 2030, albeit it still below the 2019 level. BP is also targetting structural cost reductions of $1.5bn and an additional $2bn of operating cash flow by 2027.

The Downstream division (i.e. refining & marketing) is being high-graded and will focus on advantaged and integrated positions, while a strategic review of Castrol has been announced. The focus will be on operating performance with a target to consistently improve refining availability to 96%. Capital investment will be $3bn by 2027, with a target of $2bn in cost savings. Overall, the aim is to generate an additional $3.5bn–$4.0bn of operating cash flow in 2027 and returns of more than 15%.

Investment in the group’s ‘transition’ businesses is being slashed from $5bn p.a. to $1.5bn–$2bn p.a., with less than $0.8bn p.a. in low carbon energy. The focus will be on fewer but higher-returning opportunities and more efficient growth. There will be selective investment in biogas and biofuels. In renewables, the focus will be capital-light partnerships, with limited further projects in hydrogen and Carbon Capture & Storage. The group is targeting an annual structural cost reduction of more than $0.5bn in low carbon energy by 2027.

Back to today’s update. In the three months to 31 March 2025, the commodity price backdrop was generally positive: Brent crude averaged $75.73/barrel (compared to $74.73/barrel in the previous quarter); US gas Henry Hub averaged $3.65/mmBtu (vs. $2.79/mmBtu); and the refining margin averaged $15.2/barrel (vs. $13.1/barrel). Clearly, the environment has deteriorated somewhat since the end of the quarter as a result of the tariff announcements. For example, Brent Crude has fallen to $64 a barrel following concerns over increased OPEC+ supply and global economic growth.

Upstream production is expected to be lower compared to the prior quarter, with production slightly higher in oil production & operations and lower in gas & low carbon energy including the already announced divestments in Egypt and Trinidad completed towards the end of prior quarter.

In the gas & low carbon energy segment, price realisations, compared to the prior quarter, are expected to be broadly flat, including changes in non-Henry Hub natural gas marker prices. The gas marketing and trading result is expected to be weak.

In the oil production & operations segment, price realisations, compared to the prior quarter, are expected to be broadly flat, including the impact of price lags on BP’s production in the Gulf of America and the UAE.

In the customers & products segment, the customers segment has benefitted from lower costs and stronger midstream performance, partly offset by seasonally lower volumes. The products segment saw stronger realised refining margins in the range of $0.1bn-$0.3bn and a lower impact from turnaround activity. The oil trading result is expected to be average.

The company is targeting significantly higher structural cost reductions of $4bn–$5bn by the end of 2027 versus a 2023 base. This includes the $750m delivered in 2024. Capital expenditure in 2025 is expected to be $15bn.

By 2027, the aim is to generate compound annual growth in adjusted free cash flow of more than 20% at $70/barrel oil price and returns on average capital employed of more than 16%. Note the oil price is currently $64 a barrel.

The divestment programme has been expanded to $20bn by 2027, including potential proceeds from Lightsource bp and the strategic review of Castrol. In 2025, the group is expected to generate around $3bn weighted towards the second half. There are no plans for major acquisitions.

Net debt at the end of the first quarter is expected to be around $4bn higher (c. $27bn) than at the start of the year, mainly as a result of a working capital build, which is largely expected to reverse, reflecting seasonal inventory effects, timing of payments including annual bonus payments and payments related to low carbon assets held for sale. The group remains committed to maintaining a strong investment grade credit rating. The aim is to reduce net debt to $14bn–$18bn by the end of 2027. This is seen as a more suitable level in a cyclical industry and will drive resilient shareholder distributions of 30%–40% of operating cash flow over time.

Returns will be by way of a dividend which is expected to increase by at least 4% a year and a share buyback programme. For Q1 2025, the company previously guided to a buyback of $0.75bn-$1.0bn. Further detail on operating cash flow, net debt, and shareholder distributions will be provided with the results on 29 April.

Overall, we believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

Against this backdrop, BP is looking to reduce emissions in a way that delivers attractive returns for shareholders at a time of macroeconomic and geopolitical uncertainty. However, investor disillusion with the group’s low carbon strategy, particularly in terms of capital discipline, has had a negative impact on the share price, especially relative to the peer group, leaving them on a very undemanding valuation. Looking forward, we believe a strategic pivot back towards hydrocarbons should, in time, have a positive impact on the shares. Investors will then focus on the outlook for commodity prices and cost cutting, and the cash flow and shareholder returns generated as a result.

Source: Bloomberg