Morning Note: Market news and an update on Google owner Alphabet.

Market News

US equities gained last night – S&P 500 (+0.4%); Nasdaq (+0.6%) – as traders digested the Federal Reserve’s July meeting minutes and the US Payrolls revision. The “vast majority” of officials considered a move next month as likely appropriate. Focus now turns to Fed Chair Jerome Powell’s speech expected on Friday at the annual Jackson Hole symposium. The 10-year Treasury yield drifted to 3.80%, while gold moved to $2,510 an ounce.

In Asia this morning, markets were mixed – Nikkei 225 (+0.6%); Hang Seng (+1.0%); Shanghai Composite (-0.3%) – while the yen hovered around 145 versus the dollar ahead of Ueda’s Friday appearance in Japan’s parliament.

The FTSE 100 is currently trading 0.4% higher at 8,307. Companies trading ex-dividend today include Imperial Brands (1.04%), Legal & General (2.60%), Land Securities (1.45%), Schroders (1.88%), and Tritax Big Box REIT (1.13%). Sterling trades at $1.3080 and €1.1741.

Brent Crude continued to drift and currently trades at $75.50 a barrel. Citi doesn’t expect OPEC to raise production in the fourth quarter.

Canada’s two largest railways shut down after failed union talks, putting a major strain on North American supply chains. The locking out of more than 9,000 union workers at CN Railway and CPKC may cost the country as much as $251m per day, according to Moody’s.

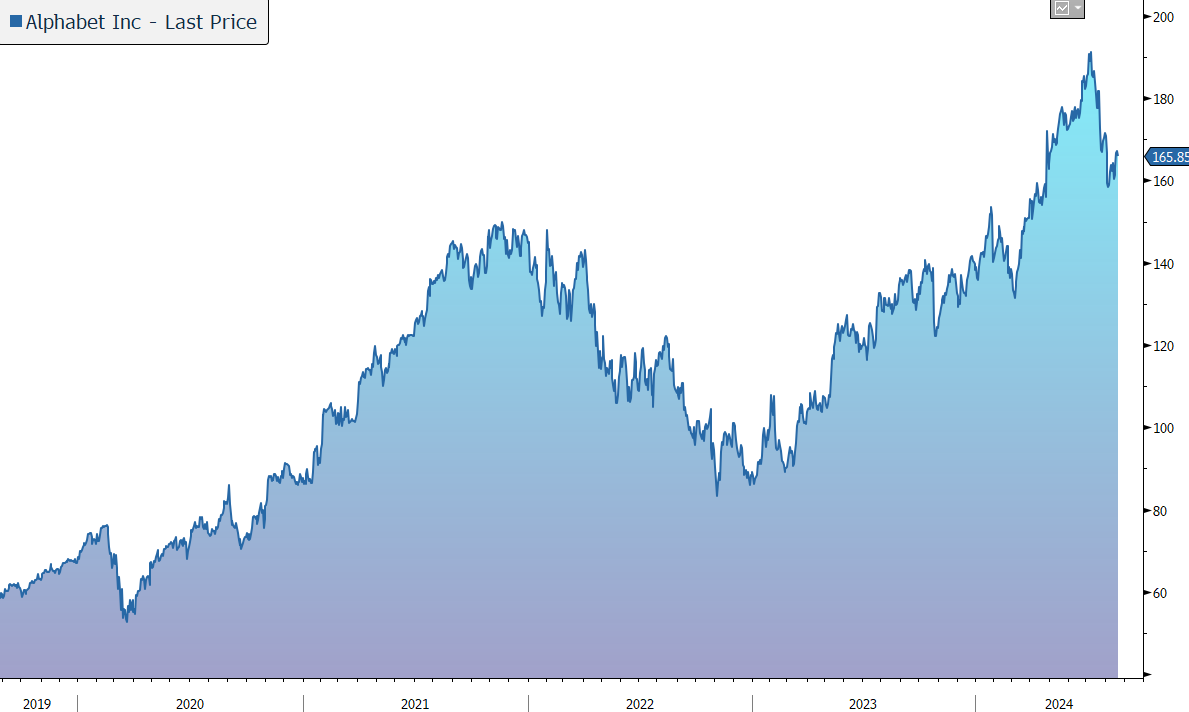

Source: Bloomberg

Company News

Over the last couple of weeks, Alphabet has hosted Made by Google 2024, its new product event, and been on the end of a negative anti-trust ruling in the US.

