Market news and updates from IHG and EssilorLuxottica

Market News

US equity markets fell last night – S&P 500 (-0.9%); Nasdaq (-1.0%) – as volatility gripped global markets from an escalation in tensions in the Middle East. Oil ($93.20 a barrel) and gold ($1,980 an ounce) moved higher. This morning in Asia, markets were also down: Nikkei 225 (-0.5%); Hang Seng (-0.7%); Shanghai Composite (-0.7%). China policymakers flooded markets with a record amount of short-term cash. The FTSE 100 is currently trading 0.5% lower at 7,462.

Treasuries advanced as buyers returned to the market – the 10-year currently yields 4.94% – following comments from Federal Reserve Chairman Powell. He signalled a November hike is unlikely while leaving the door open for more rate increases. The FOMC is “proceeding carefully” but “the evidence is not that policy is too tight right now,” the chair said. He noted that rising bond yields are tightening financial conditions and called geopolitical risks “highly elevated.” Patrick Harker called for staying on hold despite faster-than-expected growth.

Japanese core inflation slowed to 2.8% in September, lending credence to the BOJ’s view that upward pressure on prices is peaking.

The Labour party overturned huge Conservative majorities to win two parliamentary seats in Mid Bedfordshire and Tamworth. UK consumer confidence fell 9 points in October to minus 30, the biggest drop since the start of the pandemic, GfK said. That’s as households felt the impact of persistent inflation and higher interest rates, and it may prove a problem for retailers ahead of Christmas. Sterling weakened to $1.2107 and €1.1450.

Source: Bloomberg

Company News

InterContinental Hotels Group has this morning released its Q3 trading update which highlights that travel demand remained very healthy during the quarter. The shares have had a good run of late and are seeing some profit taking in early trading (-3%) against a weak overall market backdrop.

IHG owns a portfolio of 19 attractive brands across all price tiers (including Crowne Plaza, InterContinental, Holiday Inn, and Six Senses) and has a strong operating system, both of which drive customer loyalty and pricing power. The group operates a highly scalable, asset-light model, based on franchising and management contracts, with low capital intensity and high returns. The model also means the group doesn’t bear the operational costs of running a hotel. The company is focused on delivering industry-leading net rooms growth over the medium term. It currently has a 4% global market share and a 10% share of the new room pipeline.

Long-term growth is being driven by a rising global middle class with a desire to travel. In the business market, IHG’s weighting is towards essential travel and non-urban markets.

On 1 July, the new CEO took up his position. Given he led up the group’s Americas business for the past eight years, we expect little change to the current strategy. The CFO has only been in place since March 2023.

During the three months to 30 September, global revenue per available room (RevPAR) – the key measure of industry performance – grew by 10.5%. The compares to 11% expected by the market and 24% in the first half as the group faced increasingly tough year-on-year comparatives. The group saw rooms revenue growth for each of leisure, business, and group travel.

The guest appeal of the group’s brands has continued to support pricing, with average daily rate up 4.1% year-on-year. Occupancy rose by 4.1 percentage points. RevPAR is now 12.8% above the 2019 pre-pandemic level, with occupancy only 1.3 percentage points below and average daily rate 14.8% higher.

There is still a wide regional variation across the business. In Americas (the group’s largest division), RevPAR was up 4.1% and was 12.8% ahead of 2019. The EMEAA region grew by 15.9% and was 17.5% above 2019. In Greater China, RevPAR bounced by 43.2% following the lifting of travel restrictions and has now moved above 2019 levels.

IHG continued to open new hotels and sign more into its pipeline. During the third quarter, 7.7k rooms across 50 hotels were opened, similar to Q3 2022. Gross system size grew by 6.2% year-on-year, while net system size growth was up 4.7%. Conversions from other brands increased to be over a third of both openings and signings in the period. This is positive as the time to open is much shorter than with a new build. The group ended the quarter with 929,987 rooms across 6,261 hotels, 67% in midscale segments and 33% in upscale and luxury.

IHG signed 16.8k rooms (123 hotels) in Q3, up 27%, to give a global pipeline of 292k rooms (1,978 hotels), up 5.1% year-on-year. More than a quarter of signings were across the six Luxury & Lifestyle brands, as the group accelerates growth in this higher fee income segment. In the summer the group launched a new brand, Garner, to target mid-scale conversion opportunities, and is designed for value-driven travellers, a space worth $14bn in the US market alone.

As expected, there was no update on the group’s financial position at this stage. The asset-light model means IHG has low investment requirements and a negative working capital cycle. The group operates a conservatively leveraged business model and maintains strong liquidity. At the last balance sheet date (30 June 2023), gearing was 2.3x net debt to EBITDA, below the bottom end of its 2.5x-3.0x target range.

