Morning Note: Market news and updates from RS Group and Hays.

Market News

Fed Chair Powell suggested there is no particular inflation number in mind for rate cuts but has some confidence inflation is heading lower. The 10-year Treasury yield held steady at 4.29%, while gold moved up to $2,380 an ounce.

US equity markets pushed higher last night – S&P 500 (1.0%), Nasdaq (1.2%) – driven by large cap tech stocks. Apple aims to ship at least 90m iPhone 16 devices in the second half, counting on AI services to fuel demand. The company told suppliers and partners it’s targeting about 10% growth in shipments compared with the model’s predecessors. The shares rose 1.9% to a record close.

This morning in Asia, markets were also firm: Nikkei 225 (+0.9%); Hang Seng (+2.0%); Shanghai Composite (+1.1%).

China has cracked down on short sales and quants to support sliding stocks.

The FTSE 100 is currently little changed at 8,198. The Bank of England’s Catherine Mann hinted she’s not ready to back rate cuts, warning of a resurgence in inflation. Traders trimmed bets on a quarter-point rate cut at the BOE’s August decision, seeing less than a 50% chance of such a move. Sterling remains firm at $1.2858 and €1.1868.

The oil price rallied to $85.30 a barrel on the back of shrinking US stockpiles. The Biden administration is seeking up to 4.5m barrels for the Strategic Petroleum Reserve for delivery from October through December. The uranium prices and mining stocks rallied following the announcement of a mining tax increase in Kazakhstan.

The FCA has set out a simplified listings regime with a single category and streamlined eligibility for companies seeking to list shares in the country, according to a website statement. This move is part of a concerted effort to draw more IPOs to the City.

Source: Bloomberg

Company News

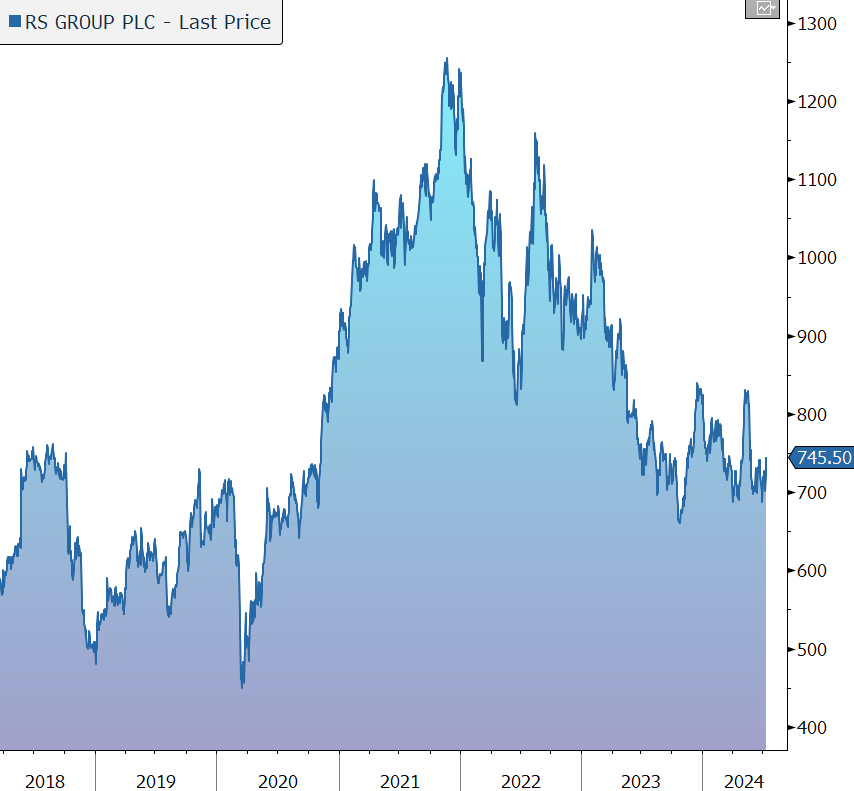

Ahead of its AGM later today, RS Group has released a trading update for the three months ended 30 June 2024. Although revenue continues to decline, performance is in line with management expectations. In response, the shares are up 2% in early trading.

