Morning Note: Market news and an update from Nike.

Market News

US equity markets edged higher last night: S&P 500 (+0.3%), Nasdaq (+0.2%). This morning in Asia, Chinese stocks led declines – Hang Seng (-2.2%); Shanghai Composite (-1.0%) – with the yuan falling to a four-month low as traders grappled with weak corporate guidance and signs that Beijing is relaxing its grip on the currency. In Japan, stocks continued to move higher (Nikkei 225, +0.2%). The FTSE 100 is currently trading 0.4% higher at 7,906. Gold slipped to $2,166 an ounce.

The 10-year Treasury currently yields 4.25%. The yield curve is signalling the dangers of recession like never before, according to Bloomberg’s MLIV blog. It has been 429 trading days since the 10- to 2-year curve first inverted, the longest period since Bloomberg started to compile the data. It signals that monetary policy is restrictive and explains why the Fed is desperately looking for opportunities to ease.

Bank of England Governor Andrew Bailey told the FT rate cuts will be “in play” at future BOE meetings amid signs that tighter policy had quelled the risk of a wage-price spiral. Meanwhile, UK households are at their most upbeat about personal finances since 2021, as GfK said its key measure of consumer confidence stalled at minus 21 in March, after a drop in February. February retail sales were flat versus a market expectation for a 0.3% decline. Sterling weakened to $1.2592 and €1.1642.

Brent trades at $85.20 a barrel. The world is using more oil than ever and demand is outpacing expectations again this year, raising questions about how soon usage will peak. And at CERAWeek, many said they expect consumption to rise for years to come.

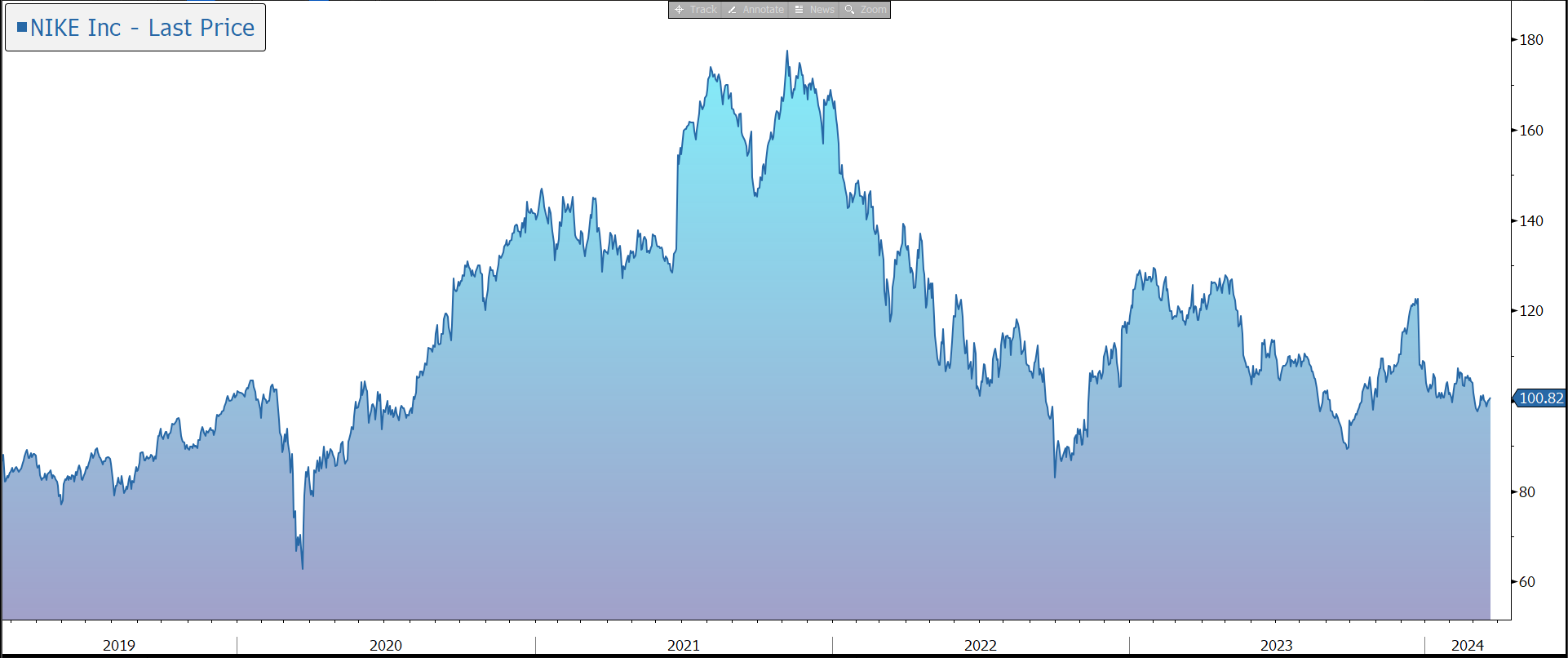

Source: Bloomberg

Company News

Last night Nike released results for the three months to end February 2024, the third quarter of its financial year to May 2024. The figures were slightly better than market expectations with an encouraging reduction in inventory levels. However, the group warned that trading in the first half of its new financial year would be weaker than expected due to the macro environment and as it rotates out of existing products into new innovations. In response, the shares fell by 6% in after-hours trading.

