Morning Note: Market news and updates from Alphabet (Google) and Microsoft.

Market News

US equity markets drifted last night – S&P 500 (-0.1%), Nasdaq (-0.8%) – and are expected to open down this afternoon following a raft of after-hours corporate reports. Microsoft (see below), Alphabet (see below), and AMD struggled to meet the market’s AI expectations.

The focus is also on the Federal Reserve decision later today. The central bank is expected to stay on hold and avoid signalling an imminent rate cut. Bond traders have lowered bets on US rate cuts this year, with the odds of a reduction in March dropping to about one-in-three. 10-year Treasuries currently yield 4.01%.

This morning in Asia, markets were mixed following the release of weak China PMI data. The official manufacturing gauge gained less than expected in January to 49.2, contracting for a fourth straight month. The services measure beat, rising to 50.7. Nikkei 225 (+0.6%); Hang Seng (-1.8%); Shanghai Composite (-1.5%). Samsung fell after profit fell for a fourth quarter.

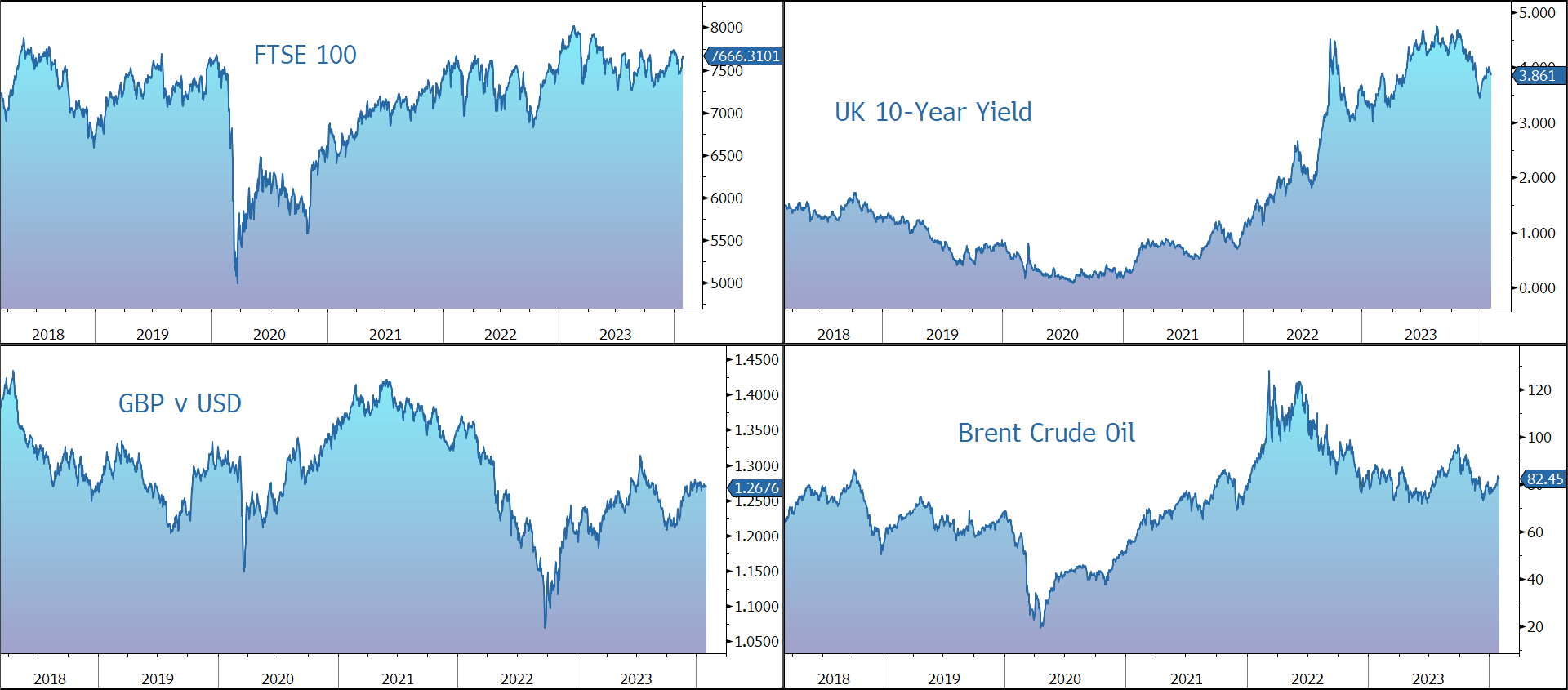

UK house prices rose by more than expected in January, up 0.7% to £257,656. Sterling currently trades at $1.2675 and €1.1722, while the FTSE 100 is currently trading 0.2% lower at 7,652.

