Morning Note: Market news and an update from Ceres Power.

Market News

US equity markets rose last night – S&P 500 (+0.9%), Nasdaq (+1.4%) – with tech stocks out-performing. The 10-year Treasury yield continued to creep up; it is currently 4.15%. Gold trades at $2,029 an ounce.

This morning in Asia, markets were generally subdued despite the strong showing from TSMC which jumped 5% on a bullish outlook: Hang Seng (-0.7%); Shanghai Composite (-0.5%). Citic Securities suspended short selling for some clients in mainland markets amid the deepening stock rout, people familiar said. Global passive funds joined the January selloff of Chinese and Hong Kong shares. And mutual fund liquidations hit a five-year high in 2023. Once again, the outlier was Japan, where the Nikkei 225 rose 1.4%.

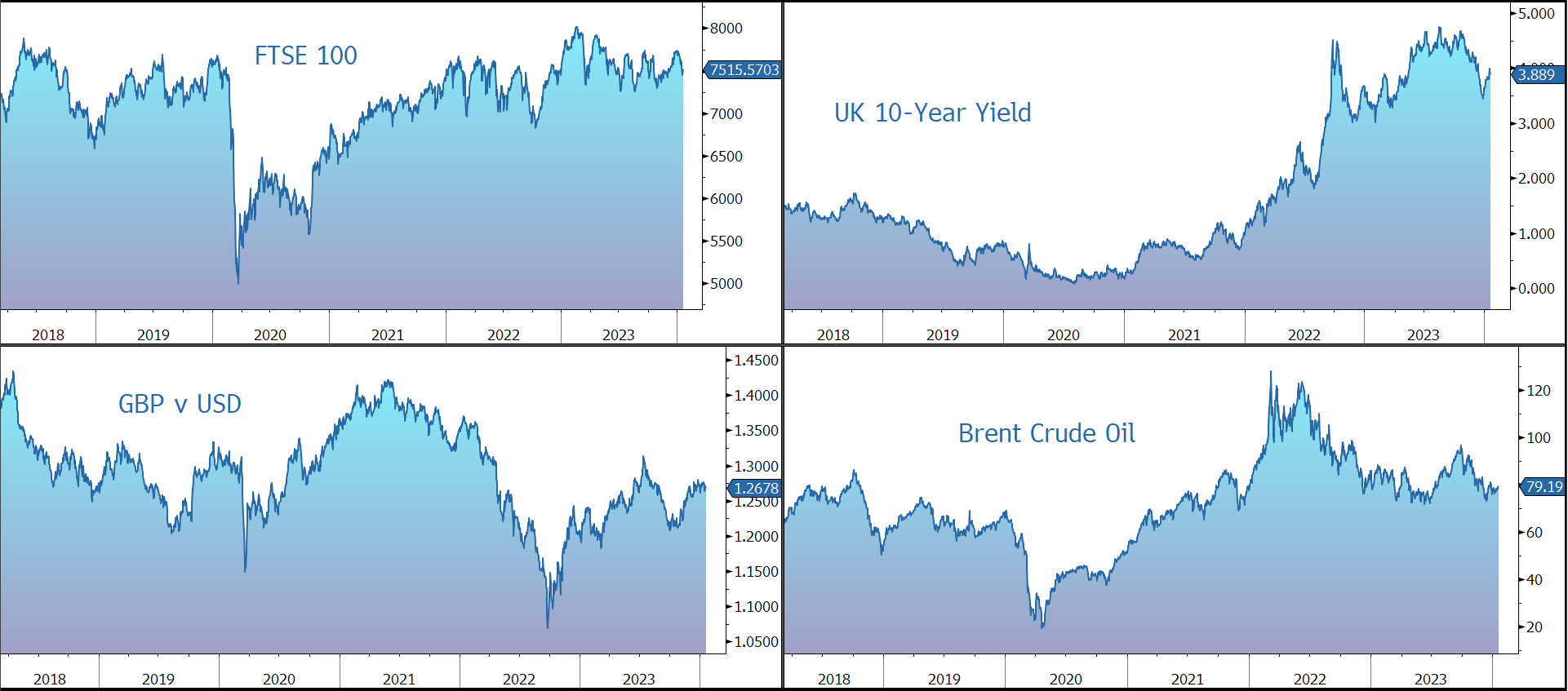

UK retail sales (ex-petrol) fell more than expected in December (-3.3% vs. -0.7% forecast) as unseasonably wet weather curbed shopping trips, while other purchases were brought forward to November, which saw a bump in spending. Sterling slipped to $1.2668 and €1.1652, while the FTSE 100 is currently trading 0.7% higher at 7,516.

Chaos in the Red Sea threatens to halt a slowdown in food inflation as vessels avoid Houthi attacks by sailing around Africa. But lengthier shipping times risk making perishable foods unsellable spooking the industry. The oil price edged up to $78.90 a barrel.

Chinese travellers were once the biggest spenders on overseas trips. But since the country reopened its borders, they’ve been staying close to home. The pullback has erased about $130bn from global tourism, a loss felt from Taipei noodle shops to Paris boutiques.

