Morning Note: Market news and updates from BP and AB InBev.

Market News

Benjamin Netanyahu ruled out a ceasefire with Hamas and dismissed calls for him to quit over security failures in the 7 October attack. The region is seeing more unrest: Israeli forces exchanged fire with Hezbollah across the Lebanese border and Saudi Arabia’s military is on high alert following deadly clashes with Yemen’s Iran-backed Houthi rebels.

Markets whipsawed after the BOJ said its 1% cap on 10-year yields was now merely a reference. The yen fell the most in two months, sliding past 150 while stocks advanced (Nikkei 225, +0.6%). The central bank said it would no longer conduct daily fixed-rate bond-buying operations, acknowledging their “large” side effects. It also raised its inflation forecasts. China stocks fell with the yuan after the disappointing PMI data. Samsung profit beat estimates and predicted a recovery in the chip market next year.

The S&P Futures are currently predicting a small decline at the US open this afternoon. The FTSE 100 is currently little changed at 7,327. The 10-year Treasury currently yields 4.84%. The oil price has recovered some of yesterday’s losses, with Brent currently trading at $87 a barrel. Gold trades at $1,998 an ounce.

Inflation in UK stores fell for a fifth straight month to hit the lowest level since August 2022, another sign the cost-of-living crisis is easing. Shop prices were 5.2% higher in October than a year earlier, down from 6.2% in September, the British Retail Consortium said. The Bank of England is expected to stand pat when it meets Thursday. Sterling currently buys $1.2157 and €1.1438.