Nike is the world’s leading sports footwear and apparel company. We are positive on the long-term outlook for the business, with the company well placed to benefit from an increased consumer demand for healthier living – the recognition of which increased during the pandemic – the shift to personalised products, and growth of digital sales. Nike has a very strong brand, an impressive track record of product innovation, and is seeking to be more personal with its consumers at scale. For the period to FY2025, the company is targeting revenue growth of high single-digits to low double-digits; gross margin in the high 40s (vs. 46% in FY2022); operating margin in the high teens; EPS growth in the mid to high teens; and a return on invested capital of 30%+.

During the latest quarter, revenue grew by 0.3% on a currency-neutral basis to $12.43bn, versus guidance for a ‘slightly negative’ result, because of tough comparatives to the prior year. The result is slightly better than the market forecast of $12.28bn, albeit helped by a shipment timing benefit.

Nike Brand sales were up 2% to $11.9bn, while the Converse brand fell 20% to $495m. By product, footwear, which accounts for 67% of sales was up 3%, with apparel down 3% and equipment up 21%.

By region, Nike Brand revenue generated currency-neutral growth in Asia Pacific & Latin America (APLA, +4%) and Greater China (+6%), and North America (+3%), offset by a 4% decline in Europe, Middle East, & Africa (EMEA) driven by increased macro volatility and softening consumer demand.

Nike Brand sales are split into direct sales (both online and through Nike-owned stores) and wholesale revenue from third party retailers. During the quarter, Nike Direct sales grew slightly to $5.4bn, with digital down 4% and stores up 6%. Wholesale grew by 3% to $6.6bn.

During the latest quarter, the gross margin increased by 150 basis points to 44.8%, including a 50bps headwind from restructuring charges. This reflected strategic pricing actions and lower ocean freight and logistics costs, partially offset by higher product input costs.

Selling and administrative expenses grew 7%, including $340m of restructuring charges, with demand creation expense (i.e., marketing) up 10%. Operating overhead expense was 6% with restructuring charges partially offset by lower wage-related expenses. EPS fell by 3% to 77c, including 21c of restructuring charges. Excluding these charges, EPS would have been 98c, well above the market forecast of 74c.

Inventories continued to fall, down 13% to $7.7bn, primarily driven by a decrease in units. With stock levels now down, the company can now focus on pushing new innovative products through the pipeline.

The group’s balance sheet remains very strong – with net cash of c. $7.9bn. During the quarter, the group bought back $886m of its own stock as part of its 4-year $18bn share repurchase programme, while the quarterly dividend was raised by 9% to 37c.

At the time of its last results in December, the group announced an enterprise initiative to accelerate future growth while building a faster, more efficient company. The aim is to deliver up to $2bn in cumulative cost savings over the next three years from simplifying the group’s product assortment, increasing automation and use of technology, streamlining the organisation, and leveraging scale to drive greater efficiency. Most of these savings will be invested to fuel future growth, accelerate innovation, and drive greater long-term profitability.

Nike will present its plans in-depth at an Investor Day later this year. In the meantime, management has stressed that while Nike Direct will continue to play a critical role, the company must ‘lean in’ with its wholesale partners to elevate its brand and grow the total marketplace. In addition, the group is building a multi-year cycle of innovation and has pulled forward several innovations by more than a year, particularly in the Air platform. It is also carefully managing its most important franchises for long-term health and, as a result, the product portfolio will go through a period of transition over the coming quarters. On a positive note, the group has announced it will partner with the German football federation, starting in 2027.

Looking forward, the group sees the launch of Air Max DN, Euro24, and the Paris Olympics as opportunities to create near-term brand momentum despite a challenging backdrop. For the full financial year to May 2024, the group still expects revenue to grow approximately 1%. In the three months to May 2024 (i.e. Q4 FY2024), reported revenue is forecast to be up slightly (vs. previous guidance for low-single-digits), reflecting a shipment timing benefit in Q3 and lower digital growth due to franchise lifecycle management. Guidance for the growth in gross margin has been trimmed to 120bps (vs 140bps-160bps previously) due in part to higher markdowns and reduced benefits from channel mix due to franchise lifecycle management.

The group also provided some early guidance for next year (i.e. the financial year to May 2025). The group expects revenue and earnings to grow versus the prior year, with operating margins expanding, excluding the impact of the restructuring charges in FY2024. However, the results will be very second-half weighted. The group is planning prudently for revenue in the first half of the fiscal year to be down low single-digits, reflecting near-term headwinds from lifecycle management of key product franchises, more than offsetting the scaling of new products. This also continues to reflect the subdued macro outlook around the world. It was this admission that pushed the shares into negative territory in after-hours trading last night.

Source: Bloomberg