Morning Note: Market news and an update from Currys.

Market News

Treasuries remain firm, with the 10-year yield falling to 3.76%. Gold moved back above $2,500 an ounce. Howard Marks said US rates will settle in a 3%-4% range after Fed cuts. “We’re going to stay there in the threes and we’re not going back to zero or a half or one,” the Oaktree co-founder said. Rate reductions are needed to keep the labour market healthy, the Fed’s Mary Daly told Reuters.

US equities registered small losses last night – S&P 500 (-0.2%); Nasdaq (-0.3%) – while most markets in Asia drifter lower this morning: Nikkei 225 (-1.1%); Hang Seng (-0.5%); Shanghai Composite (+0.2%). The yen held its recent advance to around 143.6 per dollar, hovering near a one-month high as investors reacted to data showing real wages in the country increased for the second straight month in July, reinforcing expectations that the Bank of Japan will raise interest rates again before the year ends. JPMorgan abandoned its buy recommendation for Chinese stocks.

The FTSE 100 is currently little changed at 8,273. Companies trading ex-dividend include Admiral (2.45%), Aviva (2.39%), Croda International (1.19%), DS Smith (2.59%), IAG (1.36%), and Prudential (0.82%). Sterling trades at $1.3148 and €1.1856.

US crude inventories fell by 7.4m barrels last week, API data is said to show. That would bring down total holdings to the lowest in 11 months if confirmed by the EIA. OPEC+ is said to be close to an agreement to delay a supply increase scheduled for October. Even so, the oil price remains weak, with Brent Crude hovering below $73 a barrel. Iron ore sank to its lowest since 2022.

Kamala Harris is pushing for a 28% capital gains tax on people earning $1m or more. That’s an increase from the current 20% rate but is less than the 39.6% that Joe Biden embraced. Donald Trump has called for a series of tax cuts.

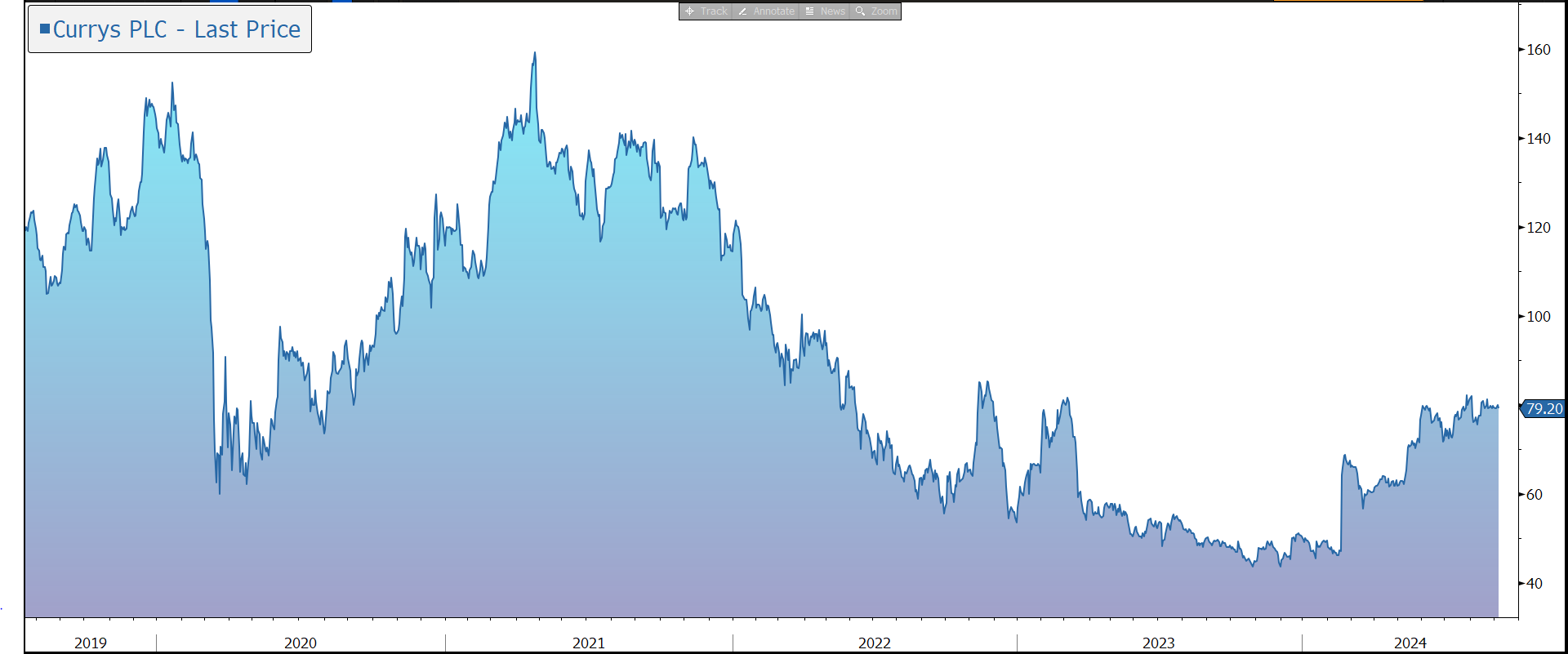

Source: Bloomberg

Company News

Currys has this morning released a trading update highlighting a positive start to its new financial year to end April 2025. However, guidance for the full year remains unchanged and, in response, the shares are down 1% in early trading.

Currys is a leading multichannel retailer of technology products and services, operating online and through 719 stores in six countries. As a result, the group is well placed to supply the technology that has become ever more central to people’s lives. In the UK & Ireland, the group trades as Currys, and in the Nordics under the Elkjøp brand. The company sold its operation in Greece and Cyprus last April.

Earlier in the year the company was subject to bid speculation following an announcement that JD.com was in the very preliminary stages of evaluating an offer. However, JD.com later announced it did not intend to make an offer.

Today’s statement highlights that in the 17 weeks to 24 August, like-for-like (LFL) sales rose by 2%.

In UK & Ireland, LFL sales grew by 5%, with strong sales aided by market share gains, encouraging early adoption of AI computing products, and England’s performance in Euro24. Mobile continues to perform strongly, with iD Mobile growing by 34% to over 1.9m subscribers. Gross margin improvements have been driven by continued positive momentum in Services, with credit and solution sales growing above expectations.

In the Nordics, LFL sales fell by 2% as the company grew its market share in a consumer environment that remains weak. Higher Services adoption has driven gross margin improvement despite tough competition. Operating costs are being tightly controlled including reduced marketing spend and central costs.

For the full year, the group remains confident in its expectations for profit and free cash flow growth. The balance sheet is expected to remain in a net cash position – the year-end balance was £96m. Over the longer term, Currys is still targeting at least a 3.0% adjusted EBIT margin, with a focus on delivering improving free cash flow.

Source: Bloomberg