Morning Note: Market news and an update on BH Macro.

Market News

US equity markets were little changed last night: S&P 500 (-0.2%), Nasdaq (+0.1%), while this morning in Asia, Hong Kong played catch-up: Hang Seng (+2.2%); Nikkei 225 (+0.1%); Shanghai Composite (-0.1%). As the yen approaches 152 against the dollar, currency strategists said authorities may target a 5-yen rally against the greenback if they intervene. Recent weakness has been excessive and such action is a possibility, former BOJ Governor Haruhiko Kuroda said, according to the Nikkei.

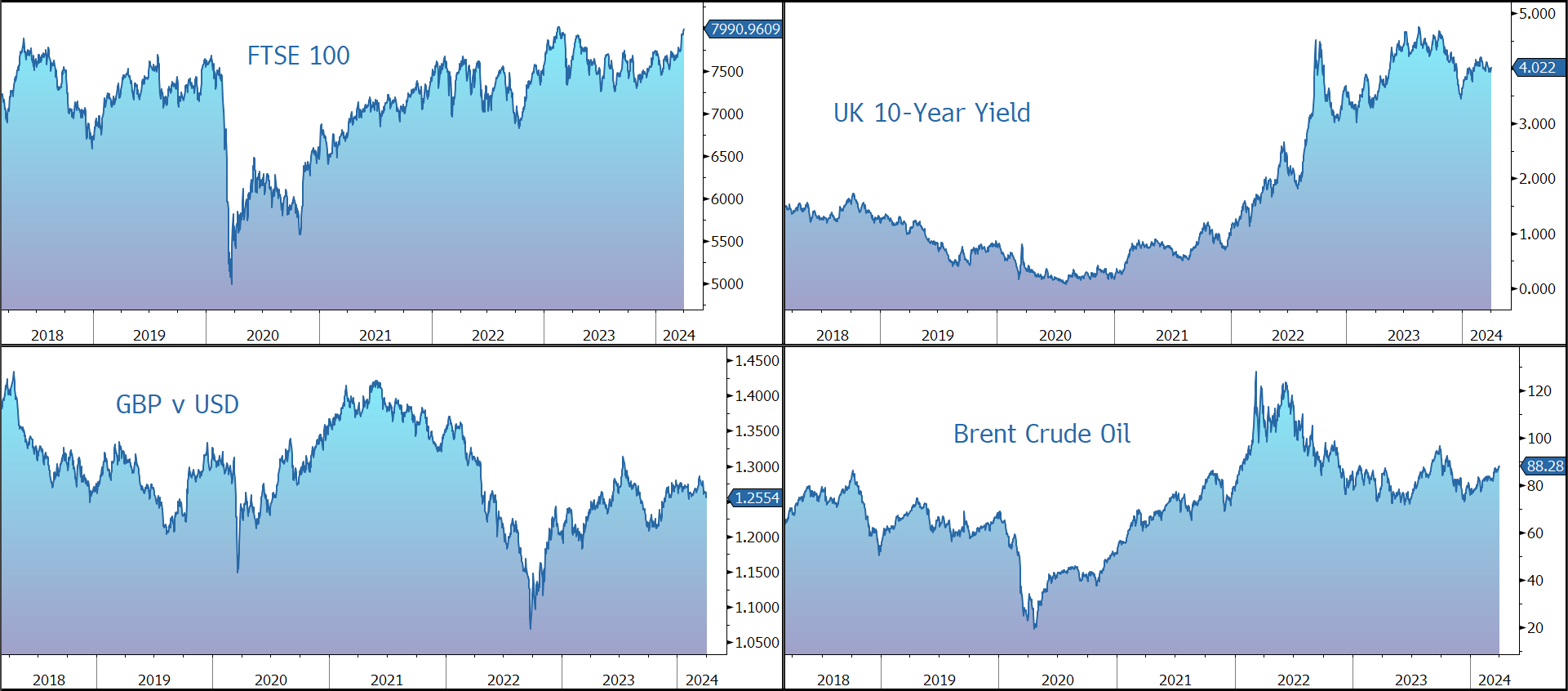

The FTSE 100 is currently trading 0.5% higher at 7,991. HSBC announced the completion of the sale of HSBC Bank Canada to Royal Bank of Canada. As expected, and subject to the finalisation of its Q1 results, the company intends to announce a special dividend of 21c per share.