In response, the group is returning surplus capital through share buybacks. The current $750m programme (c. 6% of market cap.) is 94% complete and is expected to end by the end of the year. Including dividends, the group is on track to return $1.0bn to shareholders in 2023. At that point, gearing is still expected to be below target, potentially providing scope for additional returns. The group states its next capital allocation update will be communicated at the time of its full-year results next February.

While IHG doesn’t provide full-year guidance as such, the statement does include some commentary. The group expects to close-out 2023 with ‘very strong’ financial performance. Looking further ahead, whilst there are macro-economic uncertainties and some short-term financing challenges holding back new hotel development, the group remains excited about the future and the attractive, long-term demand drivers for its markets. The company remains confident in the strengths of its business model, scale, and in its strategic priorities to capture sustainable, profitable growth.

The group has previously admitted that the pandemic may lead to some structural changes for the industry, such as an element of technology replacing certain kinds of business travel. However, IHG is already seeing clear signs of business demand returning. There will also be other trends, including a greater use of hotels to facilitate a global shift to increasingly flexible working arrangements. This further supports our view that overall demand levels could be little changed.

IHG therefore anticipates the attractive industry fundamentals will be fully restored in the longer term.

Furthermore, with its scale and strong brands, the group should also benefit from a ‘survival of the fittest’ bias as many smaller competitors exit the market.

The stock recently bounced following news of potential consolidation in the industry between Choice Hotels and Wyndham Hotels & Resorts.

Source: Bloomberg

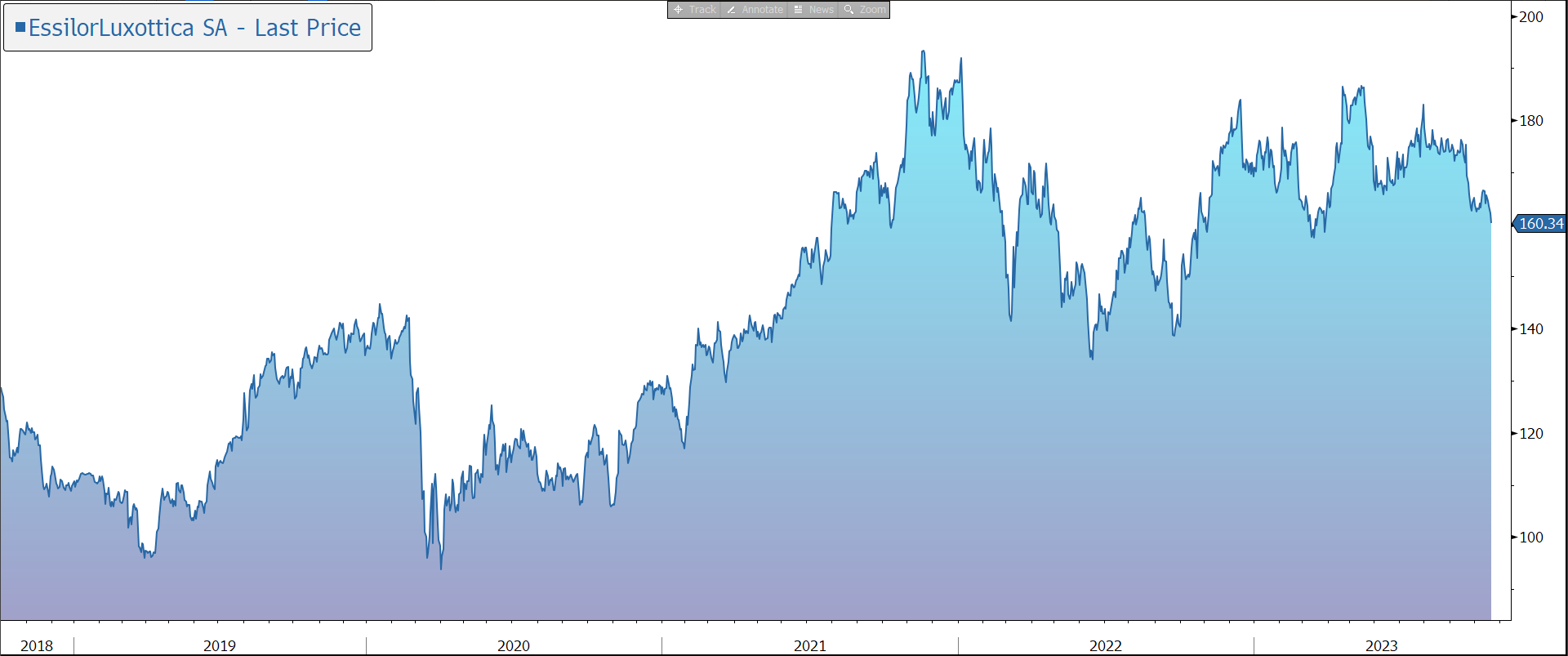

Yesterday evening, EssilorLuxottica released its Q3 results. As expected, revenue growth decelerated compared to the first half although the business continues to outpace its mid-single digit long-term target. In response the shares are down 1% this morning.

