Morning Note: Market news and updates from PepsiCo and Delta Air Lines.

Market News

Gold surged past the $2,400 per ounce threshold, the highest since touching a record-high close of $2,426 in late May as key metrics of the US economy continued to pave the way for the Federal Reserve to lower interest rates. Fresh data showed that headline inflation in the US slowed more than expected to a one-year low of 3% in June, while the annual core gauge fell to an over-three-year low of 3.3%. The dollar weakened and the 10-year Treasury yield slipped to 4.22%.

US equity markets endured profit taking last night – S&P 500 (-0.9%), Nasdaq (-2.0%) – with weakness seen in technology stocks. Investors rotated into smaller stocks, with Russell 2000 index climbing 3.6%.

This morning in Asia, the Nikkei 225 fell by 2.4% following a surge in the yen on the back of a suspected intervention from Japanese authorities. Other Asian markets enjoyed a strong session: Hang Seng (+2.5%); Shanghai Composite (+0.1%). China’s exports climbed 8.6% in dollar terms in June from a year earlier, pushing the trade surplus to its highest in more than three decades. Imports slipped 2.3%, missing estimates.

The FTSE 100 is currently trading 0.4% higher at 8,263, while Sterling has risen to $1.2919 and €1.182.

The oil price edged up to $85.60 a barrel. Startup 280 Earth, a product of Alphabet’s moonshot factory, signed $40m of agreements to extract carbon dioxide at a newly completed factory in Oregon.

