Morning Note: Market news and an update from Shell.

Market News

US equity markets were closed for the holiday yesterday. Traders have turned their attention towards today’s crucial US jobs data – nonfarm payrolls are expected to come in at +190k, with the unemployment rate at 4%. The report is set to give the Fed more signals in its fight with inflation. The 10-year Treasury currently yields 4.36%.

This morning in Asia, markets were generally lower: Nikkei 225 (flat); Hang Seng (-0.9%); Shanghai Composite (-0.2%). The yen recovered slightly against the dollar on bets that the BOJ will hike rates and cut bond purchases. Samsung traded 3% higher following the release of better-than-expected profits.

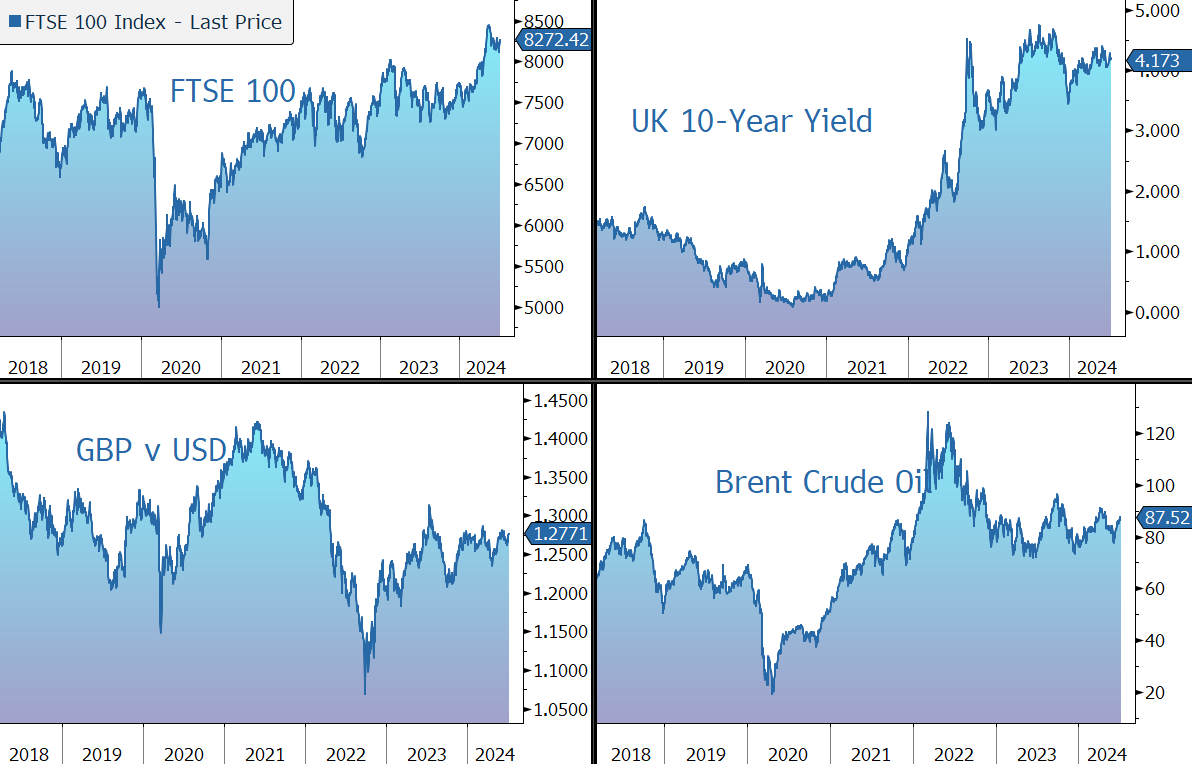

The FTSE 100 is currently trading 0.4% higher at 8,272, while Sterling – $1.2768 and €1.1797 – has firmed following Labour’s decisive victory in parliament. Glencore nudged higher following news of regulatory clearance for its $7bn acquisition for 77% of EVR, Teck’s coal unit.