EssilorLuxottica is the global leader (with a 25% share) in the eyecare and eyewear industry with exposure to the design, manufacture, and distribution of ophthalmic lenses, prescription frames, and sunglasses. We believe the long-term outlook for the industry is positive, driven by an ageing population, increased incidence of poor eyesight (caused in part by the increased use of smart phones and tablets), a growing emerging market middle class, increased education regarding sun protection, and the growth of eyewear as a fashion accessory. By 2050, uncorrected poor vision is predicted to reach epidemic proportions with over 50% of the world’s population expected to suffer from myopia (short-sightedness), many with serious vision-threatening side effects and long-term implications.

The company’s competitive advantage is based on its scale, portfolio of premium brands (such as Ray-Ban and Oakley), product innovation, flexible manufacturing base, quality service, routes to consumer, and partnerships. Essilor owns licences for some of the most important luxury brands, including Chanel, Prada, and Armani. Most recently, the group announced an exclusive 10-year agreement for the design, manufacture, and worldwide distribution of Jimmy Choo Eyewear. The group also owns a majority interest in GrandVision (GV), a global leader in optical retail with over 7,200 stores and an online presence, ownership of which expands its global retail footprint and reduces the competitive risk of retailer consolidation. The company states that its mission is to prevent industry commoditisation in Western markets, whilst promoting premiumisation in emerging markets.

During the three months to 30 September, revenue fell by 1.6% to €6.3bn driven mainly by negative currently movements. At constant exchange rates (CER), revenue grew 5.2%, versus 6% expected by the market. The rate of growth year to date is 7.2%, above the mid-single-digit long-term target.

The business saw a deceleration versus the 8.2% generated in the first half due to a weaker sun retail business now also affecting the EMEA region on top of North America, and a tougher comparison base in Asia-Pacific. The prescription business confirmed its resilience relying on a strong price-mix sustained by the success of new products.

Essilor reports in two equally weighted divisions. Professional Solutions includes the supply of products and services to third-party eyecare professionals (i.e., wholesale). In Q3, revenue grew by 5.7% at CER to €3.0bn. Direct to Consumer includes the sale of products and services directly to end consumers, that is the retail business, comprised of brick-and-mortar stores and e-commerce platforms. In Q3, revenue grew by 4.7% at CER to €3.3bn. Comparable-store sales grew by 4%.

By geography, North America, the group’s largest region (46% of sales), was up 2.1% at CER in Q3, in line with the performance in the previous quarter, with soft demand in the sun market. Elsewhere, EMEA grew by 6.9%, Latin America by 6.2%, and Asia Pacific was up 11.7% thanks to the rebound in Greater China boosted by Stellest, the group’s myopia control lens.

Innovation continues to drive growth – Stellest doubled once again and has been rolled out to additional markets, Varilux XR lenses powered by AI have been successfully launched, and Ray-Ban Reverse (which can shift from traditional convex to concave lenses) has delivered disruptive design and technology.

Earlier in the year, the group also announced a strategic diversification into the hearing solutions market with a new disruptive technology at the intersection of sight and sound. The plan is to introduce a new breakthrough hearing technology (i.e., lenses with acoustic technology) to benefit the 1.25bn consumers suffering from mild to moderate hearing loss. The audio component will be completely invisible, removing a psychological barrier that has historically stood in the way of consumer adoption of traditional hearing aids.

Although this was only a revenue statement, we would remind investors that the company has been able to translate its revenue growth into substantial margin expansion, leveraging its vertically integrated business model and successfully absorbing the inflationary pressures on most of the main cost items. Gross margins are high (64.2% in the first half), with pro-forma operating margin at 18.5%.

The business generates strong free cash flow (€954m in the first half) and is financially robust – critical in these uncertain times as the group takes advantage of attractive long-term industry growth and makes bolt-on acquisitions of smaller competitors. Earlier in the week, the group announced it will spend €400m to build a new eyewear facility in Thailand. In the first half of 2023, financial gearing was 1.6x EBITDA. At the AGM in May, a dividend of €3.23 was approved, up 29%, equating to a 2% yield.

Looking forward, Essilor doesn’t provide near-term guidance, although it highlights margins will benefit from a tailwind of price increases and GrandVision integration benefits. However, the company remains confident in its strategic vision and its ability to deliver on its long-term outlook for annual revenue growth of mid-single digit between 2022 and 2026 and adjusted operating profit margin of 19%-20% in 2026 (vs 16.8% in 2022).

Source: Bloomberg