Morning Note: Market news and an update on Fidelity China Special Situations.

Market News

The dollar surged while equity markets and digital currencies plunged after US President Donald Trump made good on his threat to impose tariffs on imports from Canada (25%), Mexico (25%), and China (10%). In response, Mexico is to implement tariffs on the US, while Canada will impose 25% tariffs against C$155bn of US Goods, including US alcohol, clothing, household appliances, and lumber). There are also plans to impose tariffs on steel and aluminium this month or next month. Trump said levies on the EU would “definitely happen”. The new levies may knock 1.2% off of US GDP, according to Bloomberg Economics, and Canada may slip into a recession.

Despite the strength of the dollar, the gold price – $2,799 an ounce – held up as investors seek safe havens. Fears the action will stoke price pressures also spurred a rise in the yields on two-year US Treasuries. This followed Friday’s Core PCE data which came in at 2.8% for December, in line with expectations. The 10-year Treasury currently yields 4.55%. The oil price jumped after Trump said tariffs will apply to crude – Brent Crude trades at $76.50 a barrel.

US equities are currently expected to open down this afternoon – S&P 500 (-1.4%); Nasdaq (-1.8%) – while in Asia this morning, the Nikkei 225 and Hang Seng fell by 2.7% and 0.4% respectively. China’s Caixin manufacturing PMI fell for a second straight month in January.

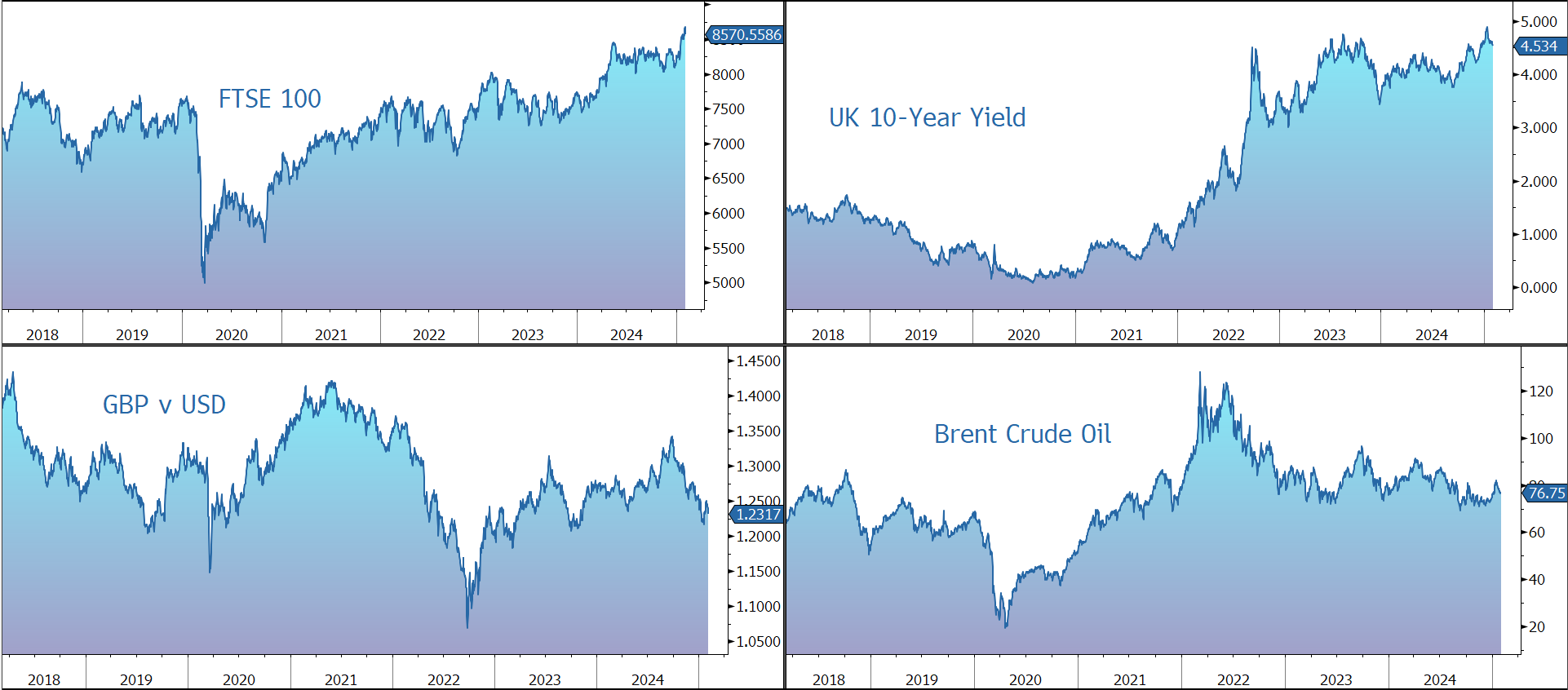

The FTSE 100 is currently 1.1% lower at 8,583. The Bank of England is expected to deliver a setback for Chancelor Reeves with ‘stagflation’ forecasts. The Bank is expected to cut rates on Thursday but is expected to downgrade its growth outlook and warn that the Chancellor’s October budget will drive up inflation. Economists predict a total of four rate cuts this year. 10-year Gilts currently yield 4.54%, while Sterling trades at $1.2320 and €1.2020.