Gold held steady at $2,037 an ounce. According to the World Gold Council, Chinese households and investors have been buying gold as a haven from volatile equity and property markets. Brent slipped back to $82.21 a barrel.

Source: Bloomberg

Company News

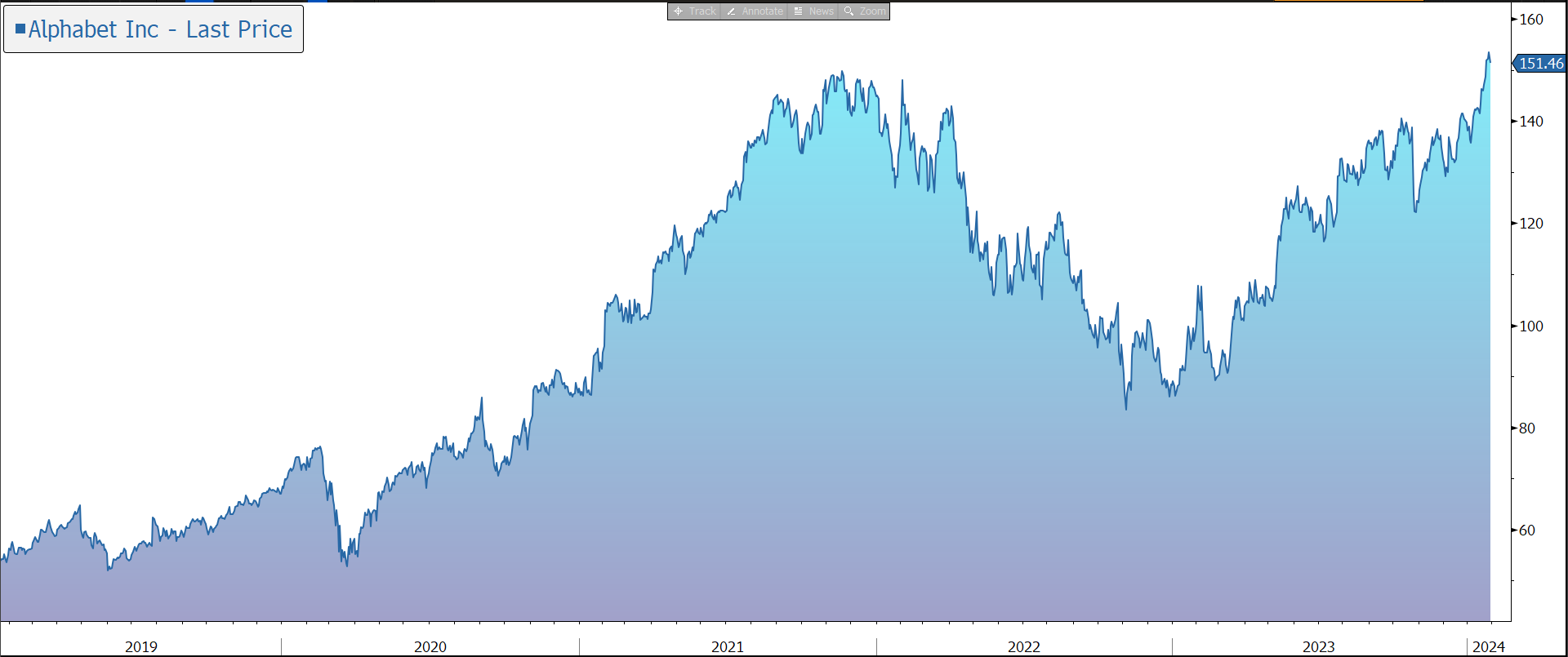

Last night, Alphabet released quarterly results which beat on revenue and earnings. Although the company enjoyed an acceleration in the rate of growth of its cloud business, ad revenue came in slightly below market expectations. The company also highlighted a ramp up in investment to support AI expansion plans. In response, the shares, which have enjoyed a strong run of late, were marked down by 6% in after-hours trading.