Alphabet is the public holding company for Google, one of the world’s most recognised and widely used brands. In addition to the core search engine, the group owns digital video platform YouTube, Google Cloud, web browser Chrome, mobile operating system Android, Gmail, Google Maps, Fitbit, and autonomous driving company Waymo, among others.

The group has a strong track record of innovation, leaving it well placed to capitalise on a wide variety of technological themes, such as digital media, e-commerce, video advertising, the cloud, the internet of things, driverless cars, and artificial intelligence. We believe the shift to internet-connected devices and streamed TV means the growth of advertising dollars on Google Search and YouTube has much further to run. Machine learning capabilities should also help advertisers get higher return on investment and encourage them to continue to allocate their advertising budgets to Google.

The company has six products with more than two billion users each and another nine with more than 500m users, most of which we believe are far from being fully monetised. The group’s structure allows it to own a portfolio of businesses with different time horizons, while its broad offering provides a competitive edge. Capital allocation is strong and spread across internal R&D, accretive M&A, and large shareholder returns.

On 13 August, Alphabet hosted its ninth annual Made by Google event where it announced its latest hardware devices and other consumer-facing initiatives. The company unveiled a new range of innovative devices, tools, and features designed to make AI more helpful. The event provided further evidence of the leading role Alphabet is playing in the new era of AI-powered consumer devices.

· The company introduced the next generation of its Pixel smartphones with three new devices, all of which include a number of new innovative AI features. Every phone in the series comes with new, exclusive-to-Pixel features.

· Google introduced several new Gemini capabilities, such as Gemini Live, a conversational AI assistant which allows natural, free-flowing conversations, and Gemini Extensions which allows users to multi-task effortlessly by using Gemini across Gmail, Maps, YouTube Music, and Drive.

· Several AI capabilities were introduced across photos and videos including Pixel Studio, an AI-guided editing, and sharing tool, and Magic Editor, a generative AI-powered photo and video editing tool that allow users to automatically reframe new and old photos.

· The company also announced Pixel Watch 3, its next generation smartwatch, with new advanced fitness experiences from Fitbit, and Pixel Buds Pro 2, the second generation of its wireless headphones.

On 5 August, a US Federal judge ruled Google acted illegally to maintain a monopoly in search.

The anti-trust lawsuit challenged the company’s commercial agreements with search distribution partners Apple, Android OEMs, and other web browsers to be pre-installed as the default search engine.

Around half of all general search queries in the US flow through a search access point covered by one of the challenged contracts, including 28% covered by the Google-Apple Internet Services Agreement and another 19% through Android OEMs and carriers.

There will be a further trial focused on determining the appropriate remedy – there are hearings in early September to go through the remedy trial process. The trial will determine what Google needs to change and whether punitive fines, if any, will be imposed. It is unclear at this point if potential remedies will aim to simply restore competition or include punitive actions seeking to claw back some of Google’s competitive advantage gained over the years,

The remedy trial is expected to start in H1 2025, with the judge’s final opinion on the remedy to be issued in H2 2025, in absence of a settlement or an appeal. The company is expected to appeal in a process that is expected to take 12-18 months. Overall, unless a settlement is agreed beforehand, any potential resolution or remedy is unlikely to be agreed before the end of 2025.

As a result, while there are limited near-term financial implications, the prospect of a change in the rules for mobile distribution may increase competition in the search market.

One potential scenario is Apple building its own search function. However, this would be a costly, capital-intensive initiative (c. $10bn upfront and $4bn-$6bn p.a.). Apple might also partner more deeply with Microsoft’s Bing and OpenAI. However, in the trial Google highlighted that Microsoft would have to pay Apple 122% of Bing’s revenue simply to match Google’s current payment to Apple.

This points to a remedy that wouldn’t harm consumers by forcing Apple’s hand to enter the search space. An alternative is that Apple could move to a non-exclusive consumer choice model, where Google could potentially maintain the bulk of its search market share while paying out less in revenue share (also known as traffic acquisition cost).

Android OEMs are expected to move to a consumer choice model, a change that has already happened in Europe.

Other potential remedies include a break-up of the company or the forced divestment of the Android operating system, Chrome browser, or Google Ads digital advertising platform. For now, however, there is little visibility over the timing or nature of any resolution, or the long-term financial implications.

However, in the meantime, Alphabet shares trade on a valuation (17x ex-cash) below most of the other tech majors and at a level we believe is very attractive for a company exposed to several areas of long-term secular growth. In addition, the company is returning capital to shareholders via a share buyback programme and a cash dividend.

Source: Bloomberg