Morning Note: Market news and an update from Deere.

Market News

US equity markets moved higher last night – S&P 500 (+0.6%), Nasdaq (+0.3%) – as retail sales data fuelled hopes of imminent rate cuts. However, the Federal Reserve’s Raphael Bostic said there’s no rush to cut rates with the labour market and economy still strong and cautioned it may take “some time” to be sure inflation is heading sustainably toward the Fed’s 2% target. The PPI print will get more attention than usual today as investors seek clarity on the state of the economy. Producer prices are seen rising 0.1% on month in January after dipping in December.

This morning in Asia, markets were also broadly higher with sentiment lifted by a resurgence in China travel over Lunar New Year: Nikkei 225 (+0.9%); Hang Seng (+2.6%); Shanghai Composite (holiday). The FTSE 100 is currently trading 0.7% higher at 7,652. Gold moved back above $2,000 an ounce.

UK retail sales excluding auto fuel rose by 3.4% month on month in January versus expectations for a 1.5% increase. It’s the biggest monthly gain in almost three years, adding to hopes that the economy has stabilised after slipping into recession last year. Chancellor Jeremy Hunt dropped a plan to cut the basic income tax rate to 18% from 20%, The Telegraph reported. Sterling currently trades at $1.2588 and €1.1684.

Brent trades at $82.80 a barrel. The US bought about three million barrels of crude for its strategic reserve. US natural gas futures fell to as low as $1.59/MMBtu, the lowest since June 2020 after the EIA reported a smaller-than-expected storage draw. At the same time, the ongoing shutdown of a liquefaction unit at Freeport LNG’s export plant in Texas means more gas will remain in the country. Moreover, meteorologists predict that the weather will continue to be milder than normal until 1 March. Only back in November, the price was $3.80, and looking ahead, analysts expect producers to reduce output in 2024, following the sharp decline in prices.

