Morning Note: Market news and an update from adidas.

Market News

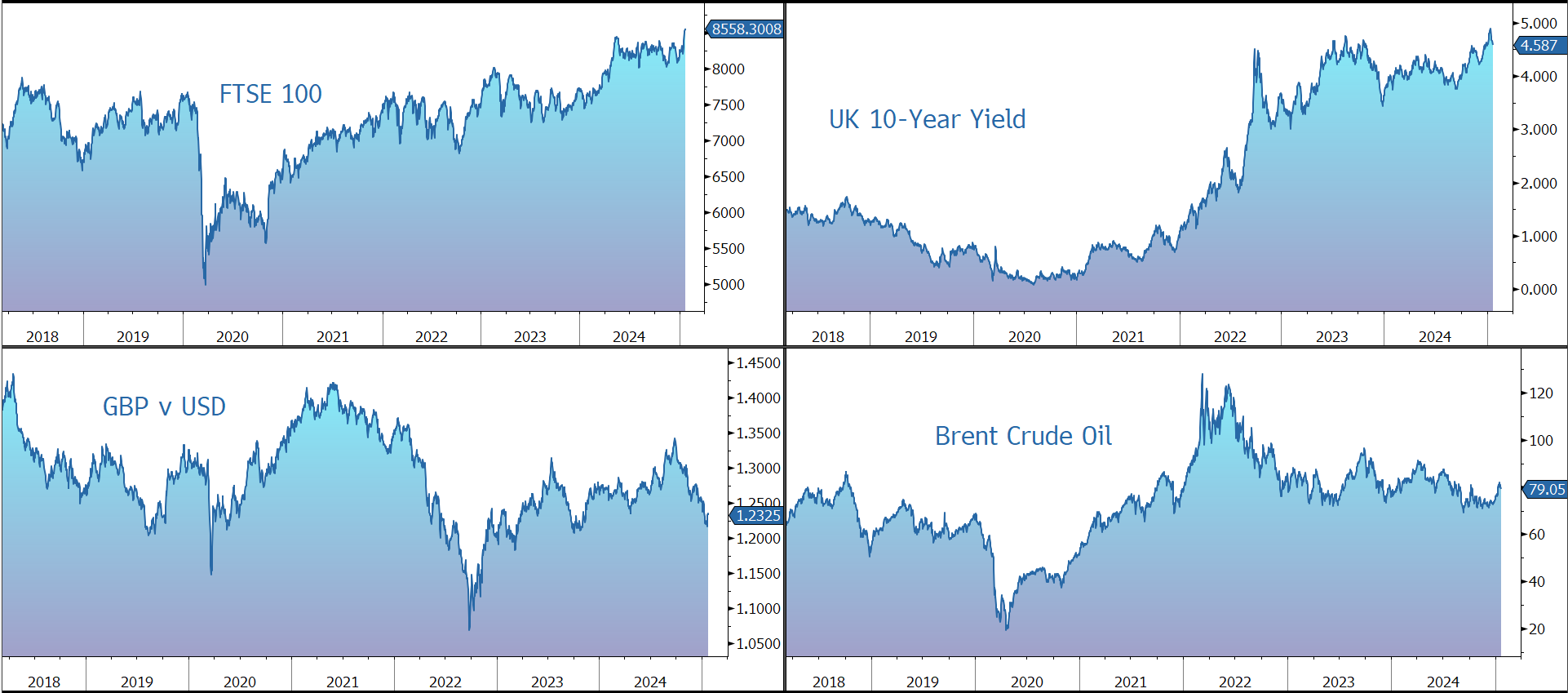

US equities rose last night – S&P 500 (+0.9%); Nasdaq (+0.6%) – with the smaller cap index, the Russell 2000, up 1.9%. 10-year Treasury yields (4.59%) and gold ($2,750 an ounce) climbed.

Netflix rose by 14% after hours as the company added a record 18.9m subscribers in the Q4, more than double expectations. United Airlines rose by 3.3% on the back of a positive outlook driven by “robust demand trends”.

SoftBank, OpenAI, and Oracle will invest an initial $100bn in an AI infrastructure project. Trump made the announcement with Masayoshi Son, Sam Altman, and Larry Ellison. SoftBank rose as much as 12% and Oracle gained postmarket.

In Asia this morning, shares in Japan (Nikkei 225, +1.6%), South Korea and Taiwan jumped in the wake of Trump’s AI plan, which lifted technology stocks across the region. However, Chinese shares bucked the trend after the US president said he was still considering a 10% tariff on all goods from the country: Hang Seng (-1.6%); Shanghai Composite (-0.9%).

The FTSE 100 is currently trading 0.2% higher at 8,558. The UK budget deficit rose to £17.8bn in December, versus £14.2bn expected, on higher debt costs. Sterling fell to $1.2 and €1.1, while 10-year Gilt yields slipped back below 4.60%.

Brent Crude drifted lower ($79 a barrel). The cost of moving barrels from most Russian ports climbed to an eight-month high after the latest US sanctions. European gas prices rose as Germany seeks to subsidise storage refills.

