Morning Note: Market news and updates from hotel group IHG and miner BHP.

Market News

This morning in Asia, China’s commercial banks cut the 5-year loan prime rate — the benchmark for mortgages — by the most on record, but investors failed to get excited. Forsyth Barr Asia’s Willer Chen called it a “good gesture” though it wasn’t the solution to the nation’s property crisis. Equities were mixed, with the Nikkei 225 down (-0.3%), while the Hang Seng (+0.4%) and Shanghai Composite (+0.4%) ended the session on a positive note.

The FTSE 100 is currently trading 0.2% lower at 7,709. Barclays is up 5% following plans to return at least £10bn by 2026. Sterling trades at $1.2585 and €1.1680.

The 10-year Treasury currently yields 4.3%. Investors have added $128bn to US money-market funds since the start of the year, Investment Company Institute data show. Traders are dialing back rate cut expectations and companies sitting on record coffers don’t seem to be in a rush to spend — signs 2024 will be another big year for cash.

Bloomberg believes the dollar looks set to enjoy a sustained uptrend as policymakers find reason to push back against imminent interest-rate cuts, defying some indications that investors remain wedded to the once-popular outlook of a weaker greenback. Gold trades at $2,022 an ounce.

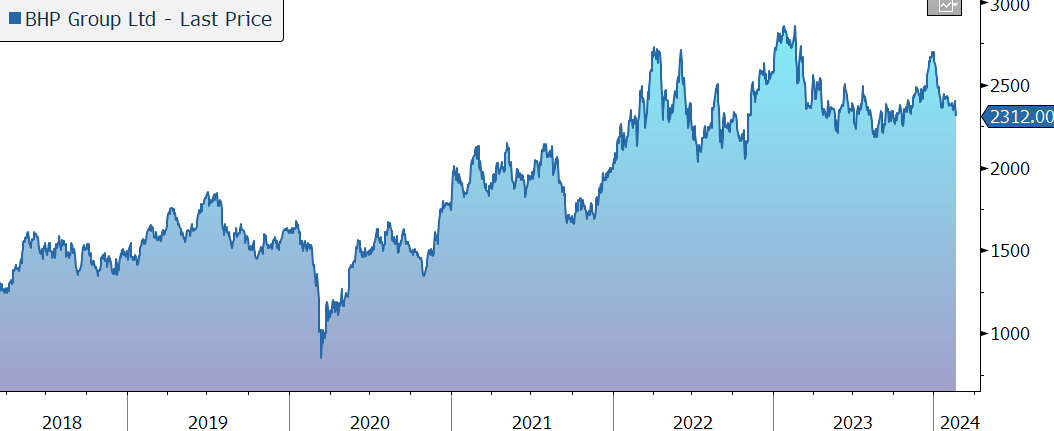

Brent nudged up to $83 a barrel. Iron ore futures have slumped on China demand concerns, while BHP expects the Nickel’s oversupply may last until the end of this decade.

Source: Bloomberg

Company News

InterContinental Hotels Group has today released its 2023 results which highlight that travel demand remained strong across all markets, while new hotels signings ended the year on a very strong note. The group has set out a new financial framework and announced an $800m share buyback programme. The shares were strong last year (+53% total return) and are up 2% in early trading this morning.

IHG owns a portfolio of 19 attractive brands across all price tiers (including Crowne Plaza, InterContinental, Holiday Inn, and Six Senses) and has a strong operating system, both of which drive customer loyalty and pricing power. The group operates a highly scalable, asset-light model, based on franchising and management contracts, with low capital intensity and high returns. The model also means the group doesn’t bear the operational costs of running a hotel. The company is focused on delivering industry-leading net rooms growth over the medium term. It currently has a 4% global market share and a 10% share of the new room pipeline. At the end of 2023, the global estate was 946k rooms across 6,363 hotels, with 66% in midscale segments and 34% in upscale and luxury. Gross revenue generated by the group’s hotels is more than $31bn.

Long-term growth is being driven by a rising global middle class with a desire to travel. In the business market, IHG’s weighting is towards essential travel and non-urban markets.

In 2023, revenue grew by 19% in underlying terms to $2,164m. Operating profit grew by 25% in underlying terms to $1,019m, while fee margins rose by 3.4 percentage points to 59.3%, driven by trading recovery in EMEAA and Greater China. Adjusted EPS grew by 33% to 375.7c, while the dividend was raised by 10% to 152.3c

Global revenue per available room (RevPAR) – the key measure of industry performance – grew by 16.1% in the year and by 7.6% in the final quarter. The guest appeal of the group’s brands has continued to support pricing, with average daily rate up 5%. Occupancy rose by six percentage points to 68%. RevPAR is now 10.9% above the 2019 pre-pandemic level, with occupancy only one percentage point below and an average daily rate 13% higher.

There is still a wide regional variation across the business. In Americas (the group’s largest division), RevPAR was up 7.0% in the year and by 1.5% in Q4. The EMEAA region grew by 23.7% and 7.0% in Q4. In Greater China, RevPAR bounced by 71.7% following the lifting of travel restrictions and by 72.0% in Q4.

IHG continued to open new hotels and sign rooms more into its pipeline as it benefits from a ‘survival of the fittest’ bias as many smaller competitors exit the market. During the year, 47.9k rooms across 275 hotels were opened. Gross system size grew by 5.3% year-on-year, while the removal rate of 1.5% was in line with the historical underlying average. Net system size growth was 3.8%, versus a target to be ‘close to 4%’. Conversions from other brands accounted for 37% of combined openings and signings in the year, a big positive given the time to open is much shorter than with a new build.