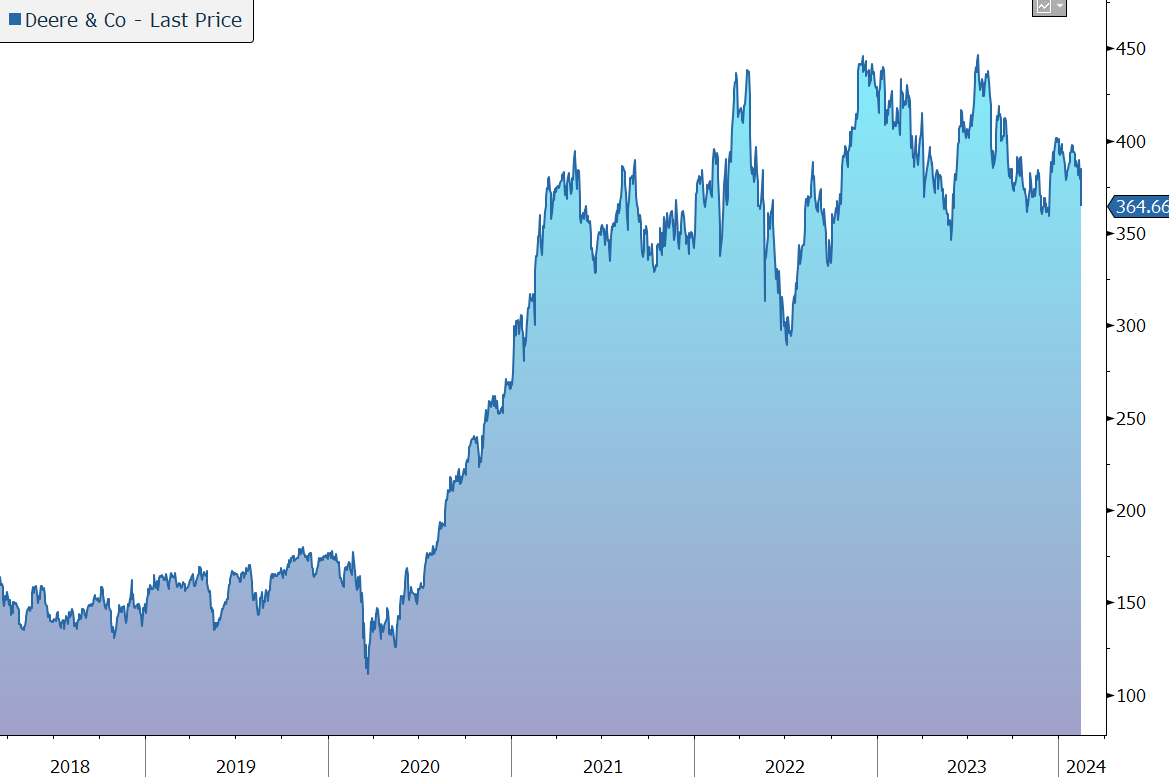

Source: Bloomberg

Company News

Yesterday lunchtime, Deere & Company released results for the three months to 28 January 2024, the first quarter of its financial year to end-October 2024. Although earnings were ahead of market expectations, the group cited moderating activity as agricultural fundamentals normalise. Even at this early stage in the financial year, the group has cut its guidance for FY2024. In response, the shares were marked down by 5% in US trading hours.

Deere is a global agricultural and construction equipment company with annual sales of more than $61bn. The group has a strong track record of innovation, a comprehensive distribution infrastructure, and global after-market capability. The group’s strategic aim is to outpace industry growth and generate a mid-cycle operating margin of 15%.

The business is benefitting from broad trends based on population and income growth, especially in developing nations, which are driving agricultural output and infrastructure investment. In addition, technological advances and agricultural mechanisation are expanding existing markets and opening new ones by helping customers increase their productivity, profitability, and sustainability.

The company believes it has incremental addressable market opportunities of more than $150bn that can be targeted through engaging with more customers and increasing levels of connectivity. The focus is on helping customers manage higher costs and increasingly scarce inputs, while improving their yields, using Deere’s integrated technologies.

However, in the near term, the market environment has deteriorated due to higher interest rates, squeezed budgets, and falling crop prices. As a result, fleet replenishment is moderating. During the latest quarter, worldwide net sales and revenue fell by 4% to $12.2bn, while net sales of equipment were down by 8% to $10.5bn, versus market expectations of $10.3bn. Net income fell by 11% to $1,751m, while EPS fell 5% to $6.23.

The Production & Precision Agriculture segment includes large and certain mid-size tractors, combines, cotton pickers, sugarcane harvesters and loaders, and soil preparation, seeding, application and crop care equipment. During the quarter, sales fell by 7% to $4.8bn due to lower shipment volumes partially offset by price realisation. Operating profit slumped by 13% to $1,045m, mainly due to lower volumes and higher R&D expenses. The margin slipped from 23.2% to 21.6%.

The Small Agriculture and Turf segment includes certain mid-size and small tractors, as well as hay and forage equipment, riding and commercial lawn equipment, golf course equipment, and utility vehicles. During the final quarter, sales fell by 19% to $2.4bn, with lower shipment volumes partly offset by higher pricing. Operating profit was down 27% to $326m, with the margin falling from 14.9% to 13.4%. Construction & Forestry sales were flat at $3.2bn, while operating profit fell 9% to $566m.

The group’s Financial Services division reported adjusted net income up 12% to $207m, due to income earned on higher average portfolio balances, partially offset by less-favourable financing spreads.

Deere’s balance sheet is robust, with net debt of c. $57bn, a level consistent with supporting a credit rating that provides access to low cost and readily available funding. The group has a policy to raise its dividend “consistently and moderately”, targeting a 25%-35% payout ratio of mid-cycle earnings.

Looking forward, the group expects fleet replenishment to moderate as agricultural fundamentals normalise from record levels in 2022 and 2023 due to high borrowing rates and falling crop prices. Net sales are now expected to decline in FY2024 by 20% in Production & Precision Agriculture, 10%-15% in Small Agriculture and Turf, and 5%-10% in Construction & Forestry. Earnings are now forecast to be between $7.50 and $7.75bn (vs. $7.75bn to $8.25bn previously).

Source: Bloomberg