Treasuries steadied after dropping overnight on strong US manufacturing data – the 10-year currently yields 4.33%. Bloomberg Economics ran a million simulations to test the fragility of the US debt outlook, and nearly 90% of them reached the same conclusion: Borrowing is on an unsustainable path. Ken Griffin issued a similar warning to his investors, calling national debt a “growing concern.”

Inflation in UK stores dropped to 1.3% last month, its slowest since December 2021, BRC said. Food price inflation eased for the 10th month in a row to 3.7%. Meanwhile, house prices gained 2.4% year on year in March, Nationwide data are expected to show, accelerating from February’s gain, while mortgage approvals are seen ticking up in February. Sterling trades at $1.2543 and €1.1695

The oil price strengthened to $88 a barrel on Middle East tensions and news of a supply cut by Mexico. Gold trades at $2,255 an ounce, close to its all-time high.

Source: Bloomberg

Fund Update – BH Macro

At the end of last week, BH Macro released its Annual Report and Audited Financial Statements for 2023.

Diversification across asset classes is a critical element of managing your investments. At Patronus, when we construct a portfolio, we look to allocate a proportion of capital to so-called ‘anti-fragile’ investments that provide shelter in difficult times when other (‘fragile’) asset classes (such as equities and bonds) are struggling to a generate positive return. We believe BH Macro is one such investment.

BH Macro is a London-listed closed-ended investment company that invests substantially all its assets in the ordinary shares of Brevan Howard Master Fund. Following the 2021 merger with BH Global (Brevan Howard’s other listed investment strategy), a larger entity with the same investment policy was created. There are sterling and dollar classes available and total company assets currently stand at around £1.5bn. Fund fees are made up of a fixed component (management fee and operational services fee) of 2% and a 20% performance fee subject to a high water mark. The fee for 2023 was 2.16%, versus 6.11% the previous year, as a result of the absence of performance fee.

The objective of the Fund is to generate consistent long-term appreciation through active leveraged trading on a global basis. The strategies mainly focus on economic change, monetary policy, and market inefficiencies. Exposure is predominantly to global fixed income and currency markets, employing a combination of macro and relative value trading strategies. The Fund seeks to achieve positive returns, uncorrelated with other markets and with low volatility. The underlying philosophy is to construct strategies, often contingent in nature, with superior risk/return profiles, whose outcome will often be crystallised by an expected event occurring within a pre-determined period of time.

The decision to hold the shares depends on whether the Fund will provide capital protection during periods of market stress. In this regard, it has a good track record when equity markets are falling and has shown correlation with market volatility. Since inception in 2007 to the end of 2023, in the twenty worst performing months for equities, BH Macro has produced 18 positive monthly returns. Over the same period, the annualised NAV return is 8.5%, with volatility (i.e., annualised standard deviation of returns) of 8%. Drawdowns have been significantly lower than other assets classes.