Alphabet is the public holding company for Google, one of the world’s most recognised and widely used brands. In addition to the core search engine, the group owns digital video platform YouTube, web browser Chrome, mobile operating system Android, Gmail, Google Maps, Google Cloud, Fitbit, and autonomous driving company Waymo, among others.

The group has a strong track record of innovation, leaving it well placed to capitalise on a wide variety of technological themes, such as digital media, e-commerce, video advertising, the cloud, the internet of things, driverless cars, and artificial intelligence. We believe the shift to internet-connected devices (including usage outside the home) and streamed TV means the growth of advertising dollars on Google Search and YouTube has much further to run. Machine learning capabilities should also help advertisers get higher return on investment and encourage them to continue to allocate their advertising budgets to Google.

The company has six products with more than two billion users each and another nine with more than 500m users, most of which are far from being fully monetised. The group’s structure allows it to own a portfolio of businesses with different time horizons, while its broad offering provides a competitive edge. Capital allocation is strong and spread across internal R&D, accretive M&A, and massive shareholder returns.

In the three months to 31 December 2023, revenue grew by 13% on a constant currency basis to $86.3bn, slightly above the consensus forecast of $85.3bn. The main drivers were ongoing strength in search and a growing contribution from YouTube and Cloud. Revenue for the full year grew 10% to $307bn.

The group reports its results across three segments: Google Services, Google Cloud, and Other Bets. Google Services is the largest division (88% of revenue), generates revenue primarily from digital advertising and the sale of apps, digital content products, hardware, and YouTube subscription fees. During Q4, Google Services revenue grew by 12% to $76.3bn.

Google Search (which accounts for 73% of ad revenue) increased by 13%. Advertising from Google Network Members’ websites (13% of ad revenue) fell by 2%. The group separates out YouTube, which accounted for 14% of ad revenue in the quarter and grew by 16%, as expected an acceleration versus the previous quarter, helped by a full period of NFL Sunday Ticket.

Other sales within the Services division include Play, content products, hardware, service, licensing fees, Nest, and YouTube’s non-advertising revenue. They grew by 23% in the quarter to $10.8bn.

Traffic acquisition costs (TAC) are the fees Google pays to other companies (such as Apple) to carry its search service and adverts (i.e., cost of sales). During Q4 they grew by 8% and currently account for 21.3% of advertising revenue. Looking forward, it is unclear whether TAC will increase as the search distribution market becomes more competitive and the impact this may have on margins.

Google Cloud includes Google’s infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. Fee revenue comes from Google Cloud Platform services and Google Workspace (formerly known as G Suite) collaboration tools. In Q4, Cloud grew by 26% to $9.2bn, better than the market expected and a welcome acceleration versus the previous quarter, albeit still slightly slower than Microsoft Azure. On the call the company said this is being driven by AI adoption. Although the group continues to invest to grow the cloud business, the division turned another quarterly profit ($864m), compared to a loss of $186m last year.

The group’s Other Bets division (less than 1% of revenue), which is effectively an incubator fund for new products and technologies, made a quarterly loss of $863m. On the call, the company highlighted that it has wound down non-priority projects.

Alphabet continues to ‘durably engineer’ its cost base to support its investment in long-term growth opportunities, most importantly AI. On the call the company highlighted that spending on data centres to support its AI plans would jump this year.

The number of employees fell by 4% year-on-year. For 2023, the group has taken an employee severance charge of $2.1bn, with another $0.7bn expected in the current quarter. Actions are also being taken to optimise global office space – exit charges in 2023 were $1.8bn – and use AI to increase business productivity. Cost of Sales reflected higher hardware costs given Pixel family launches, as well as increased content costs for YouTube for NFL Sunday Ticket.

In the latest quarter, group costs and expenses increased at a slower rate than revenue (+8%). As a result, margins expanded from 23.9% to 27.5%. For the full year, margins were 27%. EPS grew by 56% in the quarter to $1.64, above the consensus forecast of $1.59. For the full year, EPS rose by 27% to $5.80.

In October, the group made a tax payment of $10.5bn. Even so, free cash flow generation was strong ($7.9bn in the quarter), despite ongoing spend on R&D and capex, while its huge cash pile (including marketable securities) stands at $98bn. This has allowed the group to significantly increase its capital return to shareholders – buybacks currently use up around three quarters of free cash flow. During the latest quarter, the company bought back $16.2bn of its shares as part of its $70bn repurchase programme.