Source: Bloomberg

Company News

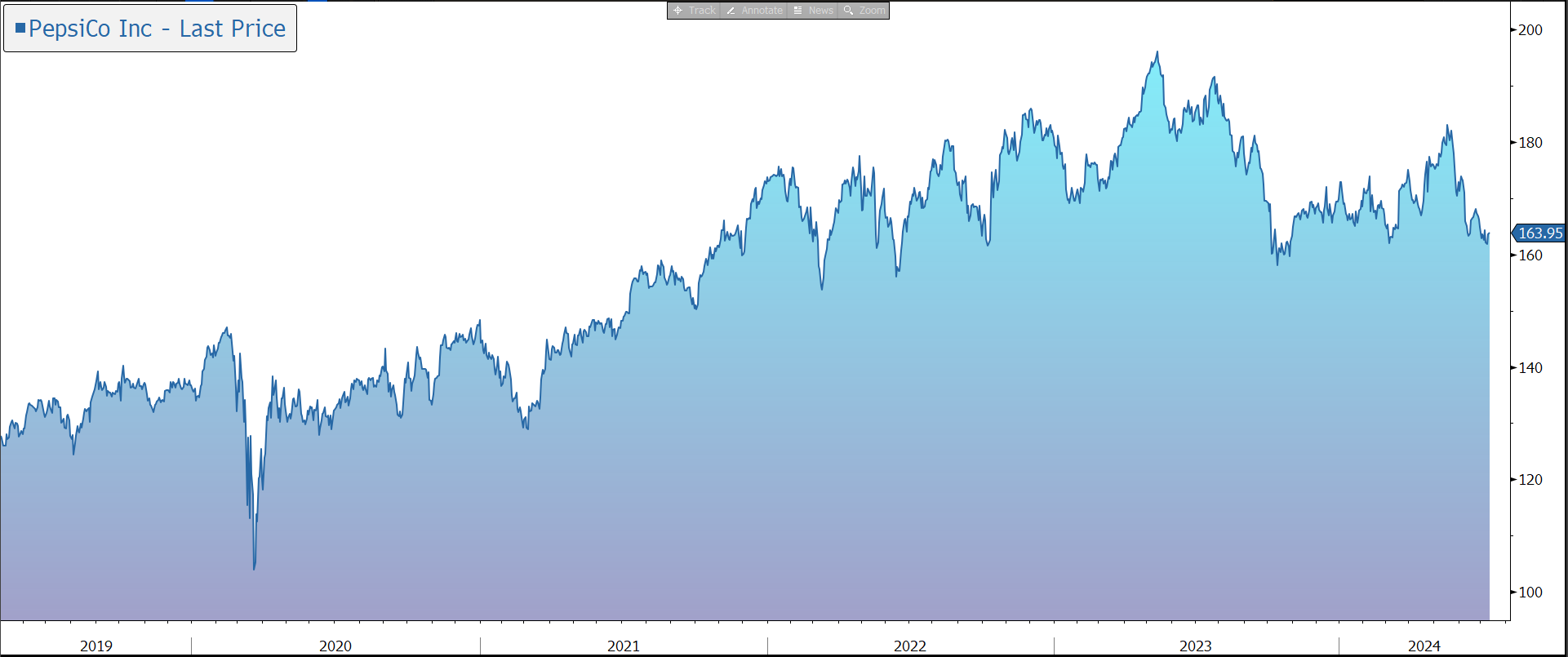

Yesterday afternoon, PepsiCo released its Q2 results and slightly reduced its full-year revenue guidance. In response, the shares were little changed during US trading hours.

PepsiCo is a global food and beverage company with annual sales of more than $91bn. The portfolio includes more than 20 brands that each generate more than $1bn of annual retail sales, including Frito-Lay, Doritos, Walkers, Quakers, Pepsi, Gatorade, and Tropicana. The group’s products are consumed more than one billion times a day in more than 200 countries and territories around the world. The long-term targets are organic revenue growth of 4%-6% and core constant currency EPS growth in the high-single-digits.

During the three months to 30 June 2024, net revenue rose by 0.8% to $22.5bn, a touch below the market forecast of $22.6bn. In organic terms (i.e., excluding currency and M&A), revenue growth was 1.9%, leaving the growth rate at 2.3% for the first half. Net pricing of 5% was offset in part by a 3% volume decline. Organic growth in the international businesses (+5.5%) made up for a slight decline in North America.

PepsiCo faced weak demand for its snacks and sodas mainly in the US, its largest market, with inflation-weary consumers cutting back spending, prompting the company to double down on promotions and marketing efforts to bolster volume growth. The company also faced difficult comparisons versus the prior year – Q2 2023 was up 13% – and the impact associated with certain product recalls at Quaker Foods North America. Consumer preferences have continued to evolve towards smaller packages that offer the benefits of convenience, variety, and portion control.

The core gross margin rose by 120 basis points, while the core operating margin grew by 103 basis points, reflecting ongoing cost management initiatives, partially offset by planned business investments. Core constant currency EPS grew by 10% to $2.28, above the market expectation of $2.16.

For the balance of the year, the group will further increase and accelerate its productivity initiatives and make disciplined commercial investments to stimulate growth. For the full year, the group now expects to deliver approximately 4% organic revenue growth (vs. at least 4%, previously), with the downgrade due to the subdued performance in North America convenient foods year-to-date. However, the group has a high degree of confidence in delivering at least 8% core constant currency EPS growth, implying core EPS of at least $8.15. The group also expects to deliver total cash returns to shareholders of $8.2bn, comprised of dividends of $7.2bn and share repurchases of $1.0bn.