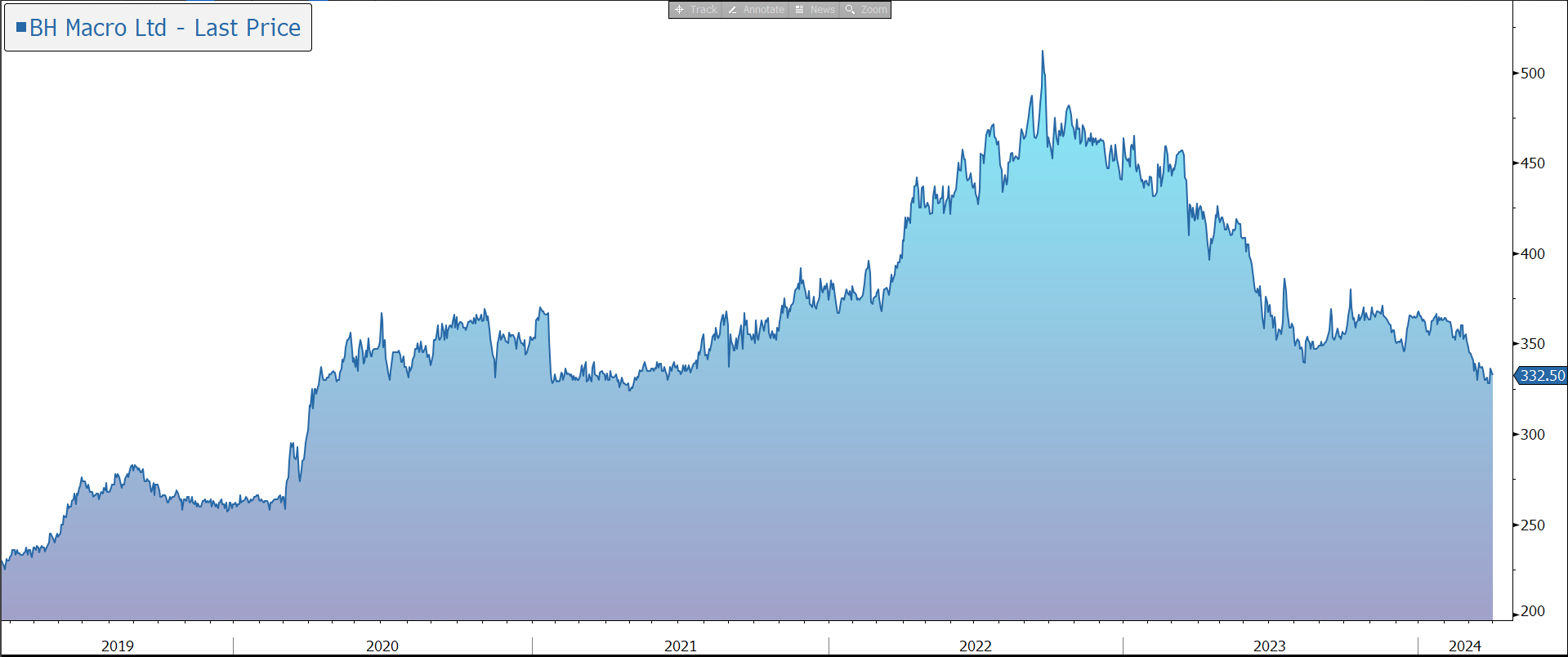

In 2020, the Fund really proved its worth in the face of the challenges arising from Covid-19, with the NAV rising by 28% while the FTSE 100 fell by 11.6%. Again in 2022, when there was a marked pick-up in risk and volatility following Russia’s invasion of Ukraine, the Fund generated another outstanding performance, rising by 22%, compared to an 8% decline in global equities in sterling terms and a 15% drawdown in UK bond markets.

In 2023, the environment for macro trading was very different from 2022. The market was influenced by the surprising strength of the US economy against a background of widespread recession fears. This caused the Federal Reserve to pivot hawkishly and hint at further rate hikes. The Fund’s macro portfolio managers leaned into this view with a range of positions to benefit from an acceleration of further tightening. However, in March, the Silicon Valley Bank crisis led to ‘a once-in-a-generation’ reversal in bond yields. Although the Fund was positioned for interest rates to rise further before peaking, the loss was capped off at around 4%, highlighting the manager’s focus on risk management. Performance improved in the second half, to leave the fund down only 1.8% for the year. This was, however, well behind other asset classes: global equities in sterling terms (+16.8%), UK Gilts (+5.6%), and cash (+4.6%).

So far this year (to 22 March), the NAV has drifted down by 1.47%.

In February 2023, and in response to persistent requests from its shareholders, the company placed £312m of new Sterling shares to increase the liquidity of the stock and spread the company’s fixed costs over a wider base. However, the move caused some indigestion and the shares have moved from a 19% premium to a substantial 17% discount, while the share price is 35% below its September 2022 peak.

The overhang was exacerbated by the merger of two of the company’s largest shareholders, Rathbones and Investec, which together own 26%, as of 14 February 2024. The Takeover Panel has now given clearance that the combined entity is not under any obligation to make sales of the stock.

At the same time, BH Macro has started to buy back its shares, an accretive move given the current discount. Since the programme was initiated in December 2023 (and up until 21 March 2024), the company has bought back 12.2m shares, more than 3% of the total. The company can buy back 5% of the shares on an annual basis.

We remain very positive on the company given its portfolio diversification attributes at a time when the geopolitical and macro-economic outlook remain very uncertain and an extended period of calm like that between 2013-19 is very unlikely to be repeated. While the company admits ‘it is hard to identify paradigm shifts in real time, the secular stagnation era may have ended’. There are several factors that may drive the shift towards structurally higher interest rates and more economic volatility, all of which provide a rich opportunity set for macro trading. Furthermore, the current 17% discount to NAV provides an added incentive to purchase the shares are this level.

Source: Bloomberg