Although advertising is cyclical, we believe Google will show relative resilience as advertisers, evaluating the effectiveness of their budgets, migrate to platforms with the most scale, measurability, and demonstrable return on investment.

Regulators are increasingly focused on the depth and form of user data that are collected and used to target ads. As a result, political/regulatory risk remains elevated, with the potential for large fines, forced changes to business practices, or a break-up. However, we believe any action could be years away.

AI remains a hot topic. We believe the Alphabet is well placed – the company has been incorporating AI functionality into its search capabilities and other products for years and is expected to launch a steady stream of innovation in the future. Furthermore, Google’s position in cloud services – it is one of the big three public providers – leaves it well placed to provide the infrastructure and computing power needed by AI, while the group’s user scale and usage frequency supports a wealth of data, providing another competitive advantage. In December, the company introduced Gemini, its most advanced AI model, capable of more sophisticated reasoning and understanding information with a greater degree of nuance than its prior technology. The hope is that Google’s Bard powered by Gemini will be a formidable competitor to Microsoft’s Bing and ChatGPT.

Looking forward, although the economic outlook will remain a headwind in the near term, the group is facing easing year-on-year comparatives in 2024. Alphabet continues to trade on a valuation (20x ex-cash) below most of the other tech majors and at a level we believe is very attractive for a company exposed to several areas of long-term secular growth.

