Morning Note: Market news and an update from M&G.

Market News

US equities sold off last night – S&P 500 (-2.1%); Nasdaq (-3.3%) – led by large tech stocks. Nvidia fell by 10% and by a further 2% in the after-market amid renewed concerns over the artificial intelligence frenzy. The Phily Semiconductor Index fell by 7.7%, the biggest one day decline since March 2020.

Weak data out of the US manufacturing sector raised concerns of an economic slowdown. ISM data showed that US activity fell more than expected in August. 10-year Treasury yields slipped to 3.83%, while gold edged lower to $2,485 an ounce.

In Asia this morning, markets were also hit by heavy selling in tech stocks: Nikkei 225 (-4.2%); Hang Seng (-1.2%); Shanghai Composite (-0.7%). The Caixin PMI showed China’s services activity expansion slowed in August to 51.6 versus 52.1 – expansion but less than expected.

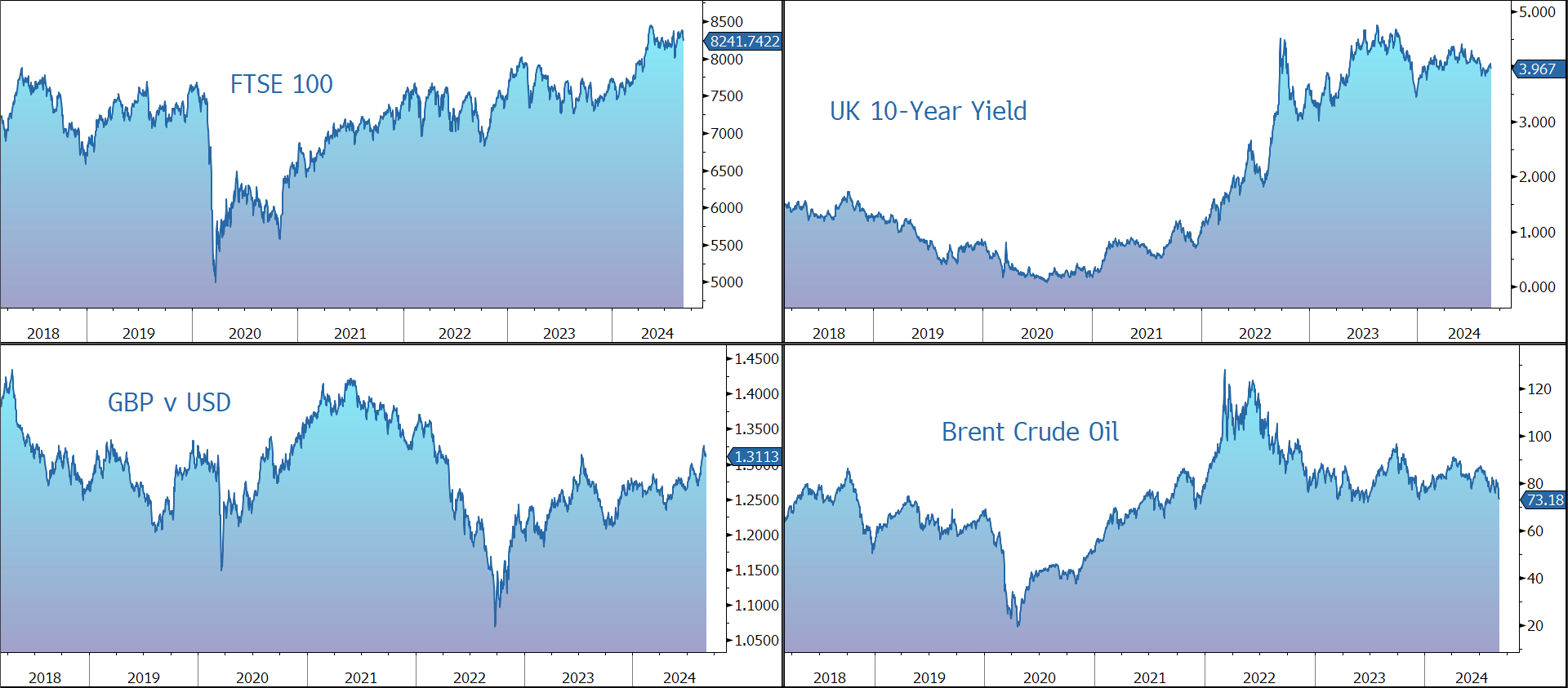

The FTSE 100 is currently trading 0.7% lower at 8,242, while Sterling trades at $1.3115 and €1.1861.

The oil price fell by 5% to $73.50 a barrel, hitting its lowest level since December 2023, weighed down by concerns over rising supply. A Bloomberg report indicated that Libya’s rival governments might be close to a deal that could resume oil production after recent disruptions.

Source: Bloomberg

Company News

M&G has today released a resilient set of results for the first half of 2024 and upgraded its cash generation and cost savings targets. In response, the shares are little changed against a weak market backdrop.

M&G is a leading international savings and investments business, managing money for around 4.6m retail clients and more than 900 institutional clients worldwide. The company serves retail and savings clients under the M&G and Prudential brands in the UK and Europe, and under the M&G Investments brand for asset management clients globally.

The company is the ultimate parent company of The Prudential Assurance Company. It is not affiliated with Prudential Financial, Inc., in the US, or Prudential plc, an international group which provides life and health insurance and asset management services in 24 markets across Asia and Africa.

Since the company’s demerger from Prudential plc, M&G has embarked upon three strategic priorities: Financial Strength, Simplification, and Growth.

Against the backdrop of a challenging market environment, in the first half of the year, assets under management and administration (AUMA) have risen by 1% to £346.1bn. There was a net client outflow of £1.5bn, with reduced outflows in UK Institutional Asset Management and continued inflows in International Institutional Asset Management.

As of 30 June, 62% of the group’s mutual funds ranked in the upper two performance quartiles over three years and 66% over five years. In institutional asset management, over 70% of funds by AUMA outperformed their benchmarks on both a three and five-year basis.

Managed costs fell by 4%, more than offsetting inflationary pressures and freeing up resources to support investment in growth initiatives, thanks to cost savings of £121m since the launch of the programme in early 2023. With today’s results, the group has increased its cost savings target from £200m to £220m by 2025, reflecting the strong progress achieved to date. This excludes any additional benefits from the combination of the Life and Wealth operations announced today.

Adjusted operating profit before tax fell by 4% to £375m. The group generated a 9% improvement in Asset Management contribution, offset by a 7% reduction in Life and Wealth due to lower contractual service margin (CSM) amortisation rates and returns on surplus assets.

Operating Capital Generation (OCG) fell by 4% to £486m. This takes the cumulative OCG since the start of 2022 to £2.3bn, enabling the group to increase its three-year cumulative target from £2.5bn to £2.7bn by the end of the year.

The company has materially improved the financial strength of the business, lifting its Shareholder Solvency II coverage ratio from 203% to 210% thanks to the resilient operating result and the reversal of £216m capital restrictions. The dividend policy is to deliver stable or growing dividends – the first half payout has been raised by 1.5% to 6.6p.

The company believes it is well positioned to navigate the current uncertain economic climate due to its diversified business model, international footprint, innovative products and services, and investment capabilities and expertise.

The group is making good progress on its financial targets, in particular on the upgraded operating capital generation target of £2.7bn by end of 2024, and the upgraded cost savings target of £220m by end of 2025.

Source: Bloomberg