Source: Bloomberg

Company News

Yesterday Ceres Power announced a long-term manufacturing collaboration and licence agreement with Delta Electronics and hosted a presentation on the deal. In response, the shares rose by 40%.

Ceres is a world-leading developer of clean energy technology: fuel cells for power generation, electrolysis for the creation of green hydrogen, and energy storage. The company designs and manufactures steel-based Solid Oxide Fuel Cells (SOFC) which, in very simplistic terms, produce electricity when fuel passes through the fuel cell, via the process of electrolysis. The key benefit of the Ceres steel-based version is that it is fuel agnostic and therefore does not require pure hydrogen, instead being able to use everything from biofuels to mains fed natural gas. Its power generation efficiency, which is around 60% and can even reach 85% with a heat recovery system, is significantly higher than the efficiency of centralised gas-fired power generation units, which are around 40%-50%. The steel-based structure also means they are more affordable, scalable, extremely robust, and able to operate at lower temperatures. The technology can be used in both stationary and transport applications.

The technology is also truly reversible, able to generate green hydrogen at high efficiencies and low cost – the solid oxide electrolyser cell (SOEC) technology produces hydrogen up to 25% more efficiently than incumbent low temperature technologies particularly when thermally integrated with industrial processes such as chemicals and steel production.

Ongoing geopolitical events have highlighted the need for energy security around the world, with governments also under increasing pressure to decarbonise their societies. Hydrogen is now widely acknowledged as an essential part of the route to net zero. We believe Ceres is well placed to benefit as the world’s energy mix moves to a lower carbon future and clean technologies play a strategic role in economic growth.

The group’s asset-lite business model is focused on multi-year development partnerships with global OEMs to jointly develop products using the technology. Ceres receives a license fee for the initial use of the system technology, engineering fees during product development, and royalties upon commercialisation. This strategy allows for broader market reach and generates high margins.

The company currently has licensing agreements and joint development projects with some of the world’s largest engineering and technology companies, such as Weichai Power in China (also a 20% shareholder in Ceres), Bosch in Germany (an 18% shareholder), Miura in Japan, and Doosan in Korea. These cover multiple uses including residential boiler systems, range extenders, data centres, marine transport, and stationary power back-up. The group also has a partnership with Shell to utilise solid oxide electrolyser cell (SOEC) technology to deliver high-efficiency, low-cost green hydrogen.

Yesterday Ceres announced a global long-term manufacturing collaboration and licence agreement with Delta Electronics for fuel cell stack production. Delta is a global leader in power and thermal management solutions with expertise in mass manufacturing, power electronics, and data centres. Headquartered in Taiwan, Delta operates across 200 facilities worldwide and is listed on the Taiwan Stock Exchange with a market capitalisation of $23bn. The company has a global footprint, with good channels to market, and a portfolio of products that complement Ceres’ products. Delta expects to integrate Ceres’ energy stack technology with its own industry-leading power electronics and thermal management technologies to develop SOFC and SOEC systems for hydrogen energy applications. The key points of the announcement are:

- The agreement includes revenue of £43m to Ceres through technology transfer, development license fees, and engineering services, of which approximately half is expected to be recognised as revenue in 2024, with the remainder split evenly between 2025 and 2026.

- There is potential for additional revenue from the sale of Ceres development stacks to Delta.

- The agreement also includes royalty payments to Ceres on future commercial production and sale to end customers by Delta. The company disclosed the royalty rate will be similar to the agreements with Doosan and Bosch, £50-100 per KW.

- Technology introduction and factory construction will start from 2024 and the initial production by Delta is expected to start by the end of 2026.

This is a big deal for the group – note that in both 2022 and 2023 Ceres generated revenue of just over £20m. This means even at this early stage of the year, the company already has line of sight over more than £40m of high-margin revenue for 2024, double the expectation for 2023. The company highlighted it has a growing and strong pipeline and that it is very confident of adding more partners. On the call, they said ‘this isn’t the last deal of the year’.

This is also the first licence deal for SOEC technology (and the first dual licence partner), which is a big endorsement of the company’s technology and strategy. The SOFC production will come first, followed by SOEC, although Delta believes the SOEC opportunity is much larger.

In 2022, the group signed Heads of Terms with Weichai and Bosch to establish a three-way collaboration to access the substantial opportunities that exist for fuel cell technologies in China. The company is still waiting for the deal to close. Although Ceres management were unwilling to provide an update on timing on yesterday’s call, they made a few comments: two-way deals are much easier to consummate than three-way deals; the relationship with both Bosch and Weichai remains strong – remember both are big shareholders; the Delta deal doesn’t interfere with anything Ceres does in China, although clearly there may be some geopolitical concern over signing a deal with a Taiwanese company.

The shares now trade on the Main Market. The stock has been very weak over the last three years due, in part, to the impact of rising bond yields on highly-rated unprofitable companies but also due to the delay in the announcement of the Weichai/Bosch agreement.

Source: Bloomberg