RS Group (previously Electrocomponents) is global distributor of product and service solutions, helping its customers globally maintain, repair, and operate industrial equipment and operations. The group’s range comprises more than 750,000 products, sourced from over 2,500 suppliers. It has more than 1.1m customers with average order value of £257. Customers are increasingly looking to consolidate spend with fewer partners who can offer best-in-class capabilities in terms of product range and service. As a result, the group has outperformed a highly fragmented £400bn global market.

Against a backdrop of weakness in global industrial production and the unwinding of unusual post-pandemic trading tailwinds, the group has simplified its operating model and reduced its cost base. These actions will improve the fundamentals of the business and will support stronger and more sustainable outperformance when markets return to growth.

Today’s update highlights that trading in the June quarter was in line with expectations, with group revenue up 3%. On a like-for-like basis, which excludes acquisitions, foreign currency, and trading days, revenue fell by 3%. As trading conditions stabilise and comparatives get easier, the pace of decline in LFL revenue across all three regions continues to slow as anticipated.

· The 3% decline in the EMEA region reflected largely ongoing volatility business conditions across the region. Total revenue grew by 7% with an additional quarter’s contribution from the Distrelec acquisition.

· Although LFL performance in the Americas benefitted from a strong performance from the Risoul acquisition, revenue still declined by 3% due to continuing weakness in electronics and industrial automation markets.

· Asia Pacific also continues to be impacted by weakness in electronics with LFL revenue down by 3% but is beginning to demonstrate underlying improvement.

The group’s cost savings programme is progressing well, as is the integration of acquisitions and investment in operational efficiencies and system enhancements. The group expects this multi-year investment will improve future operating leverage and returns.

As expected, there was no update on profitability or the group’s balance sheet with today’s statement. At the end of March, gearing was a comfortable 1.1x net debt to adjusted EBITDA. The company pursues a progressive dividend policy while remaining committed to a healthy dividend cover.

The group expects to see a positive impact of around £29m on revenue from greater trading days in 2024/25 compared to 2023/24. The current consensus estimates for 2024/25 is revenue of £3,019m, adjusted operating profit of £307m, and adjusted profit before tax of £274m.

Source: Bloomberg

Hays has this morning issued a weak trading update for the three months to 30 June 2024, the final quarter of its FY2024 financial year. The shares have been weak of late following similar subdued updates from industry peers such as Page Group. In response to today’s statement, they are up 2%.

Hays is an international recruitment group, with 236 offices in 33 countries. The group has c. 11,000 employees working in a broad range of 21 professional and skilled sectors, including Accountancy & Finance, Construction & Property, and IT. The business is also well-diversified between temporary (61% of net fees) and permanent placement markets (39%). The private sector accounts for around 85% of fees, while three quarters is generated outside of the UK.

Market conditions remained challenging in the latest quarter – the group continued to see longer-than-normal ‘time-to-hire’, impacted by low levels of confidence. Given this backdrop, the group has remained focused on driving consultant productivity and tight cost control and has delivered annualised savings of £60m in the financial year to 30 June 2024, £10m more than management’s previous expectation. As a result, average group consultant productivity increased by 3% in the latest quarter.

During the three months to 30 June, net fees fell by 15% in like-for-like (LFL) terms, with a June exit rate of minus 18%. The result was impacted by challenging conditions in Germany and Australia, plus the negative effects of elections in the UK and France.

Despite a more difficult quarter, cost actions mean the group expects FY2024 pre-exceptional operating profit of c. £105m, around the bottom of the market consensus range of £106m-£113m.

The permanent business endured the weakest performance with a 20% LFL decline, driven by volumes down 27%. This was partially offset by a 7% increase in average fee. The temporary business fell by 12%, against a strong year-on-year comparative. Overall average temp volumes decreased by 7%, with the margin broadly flat.

Group consultant headcount fell by 5% in the quarter and by 18% year on year. Looking forward, the group believes its current capacity is appropriate for today’s market conditions and expects overall consultant headcount will remain broadly stable in the current quarter.

The balance sheet remains strong, with net cash of £55m at the end of June, in line with management expectations. Encouragingly, group bad debts remain in line with last year and are at historically low levels.

Given ongoing global uncertainties, in the near-term the group expects its key markets will remain challenging, and is focused on building a more resilient business, targeting the many long-term growth opportunities.

Source: Bloomberg