Source: Bloomberg

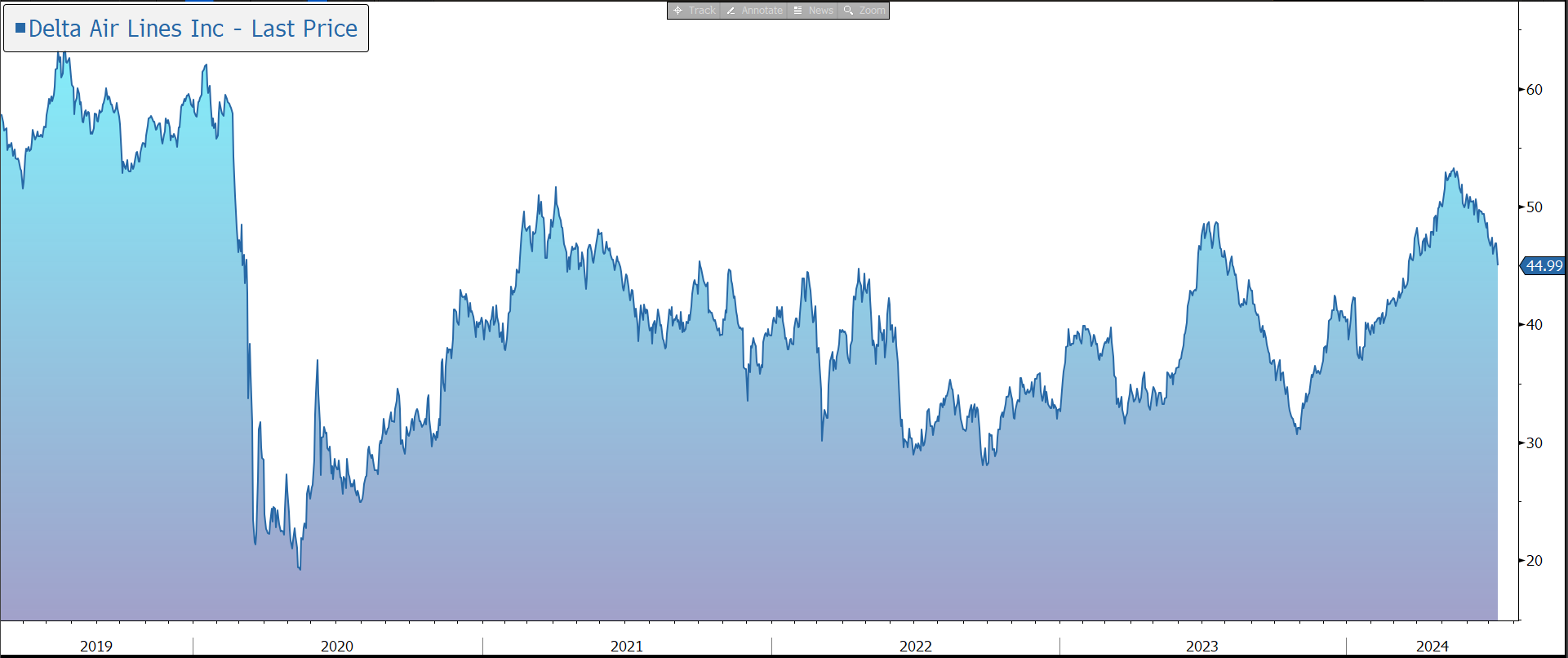

Yesterday lunchtime, Delta Air Lines released its robust Q2 results but published weaker than expected guidance for the current quarter. In response, the shares were marked down by 4%.

Delta is one of the world’s largest global carriers with a fleet of around 1,300 aircraft that are varied in size and capabilities, providing flexibility to adjust aircraft to the network. The group has acquired new and more fuel-efficient aircraft with increased premium seating to replace older aircraft and has reduced fleet complexity with fewer fleet types. In the latest quarter, the group took delivery of 11 aircraft. With an industry-leading global network, Delta and the Delta Connection carriers offer service to more than 290 destinations on six continents.

During the second quarter, peak summer travel demand remained strong. Operating revenue grew by 5.4% to $16.7bn, a record June quarter, albeit at the lower end of the company guidance for growth of 5%-7%. Year to date, Delta has led the industry in completion factor and on-time performance and operated 39 cancel-free days. Adjusted total unit revenue (TRASM) was down 2.6%.

Domestic total passenger revenue was up 5%, with international revenue up 4%. Premium, loyalty, and other diversified revenue streams comprised 56% of total revenue. Premium revenue grew 10% during the quarter, while Loyalty revenue was up 8%, driven by co-brand spend growth and increasing premium card mix. The weakness was in the Main Cabin revenue stream, which was flat during the quarter. Cargo revenue grew 16%.

Adjusted non-fuel unit costs only grew by 0.6%. Adjusted fuel expense rose by 12% to $2.8bn, with fuel efficiency improving by 1.1%. The operating margin was 14.7%, versus company guidance of 14%-15%. EPS fell by 12% to $2.36, in the middle of the group’s $2.20-$2.50 guidance range.

Free cash flow came in at $1.3bn. Financial gearing fell from 3.0x to 2.8x net debt to EBITDAR, at the upper end of its 2x-3x target range as the group progresses toward investment grade ratings.

Although demand for air travel remains strong, discounting pressure in the low end of the market has dampened pricing power. Things are expected to improve from August as US carriers start to slow seat additions. As a result, the group’s expectations for the current quarter are below the market forecast: revenue growth of 2%-4%, an operating margin of 11%-13%, and EPS of $1.70-$2.00 (vs. consensus of $2.05). However, the group remains confident in its full-year guidance: EPS ($6.00-$7.00) and free cash flow ($3bn-$4bn).

Source: Bloomberg