IHG signed 79.2k rooms (556 hotels) in the year, up 26%, to give a global pipeline of 297k rooms (2,016 hotels), up 5.5% year-on-year, and 31% of the current system size. Q4 signings were one of the highest on record (+50%). More than a quarter of signings were across the six Luxury & Lifestyle brands, as the group accelerates growth in this higher fee income segment. Last summer, the group launched a new brand, Garner, to target mid-scale conversion opportunities, and designed for value-driven travellers, a space worth $14bn in the US market alone. The brand achieved its first seven signings and two openings by the end of the year.

The asset-light model means IHG has low investment requirements and a negative working capital cycle. In 2023, the group generated adjusted free cash flow up 45% to $815m (129% conversion). The group operates a conservatively leveraged business model and maintains strong liquidity, ending the year with net debt up 23% at $2,272m. Gearing was 2.1x EBITDA, well below its 2.5x-3.0x target range.

In response, the group is returning surplus capital through share buybacks, with $750m repurchased in 2023 (6% of market cap.). With today’s results, the group has announced a new $800m programme (5% of market cap.) which would still leave end-2024 gearing at the lower end of the range.

Looking ahead, whilst geopolitical risks and the economic outlook in some geographies show challenges and uncertainties, current conditions, including employment, consumer savings, and business activity levels, remain supportive of industry growth. Near-term growth is also expected to capture several tailwinds, including: the last stages of a full post-pandemic recovery in several countries; further recovery in occupancy levels for business travel and for groups, meetings, and events; the full restoration of international flight capacity; and further potential for room rate increases driven by the increase in demand, constrained net new supply in the short term, and any ongoing inflation.

Overall, the company remains confident in the strengths of its business model, scale, and in its strategic priorities to capture sustainable, profitable growth.

The group has set out a financial framework for the medium to long term, targetting:

· high single digit percentage growth in fee revenue, though combination of RevPAR and system size growth, together with 100‑150bps fee margin expansion, annually on average.

· 100% conversion of adjusted earnings into adjusted free cash flow, supporting investment in the business to optimise growth, sustainably growing the ordinary dividend and returning surplus capital.

· 12-15% adjusted EPS compound annual growth rate, including the assumption of ongoing share buybacks.

Source: Bloomberg

BHP Group has this morning released results for the financial half year to 31 December 2023. Although the print was slightly better than market expectations, the group warned the lagged effect of global inflation will continue into the second half. In response, the shares are down 2% in early trading.

BHP is a diversified resources company with exposure to iron ore, metallurgical coal, copper, nickel, and potash. Assets are high quality and largely located in lower-risk jurisdictions, with strong development potential. The group’s capital allocation framework provides flexibility at the bottom of the cycle and discipline at the top, and has seen a shift in focus to low-cost, high-return projects. BHP has positioned itself to benefit from the unfolding mega-trends of decarbonisation, electrification, population growth, and the drive for higher living standards in the developing world, which it sees becoming key drivers of commodity demand.

During the half-year, underlying attributable profit from continuing operations was unchanged at $6.6bn. The group saw volatility in global commodity prices and demand in the developed world that was softer than expected due to anti-inflationary policies and the lagged impacts of the energy crisis. However, China demand was healthy despite weakness in housing and India remained a bright spot. The period also had its challenges, with adjustments relating to Nickel West, West Musgrave, and Samarco assets offsetting an otherwise solid operational performance and overall healthy commodity prices. In copper, BHP set new production records at its operations in South Australia and Chile.

The group experienced an effective inflation rate of c. 6.3% across its markets in the period and expects the lagged impact of inflation to continue into FY24, particularly in labour costs. Unit costs were 5.4% higher across the group’s major assets, although Western Australian Iron Ore (WAIO) maintained its lead as the lowest cost major iron ore producer globally.

The group generated a 53.3% margin from continuing operations (down from 53.5%) and its underlying return on capital employed fell from 29.4% to 26.4%.

Capital and exploration expenditure grew by 57% to $4.7bn as the group increased its exposure to future-facing commodities. 70% of medium-term capital spend is expected to be focused on these commodities.

During the period, free cash flow rose by 9% to $3.8bn and net debt moved up by $1.5bn to $12.6bn (21.6% gearing). Borrowing remains in the target range of $5bn-$15bn and is expected to remain towards the upper end in the near term. BHP’s dividend policy provides for a minimum 50% payout of underlying attributable profit at every reporting period. Today, the group has announced a half-year dividend of $0.72 per share (or $3.6bn).

Looking forward, the group believes the lag effect of higher interest rates will continue to restrain household consumption in the developed world in the next six months, but steel, copper, and nickel demand will all be modestly firmer across the OECD countries in the coming 12 months. The group also forecasts another solid year for commodity demand in China, while India has considerable positive momentum behind it. Labour costs remain a key forward-looking inflationary risk. All the group’s assets are on track to meet their FY24 production and unit cost guidance.

The company also makes the point that the overall cost of mining production is now estimated to be higher than it was prior to the pandemic. This implies that price support is also expected to be higher than in previous cycles and low-cost operators stand to capture potentially higher relative margins in certain commodities.

Source: Bloomberg