Source: Bloomberg

Company News

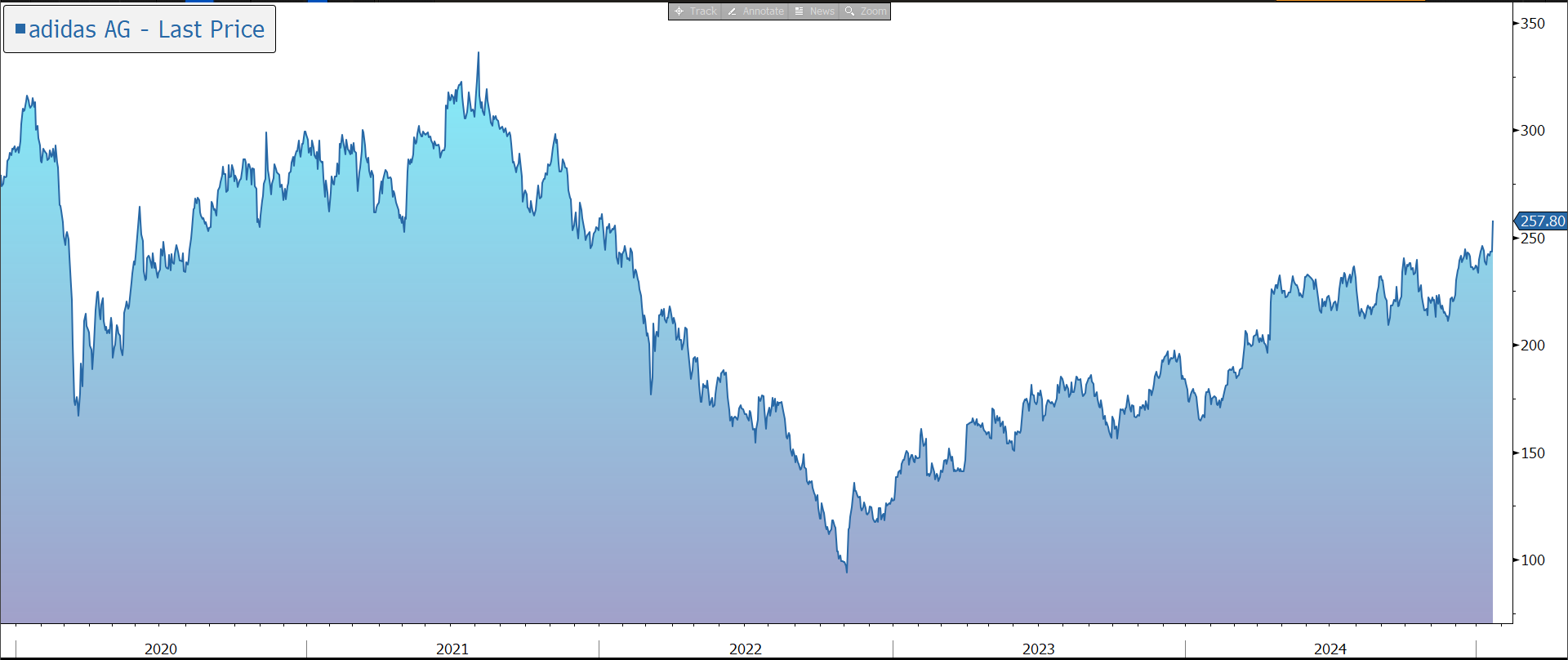

adidas released a brief trading update for the fourth quarter of 2024 which was better than expected and increased its guidance for the full year. The shares have been marked up by 6% continuing the recent recovery of the stock. The update also provides a good read-across for industry peer Nike.

adidas is a multi-brand sporting goods company. Its products have traditionally had a broad global appeal from serious athletes, casual athletes to sports fashion, and from mid-price to high-price points. As a result, the group should be well placed to benefit from the continued focus on health and fitness, the rising middle class in emerging markets, and fashion trends in sportswear.

The group’s year-on-year results are still being impacted by the previous initiatives to reduce inventory levels following the termination of the adidas Yeezy partnership with rapper and fashion designer Kanye West.

In the three months to 31 December 2024, revenue was up 19% in currency-neutral terms at €6.0bn, driven by strong momentum into brand and products. The group has clearly seen that consumers’ and retailers’ interest in its products is growing across both Lifestyle and Performance. Excluding the impact of the Yeezy revenue in both years, growth was 18%.

Further detail on trading by region, sales channel, and category will be disclosed at the time of the results on 5 March.

The company’s gross margin grew by 5.2 percentage points to 49.8%. Operating profit came in at €57m, compared to an operating loss of €377m in Q4 2023.

Based on preliminary unaudited numbers for the full year of 2024, the company’s currency-neutral revenues were up 12% to €23.7bn. This was ahead of guidance for growth of around 10%, a target that had been raised earlier in the year. The company’s operating profit is now expected to reach €1,337m, well above the guidance for €1.2bn.

Looking forward, although there is a lot of macroeconomic uncertainty right now, the company has a goal to again grow double-digit and make further progress towards its 10% operating margin target.

Source: Bloomberg