Source: Bloomberg

Company News

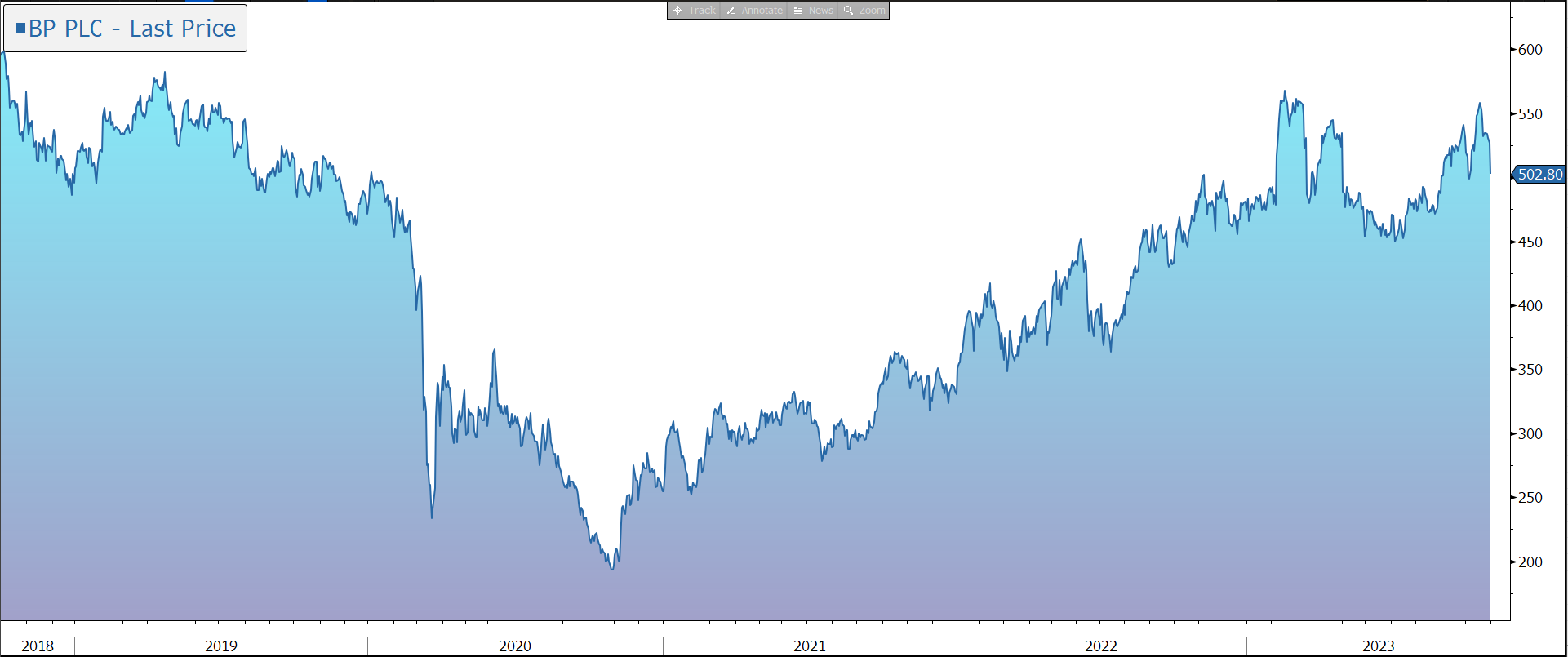

BP has this morning released Q3 results which were below market expectations due to a poor trading performance and warned of lower refining margins in the current quarter. The group increased its dividend and committed to buying back another $1.5bn of its shares during the next three months. In response, the shares are down 5% in early trading.

BP is gradually transforming into an integrated energy company, a strategy that was confirmed at its recent investor event despite the change in senior management. By the end of the decade, the company aims to have built a portfolio of transition growth engines (TGEs), with investment expected to reach $7bn-$9bn a year in 2030. Half will be invested where BP has established businesses, capabilities, and track record – bioenergy, convenience, and EV charging – with the other half in hydrogen and renewables & power. EBITDA (i.e., cash profit) from TGEs is expected to grow to $3bn‑$4bn in 2025 and $10bn-$12bn in 2030 (c. 20% of group profit).

BP is not abandoning hydrocarbons – far from it. Instead, it is ‘high-grading’ its business towards a focused portfolio of resilient high-quality oil and gas projects that generate premium free cash flow. Investment is being increased by $1bn a year, or up to a cumulative $8bn to 2030. This will help meet near-term demand for secure supplies of oil and gas, generating additional earnings that can further strengthen BP and support investment in its green transition. The incremental investment will target shorter-term, fast-payback projects that maximise value and deliver rapidly with minimal new infrastructure. Oil and gas production will be around 2.3m barrels a day in 2025 and 2.0m b/d in 2030, 25% lower than in 2019.

The overall investment of $14bn-$18bn a year includes acquisitions, providing some reassurance the company won’t engage in large-scale, value-destroying M&A. As a result of this, and an increase in assumptions for oil and gas prices and refining margins, the company is targeting group EBITDA of $46bn-$49bn in 2025 and $53bn-$58bn in 2030 in a $70/barrel oil price environment, with the latter recently increased by $2bn. The group is also targetting a return on average capital employed of over 18%.

In the three months to 30 September 2023, underlying replacement cost profit – the key measure of the group’s performance – fell by 60% to $3.3bn, below the market forecast of $4.0bn, albeit above the $2.6bn generated in the previous quarter. The decline compared to the same quarter last year mainly reflects lower oil and gas realisations and a weak gas marketing and trading result. Upstream production rose by 2.7% in the quarter to 2.3m b/d.

Cost discipline remains very strong – so far this year, upstream production costs have fallen by 5.9% – as does operational performance in terms of upstream plant reliability (95.7%) and refining availability (96.0%). The focus is now shifting to the downstream division where digitalisation could again significantly reduce the cost base.

The group advanced hydrocarbon projects including the Tangguh LNG expansion and bpx energy’s ‘Bingo’ central processing facility in the Permian Basin. Momentum in low carbon areas continued – during the quarter, Archaea Energy’s started up its first modular biogas plant. On a negative note, the company took an impairment charge of $540m in relation to US offshore wind projects.

Operating cash flow rose by 6% to $8.7bn, including a working capital release of $2.0bn. The group also received $655m of disposal proceeds from non-core assets, leaving it on track to hit $25bn by 2025. Capital expenditure was $3.6bn in the quarter (including $bn of M&A), and the group now expects full-year spend of $16bn, at the lower end of its $16bn-$18bn target. Net debt was little changed at $22.3bn, with gearing at 20.3%, and the group remains committed to maintaining a strong investment grade credit rating.