According to MLIV, the most curious exhibit in gilts recently has been the dis-inversion of the yield curve, with the 10-year maturity actually yielding more than the two-year for the first time in more than a year. Part of that speaks to market jitters about the new government’s spending plans and the shape of its fiscal house.

Oil traded near a two-month high of $87.30 a barrel as Hurricane Beryl portended a potentially worse storm season, while shrinking US crude stockpiles hinted at improved demand. Gold headed for a back-to-back weekly gain and currently trades at $2,366 an ounce.

Source: Bloomberg

Company News

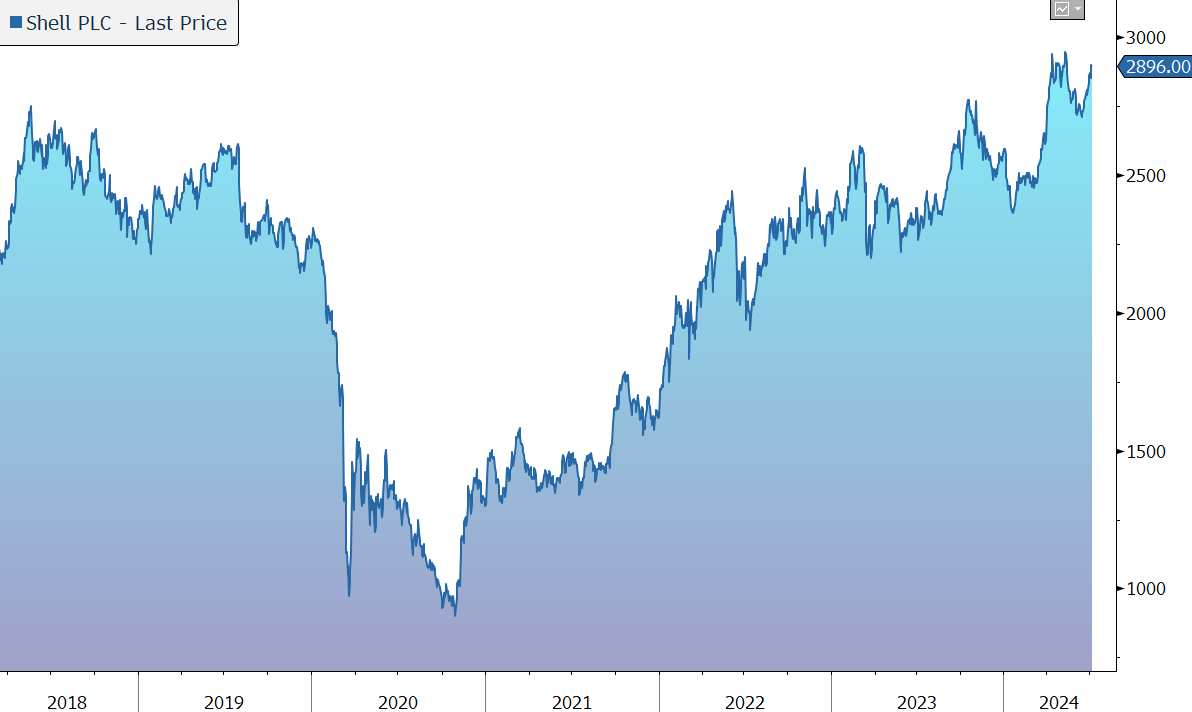

Shell has this morning released a Q2 update note and an overview of the group’s current expectations for the period. Full details will be published with the Q2 results on 1 August. In response, the shares are little changed in early trading.

Shell is a global integrated energy company with expertise in the exploration, production, refining, and marketing of oil and natural gas, and the manufacturing and marketing of chemicals. The group is also allocating capital to low and zero carbon products and services including wind, solar, advanced biofuels, EV charging, hydrogen, and carbon capture & storage. According to Brand Finance Global 500, Shell is the most valuable brand in the industry, valued at around $50bn.

The business is divided into five segments:

· Upstream (i.e. E&P) explores for and extracts crude oil, natural gas and natural gas liquids. Shell has best-in-class deepwater assets complemented by resilient conventional assets in the Gulf of Mexico, Brazil, Nigeria, UK, Kazakhstan, Oman, Brunei, and Malaysia.