Source: Bloomberg

Fund Update

Fidelity China Special Situations (FCSS) is a UK-listed closed-ended investment trust which aims to achieve long-term capital growth from an actively managed portfolio made up primarily of securities issued by companies listed in China or Hong Kong, and Chinese companies listed elsewhere. The fund has been managed by the highly regarded Dale Nichols since 2014.

Last year, FCSS merged with abrdn China Investment Company, following which the enlarged company continues to be managed in accordance with its existing investment objective and policy. The deal led to an increase in assets – £1.3bn at end 2024 – over which to spread the company’s fixed costs, helping to reduce the level of ongoing charges for all investors.

The company believes having a large research team on the ground in China is fundamental to success in seeking out the best opportunities, particularly among smaller and medium-sized companies, where the relatively higher growth potential has yet to be reflected in share prices, and investor awareness is low.

The manager believes that recent government stimulus measures in China show a strong commitment to tackling economic issues and boosting domestic demand. While consumer confidence remains low, discussions with several companies suggest that the worst of job cuts, especially in technology, may be behind us. Elevated household savings indicate potential buying power that could support recovery. The aim is for supportive policies to drive a turnaround in economic fundamentals, leading to broader earnings growth and improved market sentiment

Geopolitical risk clearly remains a concern, particularly around US tariffs on Chinese goods, but both investors and companies are aware of this. The manager points out that Chinese companies have diversified supply chains, leveraged tariff exclusions, and adapted by manufacturing in alternative locations to mitigate their impact. In fact, the manager is finding opportunities from more cases where he thinks the market may be underestimating the resilience of Chinese companies in the face of these challenges. On a broader scale, China’s reduced reliance on US exports, alongside the government’s pivot to domestic demand-led growth and recent fiscal policy measures, should help mitigate the economic impact of these external challenges to some extent.

Against this backdrop, the manager believes considerable potential for long-term growth in China’s equity market remains as capitalisation aligns more closely with the country’s economic size. Despite contributing 17% of global GDP, China’s representation in the MSCI AC World Index is just 3.4%. Today, investors can access that opportunity at close to record low valuations, with Chinese equities trading at a 55% discount to US equities and a 25% discount to emerging market equities excluding China (based on 1 year forward P/E estimates).

In 2024, the FCSS NAV increased by 12.3%, underperforming its reference benchmark (MSCI China Index), which delivered 21.6% over the same period. The Trust’s share price increased 8.6%, leaving the discount at 11%. Despite struggling of late, since inception in 2010, the annualised NAV growth is 8.0%, versus a benchmark index return of 3.8%.

At a sector level, consumer areas were among the worst performers last year, but valuations now offer some of the most compelling opportunities. In e-commerce, the largest platforms continue to leverage natural network effects, their strong market position and improved cost control to improve earnings growth.

The five largest positions are Tencent Holdings, Ping An (insurance), PDD (Pinduoduo e-commerce platform), Alibaba Group, and ByteDance (internet platform, owner of TikTok), together comprising c. 29% of the gross asset exposure. With more than 100 stocks in total, the fund has a long tail, providing a broad exposure to a wide range of potential growth opportunities.

The fund’s mandate allows for investment in unlisted companies (up to 15% of gross assets, and 10% in six assets at 30 September 2024), taking advantage of their early-stage growth before they become listed on the public markets. With valuations in the listed equity market currently at historically low levels, the manager has said that any potential new private investments would have to be very attractive in order to win a place in the portfolio. The company has confidence in the strength of the detailed process for the valuation of its unlisted holdings – they are assessed regularly by Fidelity’s dedicated Fair Value Committee with advice from Kroll, a third-party valuation specialist.

Because of confidence in the long-term growth characteristics of the Chinese economy, the manager includes an element of gearing in the portfolio – c.20% at the end of 2024. We would highlight that although gearing can enhance long-term returns, being more than 100% invested means the NAV and share price may be more volatile and can accentuate losses in a falling market.

The manager highlights that Chinese companies – even in the state-owned sector – are becoming increasingly focused on rewarding minority shareholders, including through the payment of dividends and share buybacks. This is being driven by favourable government policies but also improved governance and financial management at the companies themselves. Alibaba and Tencent have been some of the most aggressive in hiking shareholder returns. This has helped the fund grow its dividend since launch. A payout of 6.40p was declared for the financial year to 31 March 2024, up 2.4%, equal to a yield of 2.7%.

The fund has a tiered fee structure of 0.85% on the first £1.5bn of net assets, reducing to 0.65% on net assets over £1.5bn. There is also a variable element, +/- 0.20% based on performance relative to the benchmark.

The board operates a formal discount control policy whereby it seeks to maintain the discount in single digits in normal market conditions and will repurchase shares with the objective of stabilising the share price discount within a single-digit range. The discount currently sits at around 10%.

Source: Bloomberg