The company allocates around 40% of its surplus cash flow to further strengthening the balance sheet and maintaining a resilient cash balance point of around $40 per barrel Brent oil price. This provides the capacity to grow its dividend by around 4% a year at around $60/barrel. In addition, the company is committed to allocating 60% of surplus cash flow to share buybacks, equating to $4bn a year at $60/barrel at the lower end of its capital expenditure range, with the prospect of more in a higher price environment. Note the current price is $87/barrel.

Today, the group has declared a quarterly dividend of 7.27c, 21% higher than last year. A similar payout for the full year would equate to a 4.5% yield at the current share price and currency rate. The $1.5bn quarterly share buyback programme announced with the Q2 results was completed earlier this week. Today, the group has announced a further $1.5bn buyback from the $3.1bn of surplus cash flow generated in the quarter.

In the current quarter, the group expects oil prices to be supported by OPEC+ production restrictions and the continued demand rebound. European gas and Asian LNG prices will be driven by weather, demand recovery in Europe and China and ongoing geopolitical tension. In the US, weather is also a risk factor, but higher than normal storage levels and higher production should help to dampen volatility. Industry refining margins are expected to be significantly lower than the third quarter.

We believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, is increasingly leading to constrained supply.

Against this backdrop, BP is looking to reduce emissions in a way that delivers attractive returns for shareholders at a time of macroeconomic uncertainty. Although execution of the group’s low carbon strategy, particularly in terms of capital discipline, will have some impact on the share price, far more important in the medium term will be commodity prices and cost cutting, and the cash flow and shareholder returns generated as a result.

Despite strong performance over the last three years, the shares remain on an undemanding valuation, both in absolute terms and relative to the US majors, which fails to consider the potential for free cash flow generation and shareholder returns. We believe they also provide something of a hedge against inflation, while recent consolidation in the sector – Exxon buying Pioneer and Chevron buying Hess – provides further support.

Source: Bloomberg

Anheuser-Busch InBev has this morning, the group released better-than-expected Q3 results and announced a new share buyback programme. In response, the shares are up 2% in early trading.

AB InBev is a global brewing company with more than 500 beer brands, including Budweiser, Stella Artois, Becks, Corona, Modelo, and Leffe. The group’s premium portfolio represents over 30% of revenue and continue to benefit from the global trend to ‘drink less, drink better’. New products continue to contribute to growth, with the group’s innovation portfolio making up 10% of revenue. The portfolio has been expanded to address key consumer trends in health and wellness (low and no alcohol) and into products beyond beer (i.e., hard seltzers and canned cocktails). In 2022, the group generated revenue of $57.8bn.

In the three months to 30 September, the group saw continued global momentum, partially offset by US performance. Revenue grew by 5.0% in organic terms to $15.6bn, with revenue growth in 80% of the group’s markets.

Revenue per hl grew by 9.0% because of pricing actions, ongoing premiumisation, and other revenue management initiatives. Total volume fell by 3.4% during the quarter, made up of group own beer (-4.0%), non-beer (+1.4%), and third-party products (-14.2%).

Growth in the group’s Middle Americas, Africa, and APAC regions was primarily offset by performance in the US and a soft industry in Europe.

Combined revenue of the group’s three global brands (Budweiser, Stella Artois, and Corona) grew by 15.1% outside their home markets.

Beyond Beer continued to add profitable growth, with $385m of revenue in the year, up by mid-single digits, as growth globally was partially offset by a soft malt-based seltzer industry in the US.

Investment in direct-to-consumer ecommerce platforms continued to pay off, with online sales of $390m. The group now generates two thirds of its revenue is now through B2B digital platforms.

EBITDA, the group’s key measure of profitability, grew by 4.1% to $5.4bn, with the margin down 29bps to 34.9%. Disciplined overhead management and efficient resource allocation enabled increased sales and marketing investments and partially offset anticipated commodity cost headwinds. Underlying EPS rose by 2% to 86c.

The group’s priority for capital allocation is to invest behind its brands and to take full advantage of organic growth opportunities. Second is deleveraging the balance sheet. The final priority is the return of excess cash to shareholders in the form of dividends and share buybacks. Today, the group has approved a $1bn buyback programme to be executed within the next 12 months and announced an offer to buy back bonds worth $3bn.

Looking forward, the group expects EBITDA to grow in line with its medium-term outlook of 4%-8% and revenue to grow ahead of EBITDA from a healthy combination of volume and price.

Source: Bloomberg