· Integrated Gas includes liquefied natural gas (LNG), conversion of natural gas into gas-to-liquids (GTL) fuels, and other products. Shell is the global leader in LNG (achieved through the 2016 acquisition of BG), a critical fuel for the energy transition, with a business that spans upstream, liquefaction, shipping, marketing, optimising, and trading.

· Chemicals & Products is made up of a focused set of assets – there are currently five energy and chemicals parks (i.e. integrated refining and chemicals sites) and seven chemicals-only sites.

· Marketing includes mobility, lubricants, and decarbonisation. In addition to the service stations with their EV charging footprint, Shell is the global number one lubricants supplier and operator of assets is renewable natural gas, sugar cane ethanol, and biofuels.

· Renewables & Energy Solutions includes Shell’s production and marketing of hydrogen, integrated power activities (solar and wind), carbon capture & storage, and nature-based projects. The assets are helping to reduce the carbon intensity of the group’s hydrocarbon product sites.

The group’s strategy (Powering Progress) is to invest in providing secure supplies of energy, while actively working to reduce carbon emissions at a time of macroeconomic and geopolitical uncertainty.

The focus is on ‘value over volume’ – the group will take advantage of opportunities where it has competitive strengths, existing adjacencies, a track record, strong customer demand, and clear regulatory support from governments.

In the period to the end of 2025 (known as the First Sprint), the company is seeking to:

· Improve performance and increase efficiency, with annual operating costs reducing by $2bn-$3bn by the end 2025, of which $1bn was achieved in 2023. We believe this could prove to be prudent.

· Increase investment discipline – capital investment (organic spend and M&A) will reduce to $22bn-$25bn p.a. over 2024 and 2025, with around a quarter for low carbon solutions.

· Simplify the portfolio through the sale of high-cost and lower-return businesses.

· Generate free cash flow per share growth of 10% p.a. through to 2025 and free cash flow growth on an absolute basis more than 6% p.a. between now and 2030.

Today’s statement highlights that in the three months to 30 June 2024:

· In the Integrated gas division, trading and optimisation results are expected to be in line with Q2 2023, but lower compared to Q1 2024 due to seasonality. Integrated gas production is forecast to be 940-980kboe per day.

· Upstream production was 1720-1820kboe per day. Exploration well-write offs are expected to be around $0.2bn.

· Marketing results are expected to be in line with the previous quarter.

· Chemicals sub-segment earnings are expected to be close to breakeven. Trading and optimisation in the division is expected to be in line with the previous quarter.

· Renewables and Energy Solutions is expected to generate between a loss of $0.5bn and a profit of $0.1bn.

· The group is expected to endure a non-cash post tax impairment of $1.5bn-2.0bn, mainly made up of the Singapore Chemicals & Products assets ($0.6bn-$0.8bn) and Rotterdam HEFA ($0.6bn-$1.0bn).

The balance sheet is strong and the company targets AA credit metrics through the cycle. At the end of the March quarter, net debt stood at $40.5bn, with gearing at a comfortable 17.7%. Further details on the group’s current gearing will be provided with the results on 1 August.

Shell’s current policy is to return 30%-40% of cash flow from operations (CFFO) to shareholders through the cycle through a combination of dividends and share buybacks. The group’s dividend breakeven is around $40 per barrel (vs. $87 currently) and the group is targetting 4% growth annually.

At $50 a barrel, share buybacks will be undertaken as a priority to debt reduction as management believe the shares are undervalued. The latest $3.5bn programme is expected to be completed by the end of July and a new programme is likely to be announced with the Q2 results in August. Total shareholder returns are expected to amount to more than 10% of the current market cap.

We believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain a crucial part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

In common with all the oil majors, Shell is looking to reduce emissions in a way that delivers attractive returns for shareholders at a time of macroeconomic and geopolitical uncertainty. Despite strong performance over the last three years, the shares remain on an undemanding valuation (PE 9x), both in absolute terms and relative to the US majors, which fails to discount the potential for strong free cash flow generation and shareholder returns. We believe they also provide something of a hedge against inflation.

Source: Bloomberg