Source: Bloomberg

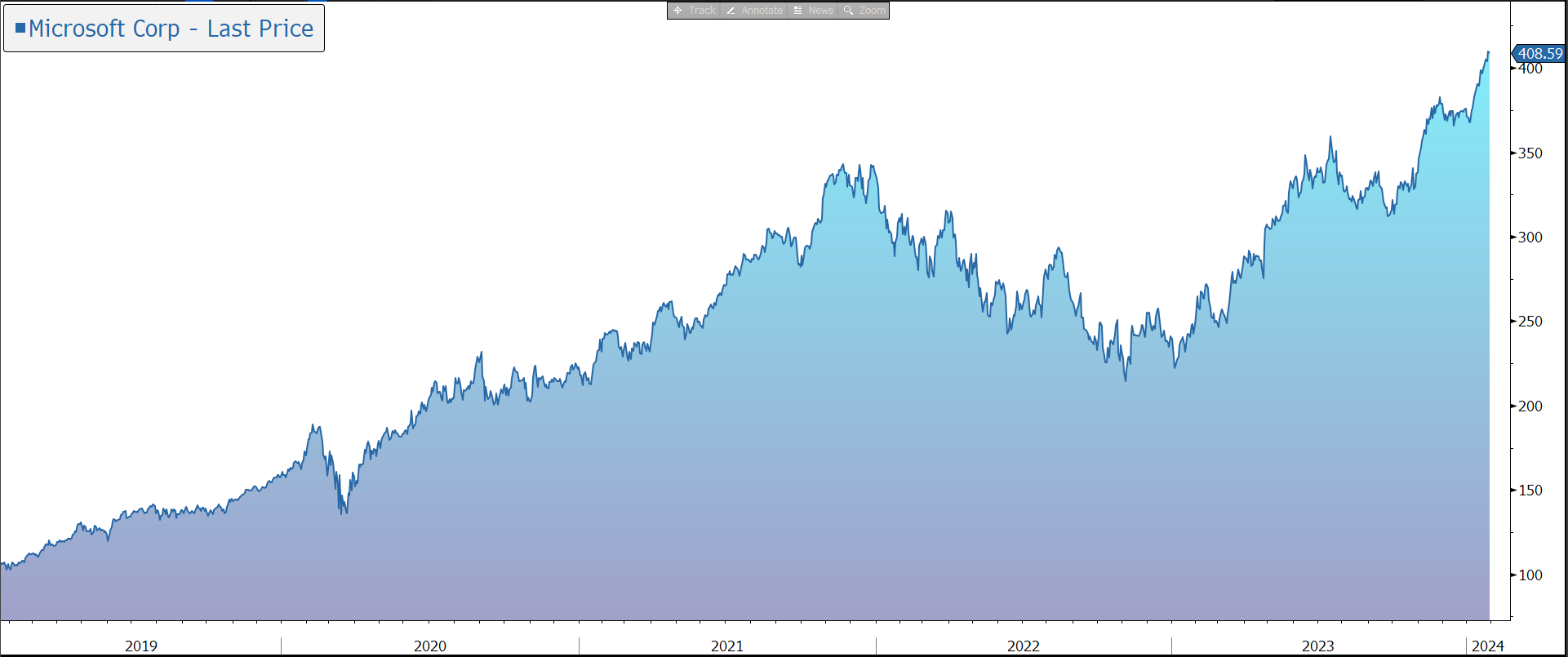

Last night, Microsoft released results for the three months to 31 December 2023, the second quarter of its financial year to June 2024. The print was better than market expectations, although the shares drifted slightly in after-hours trading.

Microsoft is a global leader in consumer and enterprise software, services, devices, and solutions, leaving it well placed to benefit from the ongoing shift to digital technology and several other secular trends. In an inflationary world, digital technology provides a deflationary force to help business offset cost pressures elsewhere. The group’s competitive edge lies in the strength and breadth of its portfolio of resilient and trusted technology which provides unique integration of its cloud-based products and services, covering productivity apps, infrastructure services, security, and communications. The group’s offering includes Windows, Microsoft 365 (formerly Office), Skype, Hotmail, LinkedIn, Bing, GitHub, Surface, Xbox, and OpenAI ChatGPT. Not only are the group’s products designed to work together but, for the customer, it is also more economical to bundle multiple products.

Its portfolio is being continuously enhanced through in-house product development and acquisitions, allowing the company to push through price increases and sell new products and services to a growing base of consumers – in the past few years, gaming, security, and LinkedIn, have all surpassed $10bn in annual revenue. In addition, as one of the world’s three largest cloud companies, Microsoft Azure is benefitting from the migration of workloads from on-premise to public cloud platforms, a transition that we believe has a long way to go. With its stake in OpenAI and its agreement to be their exclusive cloud provider, Microsoft is well placed in the world of AI. Most recently, the group has released the Microsoft Windows Copilot, the AI assistant tool.

The group operates a user subscription model which generates a visible, long-term annuity revenue stream with higher margins and strong cash flow. In FY2023, the group generated revenue of almost $212bn (up 11%), gross margins of 69%, and operating margins of 42%. Microsoft has a very strong balance sheet and in addition to reinvesting cash back into high growth opportunities and M&A, the company has consistently increased its dividend and is repurchasing its own shares.

During the latest quarter, revenue grew 16% at constant current (CC) to $62.0bn, a touch better than the consensus forecast of $61.1bn. The results include Activision Blizzard (the video gaming company) from 13 October.

Productivity & Business Processes generated revenue of $19.2bn, up 12%, driven by Office 365 Commercial (+16%) and Dynamics 365 (+24%). Intelligent Cloud generated revenue of $25.9bn, up 19%, driven by Azure (+28%). Microsoft Azure’s is outperforming the other cloud providers due to its greater exposure to enterprise and hence, potentially more resilience, and its better positioning around AI workloads. The More Personal Computing division generated revenue of $16.9bn, up 18%, with growth in Xbox content and services (+60%) and search and news advertising (+7%), partly offset by a decline in devices (-10%).

The gross margin rose from 66.8% to 68.3%, driven by a sales mix shift to higher margin businesses. Operating expenses only grew by 3% and, as a result, the operating margin rose from 38.7% to 43.6%. EPS grew by 23% at CC to $2.93, above the market forecast of $2.78.

The group generated very strong free cash flow, up 86% to $9.1bn in the quarter, reflecting the timing of cash paid for property and equipment. Net cash was c. $6.8bn. The company is authorised to repurchase up to $60bn in shares, with $2.8bn bought back in the latest quarter. The company also paid out $5.6bn in dividends.

Microsoft is expected to spend heavily on capex this year – up 40% to $40bn or 16% of revenue. Much of this will be spent on new AI chips and high-performance networking for its datacentres.

On the analysts’ call, the group provided guidance for the current quarter. By division, revenue in Productivity and Business Processes is expected to grow by 10%-12%, Intelligent Cloud by 18%-19% (including Azure in line with the Q2 growth rate), and More Personal Computing by 11%-14%.

We believe in the current environment the company faces a relatively lower level of political risk and should prove more defensive during the current economic uncertainty.

Source: Bloomberg